Editor’s Note: Last week, the Federal Reserve cut interest rates by 50 basis points… and the market responded by pushing “risk-on” groups higher.

This is a bullish signal. And it should open up a lot of new opportunities for traders.

Finding the right stocks to trade within these groups is where things could get tricky.

If you don’t want to look at hundreds of charts each week trying to find the best trade, Justin’s proprietary trading indicator—which he calls the One Chart to Rule Them All—is a simple way to set yourself up for success at the start of every week.

Go here to get a first look at Justin’s indicator.

***

Don’t get too comfortable.

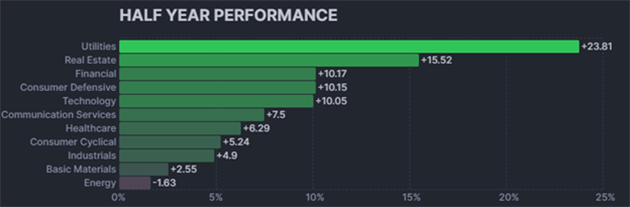

Over the past six months, defensive stocks have dominated.

Utilities are the top-performing sector over the period, rallying 24%. Real estate and consumer defensive stocks have also been top performers, gaining 16% and 10%, respectively.

Source: FinViz

Source: FinViz

Many traders see this and think the market is close to topping… or are even “pricing in” a recession.

When you’re worried about these sorts of things, it’s easy to get married to defensive stocks.

But I wouldn’t do that.

To me, this looks like a vanilla rotation. In fact, the pendulum is already starting to swing the other way. Money is cycling back into “risk-on” groups.

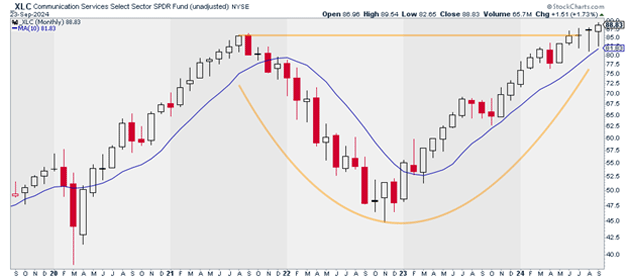

Take a look at this chart. It shows the performance of the Communication Services Select Sector SPDR Fund (XLC). On Friday, it recorded its highest weekly close ever:

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

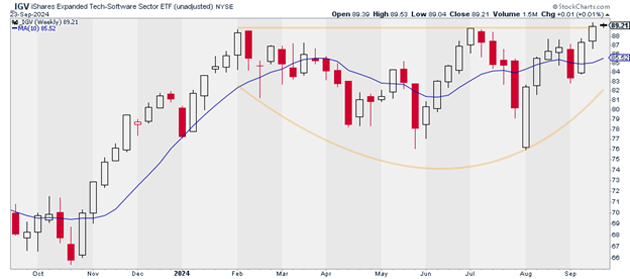

Software stocks are also on the move. The iShares Expanded Tech-Software Sector ETF (IGV) is also coming off its highest weekly close ever. Not only that, but it’s on the verge of breaking out of a massive, three-year base.

If successful, software stocks should enter a multi-month rally… at the very least.

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

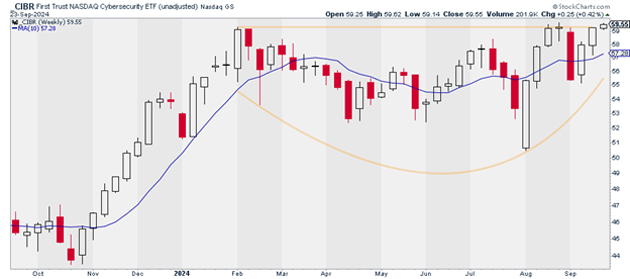

Then there are cybersecurity stocks. The First Trust Nasdaq Cybersecurity ETF (CIBR) notched its highest weekly close ever… after breaking out of a multi-month base:

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

This is likely just the beginning. By the end of the week, don’t be surprised if semis join the party. We’re already seeing industry leaders like Broadcom (AVGO) wake up in a major way.

Getting on the right side of these sorts of rotations can make the difference between having a decent year… and a phenomenal one.

That’s why my subscribers and I have aggressively increased our exposure to “risk-on” groups in recent weeks. We want to board the train before it gets too crowded.

Of course, timing rotations isn't easy. Even full-time traders routinely miss them. That’s because it requires a ton of work.

Most people just don’t have the time.

That’s why I created a tool that can anticipate these big moves before they happen… by looking at just ONE chart at the start of the week.

This chart compares the performance of “risk-on” sectors with “risk-off” sectors, allowing me to zoom in on the best stocks to trade based on how the market’s moving.

Quick and easy.

If you want to see how it works, I’m preparing a video to walk you through it. Go here to make sure you don’t miss it.

Justin Spittler

Chief Trader, RiskHedge