September is finally over…

…and traders couldn’t be happier.

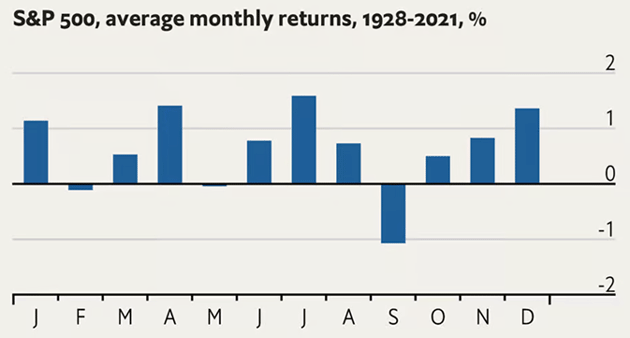

As you may know, the stock market follows predictable patterns around the calendar year. This is called “seasonality.”

September is historically the worst month of the year for stocks.

Since 1928, the S&P 500 has declined by more than 1% during the month of September, on average. No other month comes close to that.

This year was no exception. The S&P 500 ended September down 5%, while the Nasdaq 100 slid 5.2%.

The good news is it’s now October, which often kicks off the strongest period of the year for the market.

Historically, stocks rally strongly from October to January:

Source: The Economist

Source: The Economist

Of course, there’s no guarantee stocks will rise in the coming months because of seasonality trends.

After all, the market still has issues—most notably the strong dollar.

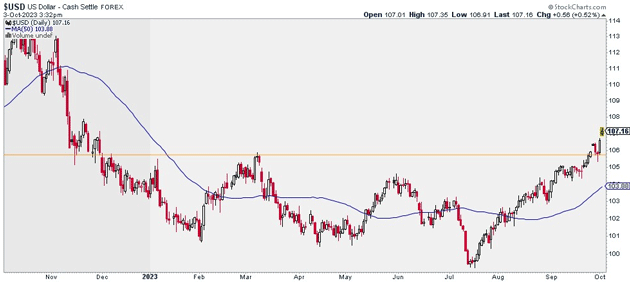

You can see what I mean below. This chart shows the performance of the US Dollar Index, which tracks the buck’s performance against a basket of major currencies—including the euro and the Japanese yen.

Source: StockCharts

Source: StockCharts

The dollar is on a warpath!

It’s spiked more than 7% since July. That’s a tremendous move for the world’s most important asset.

If you’re traveling outside the country, this is good news. It means your money goes a lot further.

But the surging dollar has been an issue for traders and investors alike. Simply put, stocks don’t like when the dollar is aggressively rising.

The silver lining is the dollar is pretty extended here. In fact, the Dollar Index has climbed higher for 11 straight weeks—good for its longest winning streak since 2014.

At this stage, it’s probably only a matter of time before the dollar pulls back… or consolidates, at the very least.

And that would give stocks an opportunity to rally. For now, continue to exercise patience.

Justin Spittler

Chief Trader, RiskHedge