Less than 1 in 1,000 investors are aware of what’s unfolding…

But what I’m about to show you might be the single-best early-stage investing opportunity of the 2020s.

Investors who act now could see gains of 3,000% to 6,000%...

And if history repeats itself, those gains will come rather quickly – within a year or two.

Because a brand-new industry is quietly taking shape...

And for once, ordinary investors have the rare chance to get in on the “ground floor.”

But there’s one catch:

You can’t play this the “lazy” way.

Because this trend is so new, there are no ETFs, no mutual funds, no “baskets of stocks” to play it.

We’re that early.

The only way to play this is to buy the correct individual stocks.

These stocks are small and under the radar. But as I’ll show you, anyone with a brokerage account can buy them...

- In short: Today’s opportunity is a direct way to play what I call “Genomics 2.0”…

If you aren’t familiar, genomics is the study of all of a person’s genes… or their “genome.”

While genetics is concerned with individual genes and the traits they pass on to the next generation, genomics is more comprehensive.

By understanding all of our genes and how they interact with each other, scientists can discover secrets embedded in our DNA.

Through genomics, scientists have made major medical breakthroughs recently...

The most impactful one has been a huge leap in progress in “precision medicine.” Which, in short, allows doctors to customize treatments for individual patients to make them more effective.

If you’ve been following my work, you know I’ve been pounding the table on genomics stocks for almost a year now...

Last April I recommended CRISPR Therapeutics (CRSP), Editas Medicine (EDIT), and Invitae Corporation (NVTA). Those 3 picks have seen peak gains of 311%, 312%, and 268%.

Other genomics stocks have soared even higher…

Pacific Biosciences (PACB) went on a tear recently, soaring more than 2,000% between last April and this February.

Source: StockCharts

Source: StockCharts

Genomics pioneer Exact Sciences (EXAS) has surged more than 3,100% since early 2016.

Source: StockCharts

Source: StockCharts

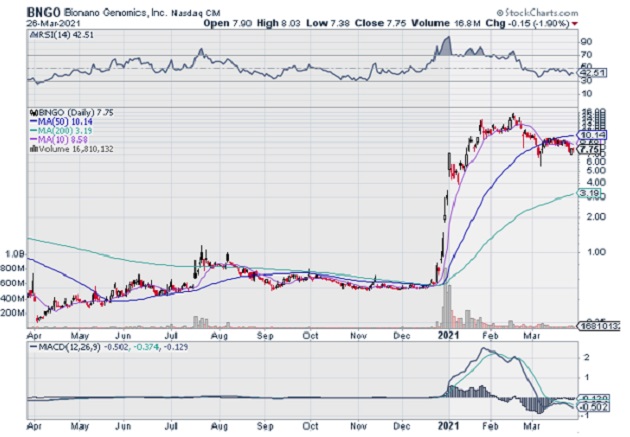

And Bionano Genomics (BNGO) has skyrocketed 6,200% over the past year. That’s enough to turn every $10,000 invested into over $630,000!

Source: StockCharts

Source: StockCharts

These are truly life-changing returns. A single investment in any of these stocks could allow you to retire a decade early.

And I have no doubt that certain genomic stocks will continue to deliver market-beating returns for years to come…

But as a sector, the cat’s out of the bag.

Genomics stocks are on the radar of most serious tech investors... and it’s no longer a ground-floor opportunity.

In other words, the easy money in genomics has already been made.

- But in Genomics 2.0... I believe the “easy money” is still very much on the table.

By “easy money,” I mean the large, often fast gains that come from investing in a new sector before anyone else.

That’s because Genomics 2.0 is the newest industry on earth.

I’m talking about proteomics… or the study of your body’s proteins.

If this is the first time you’re hearing of proteomics, you’re not alone. I’ve never seen it written about in any investing publication, outside of RiskHedge. As I said, this is truly an early-stage, ground-floor opportunity.

When most people hear “protein” they probably think of “high-protein foods” like beef or eggs. But proteins are far more important than a big juicy steak…

They are the building blocks of every living thing on earth. Inside your body, billions of tiny biological nanomachines called proteins are hard at work.

Proteins allow your eyes to detect light. Your brain to think. And your blood to carry oxygen. Proteins allow your body to battle infections, and convert what you eat into nutrients.

And here’s what most people don’t realize: Your proteins are even more important than your genes. Don’t just take my word for it…

The New York Times recently wrote:

“Genes tend to get more attention, but proteins might really deserve the limelight.”

In other words…

- Genomics is the sideshow: proteomics is the main event.

And investing in proteomics today could be like turning back the clock and buying genomics stocks 2 years ago… before they handed out the massive gains I showed you earlier.

According to renowned medical research facility the Baker Institute, proteomics provides 1,000X more information than DNA.

My colleague Stephen McBride and I recently chatted with a PhD geneticist who told us: “Genomics is fun, but the real breakthroughs will come from proteomics.”

In short, proteomics is the next frontier of technology.

Scientists believe it could one day cure human aging...

Allow us to design bacteria that scrub pollution from earth’s atmosphere...

And even eradicate some of today’s worst diseases, like Alzheimer’s.

- The potential of proteomics is mind-blowing…

Until recently, the sheer number of proteins in our bodies, along with their complexity, have kept proteomics confined to college science labs.

But that officially changed in November…

That’s when Google’s powerful AI supercomputer called DeepMind finally solved the “protein folding problem” that had been baffling scientists for 60 years.

Scientific journals called it a “conundrum of science.”

But it’s finally been solved… and it’s opened up a whole new world of investing opportunity.

But remember: This opportunity is so new, there isn’t even an ETF to play it yet.

The ONLY way to take advantage is with the right individual stocks… and there are only a handful of them out there.

- Last night, my partner Stephen McBride named one of our top proteomics stocks to buy today.

He and I are in 100% agreement that this stock is a total gamechanger. Everyone who tuned in to the big event got instant access to this pick last night.

Because this is such a massive opportunity, we want you to have access to it as well. So, we’ve made a replay available for a limited time. Go here to get the name of this proteomics stock now, and have a pen and pad ready to write it down…

Justin Spittler

Chief Trader, RiskHedge

P.S. Please keep in mind: This is a smaller stock most folks haven’t heard of. And like any early-stage company, it will be volatile. As always, never bet more money than you can afford to lose. It’s not for everyone. But for those excited to get in on this ground-floor opportunity, go here.