What’s the greatest secret in all of investing?

I’m not talking about empty slogans like, “Buy when there’s blood in the streets.”

I mean in the real, concrete sense: What’s the one secret that if more people knew, they’d be rich?

My answer will probably surprise you.

I like to think I’m more qualified than most to answer this.

For one, I co-own a financial research business and I’ve read thousands of pieces of feedback from individual investors over the years.

I’m also a Certified Public Accountant and used to work with closely held businesses and wealthier families in South Florida.

I’ve seen the intimate financial details of more families than I can count… from celebrities and professional athletes down to the average family.

The #1 thing I’ve learned:

-

The families that achieve lasting wealth aren’t necessarily the ones who earn the most from careers.

No… the families that get rich and stay rich are ones that invest using simple, proven strategies and have the discipline to stick with them.

Before you think “heard that before” and click away… please understand I’m not talking about the “buy and hold until you retire” strategy most financial advisors preach. The one where you invest a little in a broad index fund every month and ignore the market’s ups and downs.

Although that can work for some folks, it has major drawbacks. For example: When the market crashes, like it has this year, you are guaranteed to lose a lot of money.

Your financial advisor will assure you those losses are temporary. And he’s probably right… as long as markets bounce back on a time frame that suits your financial goals.

-

But what if you barely had to experience bear market losses at all?

This idea is more important than ever today. The standard 60% stock/40% bond portfolio is having its worst year since the Great Depression.

I’ll come back to that in a second. First, let me show you an example of a simple strategy that any disciplined investor can use to beat the market.

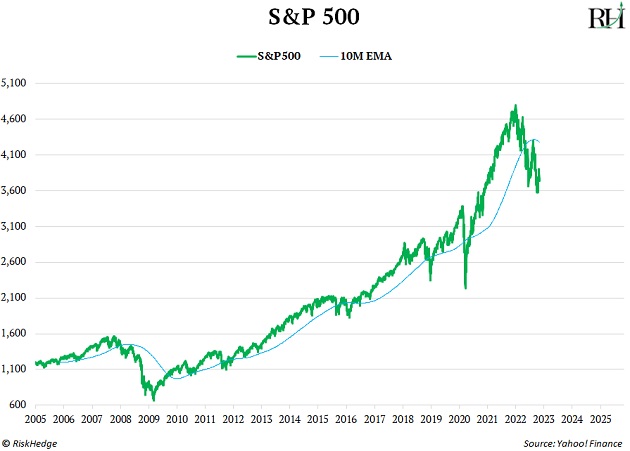

This chart shows the S&P 500 in green. In blue is the S&P 500’s “10-month exponential moving average.” That’s a simple math equation that averages the S&P 500’s price over the last 10 months, but weights recent months more heavily.

Now imagine this. Instead of buying and holding the S&P on blind faith that it will always rise on a timeline that suits your financial goals…

You only own the S&P 500 when its price is above the moving average.

When it’s below its moving average, you get out.

Since 1950… the S&P 500 has returned 9.9%/yr.

This simple strategy returned 11.5%.

That 1.6% boost is a LOT.

If you save and invest $2,000 a year for 40 years and earn a 9.9% return, you’d have $946,000 at the end. Not quite millionaire status.

If you earn an 11.6% return… you’ve got $1.53 million.

-

You’re easily a millionaire.

But that’s not even the most important part.

The most important part is you would’ve exited the S&P 500 before its most damaging crashes…

Saving you a lot of emotional pain and “temporary” losses.

Isn’t that amazing? By implementing one simple rule and having the discipline to stick with it... you can boost your returns and cut your risk.

Of course, this is just a simple illustration. It won’t solve all investing problems.

Oftentimes when the S&P 500 is struggling, other markets are charging higher.

This strategy won’t let you profit from bull markets elsewhere—like commodities, real estate, international stocks, or bonds, for example.

And there’s almost always a bull market somewhere.

But my point remains… a little discipline is all it takes to beat the markets.

So why doesn’t everyone do this?

Most investors, in my experience, lack the ability to commit to one winning strategy and stick with it.

Instead, they hop around from hot sector to hot sector… and always seem to be two steps behind the markets as a result.

In critical times like today—with stocks and bonds combining for their worst year since the Great Depression—being two steps behind the market is not something anyone can afford.

That’s why this Thursday at 2 pm ET, I’m going live with my first-ever Urgent Publisher’s Announcement.

I’ll be sharing a new, dead-simple way to ensure you’re always on the right side of markets.

When you implement this strategy—which takes less than five minutes—you’ll instantly stop worrying about the ongoing bear market.

You won’t care if markets go up, down, or sideways. Because you’ll be positioned to profit, no matter what.

And if you implement the idea AND stick with it—your family will become one of those rich ones.

I’ll show you everything you need to know on camera on Thursday at 2 pm ET.

More tomorrow.

Dan Steinhart, CPA

PS: In my personal experience, it’s hard to beat the market when stocks are ripping higher. But it’s pretty easy to beat the market by a significant margin when it’s struggling, like today. I’ll show you how I do it on Thursday at 2 pm ET. Mark your calendar.