My friend and colleague Justin Spittler (our Director of Trading) is doing something special Monday.

For the first time, he’s sharing his proprietary trading indicator on camera. It’s timely because this simple one-line chart can help you tune out the upcoming election noise and focus on making profitable trades.

You can attend by signing up here. The video showcase is Monday morning.

Moving on...

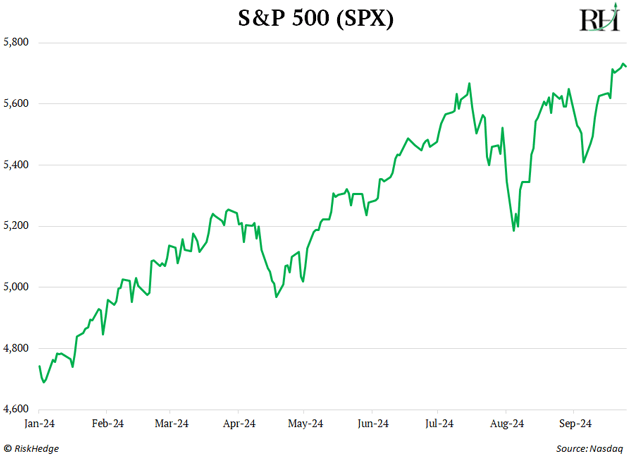

- Who canceled the September swoon?

September is historically the worst month for stocks. And we know markets typically dip ahead of US presidential elections.

The S&P 500 isn’t obeying these seasonal trends this year.

US stocks just hit their 41st record high of 2024. It’s the best start to a year since 1997!

My friend Jawad Mian of Stray Reflections recently reminded me of an important investment truth.

You often make the most money finding “anomalies” in the market: “To find these opportunities, ask yourself: What IS happening that SHOULDN’T be?”

Stocks are ripping higher right now. This SHOULDN’T be happening, but it IS.

This tells me there’s real strength behind this market. And it’s not only a handful of stocks going up. Over 150 names in the S&P 500 are up 20%+ this year.

Scroll down the list of stocks hitting new highs. You’ll see everything from U-Haul (UHAL)… Walmart (WMT)… Booking Holdings (BKNG)… taser maker Axon Enterprise (AXON)… McDonald’s (MCD)… and even stodgy ol’ IBM (IBM)!

This is a market for making money. Invest accordingly.

|

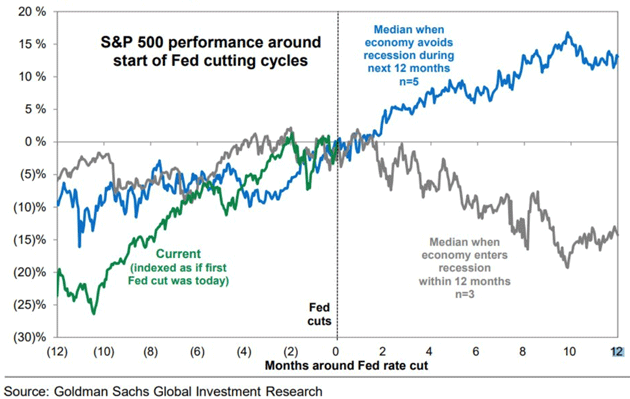

- The Federal Reserve cut interest rates last week for the first time since COVID.

The S&P 500 quickly vaulted to all-time highs.

Where it goes over the next year depends on the strength of America’s economy.

When the Fed cuts rates because we’re headed into a recession, things get messy. It’s happened a dozen times since 1970, and stocks have typically fallen 14% over the next 12 months.

Stocks perform much better after rate cuts when the economy keeps humming. They gain 11% in the next year, on average, as this chart shows:

Source: Goldman Sachs

Source: Goldman Sachs

Nobody knows where the economy will be a year from now. But our research suggests it’s as strong as an ox today.

Legendary trader Stan Druckenmiller often says, “The best economist I know is the guts of the stock market.” In other words, you should trust signals coming from the stock market more than some economist sitting in an ivory tower.

And right now, the guts of the market are screaming, “Higher!”

|

Discover the Ultimate Trading Chart: Get exclusive access to Justin Spittler's "One Chart to Rule Them All." Don't miss out—sign up for the video showcase on Monday, September 30! |

Homebuilder stocks are hitting fresh highs. Would this be happening if the economy was in the toilet? No chance.

I had dinner with the manager of a multibillion-dollar global fund in Abu Dhabi last week. Bahraini meat skewers, tasty! His view: Get ready for a melt-up in US stocks in the next 6–12 months.

My take: Continue to invest in great disruptors profiting from megatrends, and the rest will take care of itself. That’s what we do in Disruption Investor.

- Have you tried ChatGPT’s new toy?

OpenAI just released ChatGPT’s new “advanced voice mode.”

I’ve played around with it for a few hours and wow, it’s a game-changer. Typing questions into artificial intelligence (AI) chatbots feels like going back to fax machines.

My daughter is too young to type, so I had her ask ChatGPT to explain how airplanes fly. It explained flight (to a five-year-old), then asked whether she liked flying and where she wanted to go on her next vacation.

It’s hard to communicate just how impressive voice mode is. It feels like you’re talking to a real person. AI just got a new superpower.

Parents will use this tool to coach their kids through hard math problems. Others will use “VoiceGPT” to hone sales pitches.

The idea of talking with chatbots all day sounds dystopian. Teenagers already walk around like zombies with their heads stuck in their phones. AI will make this worse, right?

I don’t think so. Today, we slouch and squint while we type on keyboards and bump into people on the street because our heads are stuck in our phones.

AI solves this by making computers more natural.

Technology has always been unnatural. We tap awkwardly placed buttons on our PCs… swipe our smartphones… and once upon a time, we flicked switches on giant mainframes.

With AI, we can just talk to the machine, and it’ll know exactly what we want. A decade from now, screens will barely exist. This is where the puck is going.

AI will usher in the invisible computing age. AI, everywhere, all the time.

Better… smaller… faster computer chips enable this innovation.

Chipmakers are the obvious winners here. That’s why we own six chip stocks in Disruption Investor, and they continue to be one of my top sectors to invest in.

- Today’s dose of optimism…

The number of Americans dying from drug overdoses surged sixfold over the past two decades. Prescription painkillers like OxyContin and synthetic opioids like fentanyl are the main culprits.

Good news: We just saw the biggest decline in overdose deaths on record, with fatalities dropping 10% across the US. Causalities fell 22% in Vermont and 31% in Ohio.

Data suggests the widespread availability of naloxone, a medication which reverses opioid overdoses, is helping.

Have a great weekend, and I’ll see you Monday.

Stephen McBride

Chief Analyst, RiskHedge