It might just be the best opportunity in American history for this investment.

Will you take advantage of it?

Longtime RiskHedge readers know me as the disruption guy.

It’s my job to study disruptive trends and show you how to make money from them.

And today, I have a “special situation” disruption for you.

This money-making opportunity only comes around once every couple of decades.

The last time we saw this setup, investors made 1,600% gains. The time before that, folks “only” banked 550% profits… in less than five years.

And after just chatting with one of the world’s leading experts on this specific type of investment, I can tell you this once-in-a-generation opportunity is on the table again.

More on that in a minute. But first…

- Did you notice something odd on last week’s bank statement?

This past week, the US Government started handing out “free money.”

Over 60 million Americans have already received a $1,200 check from Uncle Sam. And there’s plenty more on the way.

The US government passed a historic $2.2 trillion stimulus package to fight the economic fallout from the coronavirus.

And get this… governments around the world have passed $7 trillion worth of stimulus in just the past four weeks!

My friends, the money spigots have been turned on. These are the biggest, most expensive spending packages in history.

It dwarfs what we saw in the financial crisis… and even the Great Depression.

According to Congressional Research, the total cost of WWII was $4.1 trillion in today’s dollars. Yet governments have already agreed to splash out $7 trillion!

Governments have never borrowed and spent this much money.

- This spending spree is sparking a huge money-making disruption.

When folks see governments throwing trillions of dollars around, it triggers a thought in their minds.

If you’re familiar with how our financial system works, you know our money isn’t tied to anything of real value anymore. Rather, the value of the dollar largely depends on politicians making responsible financial decisions.

In other words, there are consequences when governments spend and borrow ungodly sums of money.

And right now, politicians are going out of their way to spend as much money as possible.

Each time this happens, folks worry about the value of their hard-earned savings. And they’re drawn to “real” assets the government can’t just create out of thin air.

In other words, it perks their interest in hard money—like gold.

- Out of control spending kicked off a gold supercycle in 2000.

US government spending started getting a little wild at the turn of the century.

In 2000, spending jumped by $70 billion… a year later, it soared another $125 billion. And when the ‘08 crises hit, spending was surging $270 billion a year!

As government spending soared, so did Americans’ interest in gold.

In 2000, gold was selling for $200/ounce. By the end of the decade, it surged almost 600% to $1,350.

No investor would turn their nose up at 600% gains.

But buying gold isn’t the “special situation” disruption I have to show you.

- When folks pile into gold… it pays to own gold stocks.

Gold stocks are like gold on steroids.

They’re “leveraged” to the price of gold… meaning when gold moves an inch, gold stocks can move a mile.

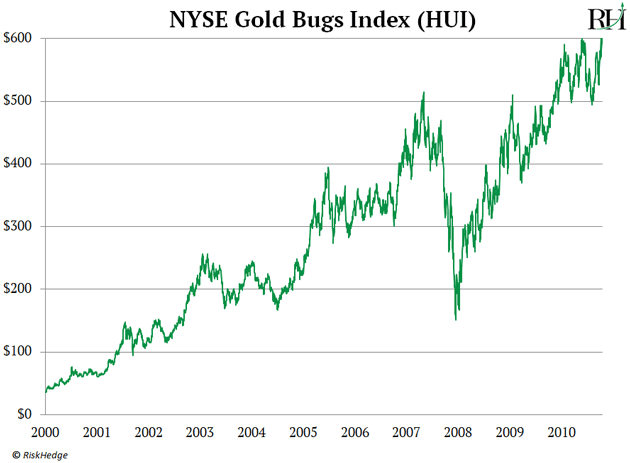

When gold spiked 600% between 2000–2010, the average gold stock surged 1,600%!

Many individual gold stocks soared even higher during that time.

Agnico Eagle Mines (AEM) surged 2,850%...

Kinross Gold (KGC) shot up 1,940%.

And Newcrest Mining (NCM.AX) jumped 2,640%...

- The exact same pattern played out in the 1970s.

From 1976–1980, US government spending jumped 55%...

Gold rocketed almost 400% during that period… but gold stocks handed investors almost 6x their money.

Do you see the pattern?

When governments start splurging, investors get interested in hard assets like gold. And when gold jumps, you want to own gold stocks.

- And this pattern is starting to repeat itself…

Since Congress started debating the historic $2.2 trillion stimulus package in early March, gold stocks have shot up 57%!

In short, this unprecedented spending spree is creating a once-in-a-generation speculative opportunity in gold stocks.

And the industry insider I’m talking with—a true legend in the resource space—believes we’re at the start of another big run-up in gold stocks.

- Now, I get it… Gold isn’t as “exciting” as the disruptions I often write to you about...

Self-driving cars… healthcare disruption… and cyber are much “sexier” than gold.

But don’t let that stop you from taking this opportunity seriously.

I’ll choose profits over excitement any day. And buying gold stocks at the right time—NOW—is one of the best ways to collect big gains quickly.

Gold stocks have exploded for triple—or quadruple—digit gains seven times in the past 48 years.

Today, the cycle just started again… and it could be the most lucrative yet.

By picking the right gold stocks, you can make tons of money.

But finding the right gold stocks isn’t easy. There are thousands. Most are “duds.”

If you’re interested in putting money to work in this idea, my #1 piece of guidance is this: Don’t go it alone. Find a proven expert to guide you.

- That’s where my friend Marin Katusa comes in...

Marin is a hedge fund manager, New York Times bestselling author, and one of the most trusted and well-connected dealmakers in the resource space. He’s personally financed some of the most successful mining businesses.

And he’s built one of the greatest investment track records in history (with wins of 1,852%, 1,050%, 1,450%, 2,400%… even 4,160%).

Right now, Marin says the stage is set for what he believes are the greatest investment opportunities we’ve seen in a generation.

And he’s personally investing millions of his own money in a small group of stocks to take advantage of this rare window.

Now, because this is such a big—and urgent—opportunity…

- I’ve asked Marin to join me and RiskHedge CEO Olivier Garret in an exclusive interview for RiskHedge readers only.

During this emergency broadcast, which we’ll air on Tuesday, April 28 at 10:00 am ET, Marin shares:

✔ Why an inevitable surge in gold is coming

✔ How to spot the companies poised to deliver massive returns over the next 12–24 months

✔ One of his top gold stocks to buy right now (name and ticker free for everyone who attends)

You don’t want to miss it.

Stephen McBride

Editor — Disruption Investor

Reader Mailbag

We’ve been flooded with great feedback on last week’s RiskHedge Report: “Coronavirus Will Wipe Out These Three Industries for Good.”

I said this was the final nail in the coffin for 1) movie theaters, 2) department stores, and 3) office space operators. Your fellow readers had a lot to say.. including a few predictions of their own…

Read their responses below, and keep the feedback coming at Stephen@riskhedge.com.

Hi Stephen, thanks for your insights... all good thoughts. In addition, I doubt the cruise industry is going to make a comeback after all this. It won't cease to exist, but the thought of getting stuck at sea, quarantined for a month on a ship full of sick people, especially for older folks with health risk factors, is going to put a giant dent in the business. Even with a vaccine for 'rona, there will always be the worry of some other nasty virus lurking. Cruise ships are notorious for cabin ventilation being shared all over the ship.

Another industry to be adversely affected longer term, is stadium or crowd-based sports venues; that is, those venues that need a crowd to make a profit. I don't see crowd-based games going away completely, but watching ball games on a big screen hi-def TV is already reducing crowds in the NFL and other sports. Big name teams might do okay, but the less successful franchises won't. I have to wonder if the same issue might affect the gate receipts for live music concerts, too. Crowd-based events won't do well, especially if there's no vaccine for the virus du jour. Best regards—Frank

Bookstores—I read a lot of books BUT haven’t visited a bookstore in years. Get hard books via Amazon and digital books for Kindle via the web. Amazon and other websites recommend books weekly and most books can be found through authors websites, etc. Every book can now be previewed online.

Music DVD/CD shops—iTunes, Sirius, Spotify, Pandora, etc. have doomed those shops. Here again comes Amazon for hardcopies.

Walk-in banks—Most banking functions can now be conducted online. There’s little need for large lobbies and large teller counters. I did find out that due to the COVID-19 shutdown, that I have to call-in for an appointment in order to access my safe deposit box.

Thanks for your interesting RiskHedge Reports—Dan

Stephen, the newspaper industry has been struggling for years, having lost much ad revenue to the online world. Classified ad business has almost completely moved online. Now that so many stores and restaurants are closed, even those that were recently advertising in local papers currently don’t have any reason to do so (nor the money to spend). I am encouraging people who value their local papers to buy classified ads now, even if they have nothing to sell and no jobs to list. I spent $20 for an ad to send some words of hope in the current situation.

The other troubled business is the US Postal Service. Bizarre internal rules forcing them to prefund pensions many years into the future have plagued them for years. They, too, have lost business to the internet, as people can both receive and pay their bills online rather than doing so by mail. Other package services (FedEx and UPS) have taken much of the parcel post business. Again, now that stores are closed, they have no reason to mail circulars and other postal ads. First class mail is the best revenue source for the PO, so I am encouraging people to send their friends and family letters and cards.

Helping these two traditional industries survive requires only a modest expenditure done by many people. I hope you will bring this issue to the attention of your readers—and I hope they will respond by following my suggestions. —Jean

I’ve worked from home for the last two years of my buyout agreement and loved it! It’s a real shame and tragedy that it took Covid-19 to make businesses aware of the savings available for work-from-home strategies. I’m convinced the cost savings for businesses, workers, and our climate will be enormous, and that anything and everything that has to do with commuting to work will be disrupted. In addition to what you mention in your email, some of these businesses include:

- Oil (already in trouble)

- Autos (less demand for sure)

- Convenience Stores (less convenience/less demand)

- Starbucks (coffee delivery?)

- Uber, Lyft, etc. (never understood this market anyway)

- Clothing/Apparel (casual will be king)

- Education (endowments for research instead of buildings?)

- Residential Construction (even more demand?)

—John

The gaming industry will take a beating. The sporting industry will take a long time coming back. Their only savior will be TV. Playing to empty stadiums. —Jack

I don't think this Covid-19 crisis is the end of the cinema industry. The future of cinema is art crossover, urban cinemas on the one hand and dine-in cinemas on the other. The traditional suburban "popcorn and coke" multiplexes will be fewer in number in the future. However, they will not disappear for a multitude of reasons. Not leastways is the codependency of exhibition on distribution and vice versa. Here is an explanation for non-industry insiders:

Without a red carpet premier and the subsequent cinema release, all the "free" promotion that accompanies a film run goes away and the distributors have to replace that pay-as-you-go promotional tour of the world that is a film release with print, promotion, and marketing hard dollars. Without a cinema release, a film is just another consumer product that has to fight for eyeballs like a video game. —Jeff

Stephen, you've opened my eyes to something I hadn't given so much as a thought to. I've spent the last couple of weeks looking for those stocks that can take advantage of the present situation without even thinking of those which I might need to divest.

I'm about 50/50 funds/shares, and your newsletter had me take a very, very close look at the underlying investments in the funds... and I have found a bit of weeding that needs to be done!

Thank you for your insight and making me look deeper into my funds. All the best and 'stay safe' —David

Completely agree with the last one working from home. However, people are tired of being cooped up at home (especially if they start working from home permanently). At least for a while, people are going to go out shopping and watch movies and not take our freedoms for granted. You are probably right (eventually), but probably not for another couple of years to five, provided they find a cure and we don’t have another pandemic. —Claudia

Stephen, I agree with your list, so far. I also think cruise lines and ski resort operators are vulnerable.

On the flip side, a move toward an increase in a permanent, work-from-home population might benefit residential real estate, as more white-collar workers might want to trade up to a residence with space for a dedicated home office. —Tom

Buses, subways, and possibly trains could be in trouble as more folks will find alternative travel arrangements. Could this be an incentive for car rental companies to take up the slack? —Lionel