My warning came true… The US government runs out of money in 20 days… Should you dump your stocks?... I want to know: Would you follow a contrarian indicator portfolio?

- I told you this would happen.

On January 30—with US stocks having surged 10% to kick off the new year—I warned: “Markets are about to hit a brick wall...”

The reason was simple: I knew the “debt ceiling drama” was around the corner.

The following month, stocks started falling... and they haven't recovered.

And as expected… worries of a potential US default is by far the biggest story in finance.

It’s plastered all over the front page of Bloomberg…

Source: Bloomberg

Source: Bloomberg

Legendary trader Stan Druckenmiller warned the US debt crisis is “worse than I had imagined.”

Former Federal Reserve vice chairman Bill Dudley also issued a stark warning: “Be afraid; be very afraid.”

- “Stephen… should I be worried?”

Uncle Sam spends a lot more than he collects in taxes. He funds the gap by borrowing money.

Some folks think there’s no limit to how much money politicians can spend, but there is.

The “debt ceiling” is a self-imposed limit on how much money Uncle Sam can borrow. We hit the $31.4 trillion limit a few months ago.

Now, Republicans and Democrats in Washington—who seem to despise each other—must sit down and agree on a deal to raise the cap.

The clock is ticking. Uncle Sam’s coffers will run dry as early as June 1. That’s only 20 days away!

If the world’s most powerful country fails to repay investors who bought Treasury bonds—the world’s safest asset—it would cause a market meltdown.

- But this isn’t the US government’s first debt ceiling rodeo.

Congress has raised the debt limit 102 times since 1917.

Every US president over the past century has hiked the debt ceiling at least once. This includes President Joe Biden, who’s lifted it twice already.

It’s a safe bet politicians will kick the can down the road once again.

I can almost guarantee the debt ceiling will be lifted sometime in the next few weeks.

Friends, this is all just political theater.

The debt ceiling debate makes bureaucrats feel important. They use it as a negotiating tactic to get what they want.

Here’s the playbook: Republicans and Democrats argue for a couple weeks before coming up with a plan, which allows both sides to spend more of your money.

- Here’s what you should do with your money over the next three weeks...

Despite there being a 100% success rate on debt ceiling raises, once every decade or so, it becomes a huge issue that spooks the markets.

The last time this happened was in 2011, when President Obama faced off with a Republican-controlled House. Congress raised the limit just two days before the US government ran out of money.

Negotiations came down to the wire and rattled markets. The S&P 500 fell 17% in the months leading up to the deadline.

While stocks could still slide as politicians hammer out a deal... my research suggests the brunt of this sell-off is in the rearview mirror.

The stock market is smart. It anticipates these types of events months in advance. This is likely one of the reasons the market has been flat over the past three months.

- Right now is your opportunity.

Use this as a chance to buy your favorite stocks on sale.

I recommend loading up on great businesses unaffected by the noise.

Will ASML (ASML) sell fewer chipmaking machines because markets are worried about a debt showdown? Will AI chip leader Nvidia’s (NVDA) business take a hit because some politicians are fighting? Probably not...

And folks who can afford $10,000 Louis Vuitton (LVMUY) handbags aren’t going to stop splurging because Washington milks this drama.

Here’s my top piece of guidance for you…

Drown out all this noise. It’s political theater designed to distract you from what really matters: investing in, and profiting from, great businesses.

Many decades of financial history show investing in solid companies and holding them for a long period of time is the surest way to make money in the stock market.

- I’ll leave you with an important investing tip.

Debt ceiling showdowns always remind us of how much money America owes.

You’ll hear folks say things like, “The US is $31 trillion in the hole; the country is bankrupt.”

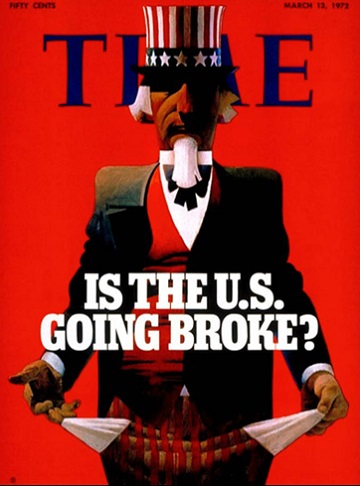

RiskHedge readers know I love using financial magazine covers as contrarian indicators. Check out this TIME cover:

Source: TIME

Source: TIME

Squint and you’ll see the date in the upper-righthand corner: March 1972.

I’ve been reading about America’s ballooning national debt my entire life. And I agree it’s a major problem.

But as investors, we don’t get paid for our opinions. We’re here to make money. And investing based on US national debt fears has been a surefire way to miss out.

If you bet against US stocks when…

- TIME printed this cover back in 1972…

- presidential candidate Ross Perot wheeled out national debt charts in 1992…

- or America’s credit rating was downgraded in 2011…

...you lost money.

I would know… because this was me 12 years ago. In 2011, I was genuinely convinced the US was in serious trouble… and that US markets could crash and never recover.

I was dead wrong. US stocks tripled over the next decade and outperformed pretty much every other investment on the planet.

Use any sell-off as an opportunity to buy your favorite stocks at lower prices. Even if you don’t buy, don’t panic-sell your portfolio over the debt ceiling.

Stephen McBride

Chief Analyst, RiskHedge

PS: I’m considering building a portfolio that trades against whatever is on the cover of publications like TIME, The Economist, and Forbes.

If that’s something you’re interested in, write me at stephen@riskhedge.com.

In the mailbag…

On Wednesday, we asked where you stood on the climate change debate. Here’s what one reader had to say:

I believe climate change is real, but man-made change on a global basis is a hoax.

Question: If sea levels are going to be rising in the next 10, 20, 30 years, why would you buy and develop beach-front property, especially if you believe climate change is real? —Lawry

Another reader said:

I believe that the climate is changing, just as it has since the Earth came to exist. The theory that man is responsible is a hoax. —Anonymous