Today, we’re buying into $23 billion capital markets company Tradeweb Markets (TW).

Last month, clients traded $42 trillion in volume across its platforms.

We’re picking up shares today for a couple reasons...

For one, the broad stock market has recovered in a major way.

Yesterday, the S&P 500 ETF (SPY) and the Nasdaq 100 ETF (QQQ) both reclaimed their 50-day moving averages. This was driven by strong performances in technology, communications, consumer discretionary, and financials stocks.

These are “risk on” groups. If they’re performing well, it’s often a good time to buy stocks.

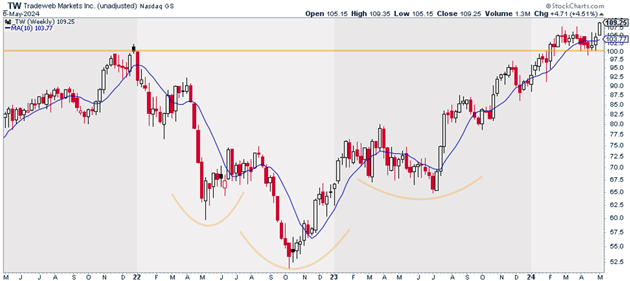

Tradeweb’s chart is also very bullish. As you can see below, Tradeweb broke out to new all-time highs back in February. It’s been consolidating above those prior cycle highs.

This is perfectly normal behavior. It’s a stock’s way of flipping prior resistance into support.

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

TW’s consolidation pattern appears to be over. Instead, it looks like it’s just begun its next major leg up.

I suggest picking up a starter position in TW today. I believe the stock could hit $155 within the next 12–18 months.

Exit your position if TW closes below $101. That gives us a risk-reward ratio of 4:1 on this trade.

Action to take: Buy TW at current market prices.

Risk management: Exit your position if TW closes below $101.

Justin Spittler

Chief Trader, RiskHedge