Rotation is underway…

As I’m sure you noticed, the past few weeks in the market have felt a lot different than the first six months of the year.

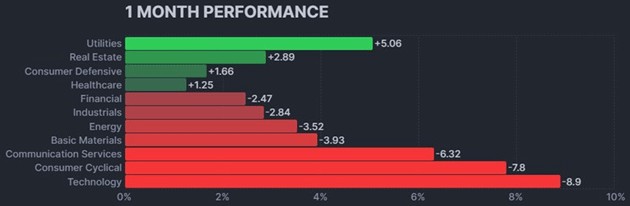

This graphic below says it all.

As you can see, utilities, real estate, and consumer defensive stocks have led the way lately. Meanwhile, technology stocks—which were massively outperforming for much of this year—have been getting crushed.

Source: FinViz

Source: FinViz

This is what we call “rotation.” It’s what keeps bull markets chugging along.

If you time these rotations ahead of time, you can become a very successful trader.

That brings me to my new Trade of the Week: ExxonMobil (XOM).

Exxon is the world’s largest energy stock.

Energy stocks are quietly setting up right now. Based on my analysis, they’re one area of the market that could see major inflows in the coming weeks.

But that’s just one reason why we’re putting on this Exxon trade…

Exxon also has one of the best-looking charts in the entire energy space. One of the things that I love about this setup is the lack of overhead supply.

Exxon is trading less than 4% below its all-time highs. The Energy Select Sector SPDR Fund (XLE), for comparison, is still more than 11% below its all-time highs, which dates all the way back to 2014.

In other words, XOM is displaying MAJOR relative strength.

I suggest putting on a starter position in XOM. I believe the stock could hit $140 over the next 12–18 months.

Exit your position if XOM closes below $113. That gives us a risk-reward ratio of more than 4:1 on this trade.

Action to take: Buy XOM at current market prices.

Risk management: Exit your position if XOM closes below $113.

Justin Spittler

Chief Trader, RiskHedge