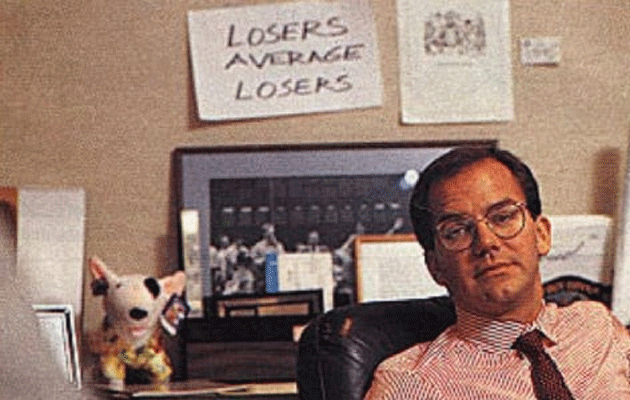

“Losers average losers.”

Paul Tudor Jones famously had these three words pinned above his desk:

Source: Mind the Product

Source: Mind the Product

But this isn’t just an iconic photo of one of the greatest traders who’s ever lived. It’s also one of the most important lessons for traders. It doesn’t matter if you’re just getting started or you’re a seasoned pro.

Buying laggards is a recipe for disaster.

You’re much better off adding to winning positions. And that’s what my latest Trade of the Week is all about…

Last August, I encouraged you to pick up shares in the Global X Uranium ETF (URA).

This fund invests in a basket of uranium stocks. It's a one-click way to bet on the nuclear energy renaissance.

|

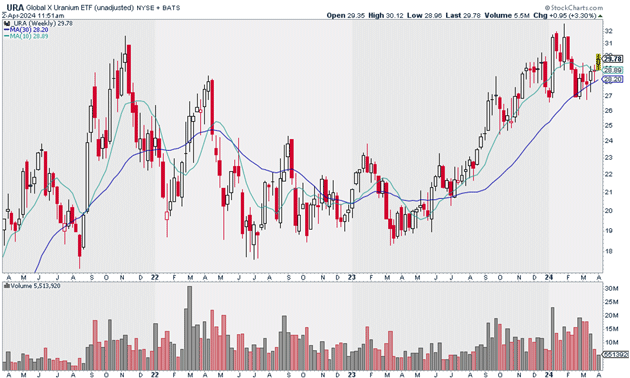

At the time, URA was trading for just under $23—and it had just started to break out of a multi-year consolidation pattern. It was signaling major upside. I said it could reach $30 over the next 12 months.

Two months ago, URA hit my target, topping $32. It then went on to pull back 17%, leading many traders to give up on the industry.

But remember: Winners keep winning. And I see URA setting up for another major leg higher. You can see what I mean below.

URA has been quietly grinding higher the past few weeks. Yesterday, it reclaimed its rising 10-week moving average:

Source: StockCharts (Click to enlarge)

Source: StockCharts (Click to enlarge)

We also saw some industry leaders within the group break out in a major way yesterday, including NexGen Energy Ltd. (NXE).

This tells me uranium stocks may be on the verge of another big move higher.

I suggest picking up a half position in URA today. I believe it can hit $45 within the next 12 months.

Exit your position if URA closes below $27. That gives us a risk-reward ratio of nearly 4:1 on this trade.

Action to take: Buy URA at current market prices.

Risk management: Exit your position if URA closes below $27.

Justin Spittler

Chief Trader, RiskHedge