It’s earnings season.

This is when companies share their quarterly results with the world.

A strong earnings report can cause a stock to skyrocket. A bad report can send a stock into a tailspin.

The problem is that it’s very difficult to know if a stock’s going to have a positive or negative earnings reaction.

That’s why I rarely ever buy a stock right before it reports earnings. To me, that’s basically gambling.

But that doesn’t mean we can’t capitalize off earnings season as traders. You see, sometimes the best trades come after a company’s already reported stellar earnings.

That brings me to our latest Trade of the Week: Palantir Technologies (PLTR).

Palantir is one of today’s most disruptive software companies. It’s also a major player in artificial intelligence (AI).

On February 5, Palantir demonstrated this to the world when it shared its fourth-quarter earnings. The company’s sales increased 20% for the period, driven by “unrelenting” demand for the company’s AI solutions. Management also reported a 70% increase in commercial revenue.

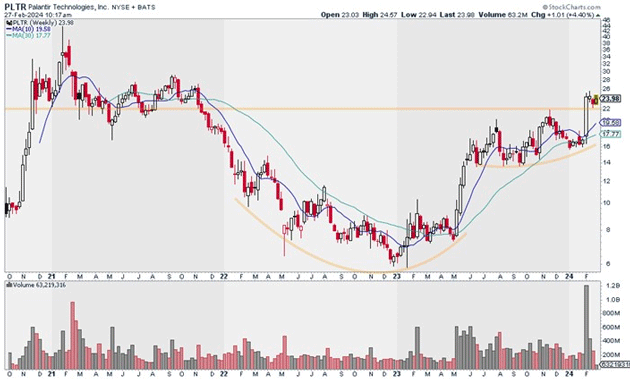

The stellar results caused PLTR to jump 31% in a single day on huge volume. This is what’s known as a power earnings gap (PEG).

In some cases, a stock will give back a lot of its PEG gains. But that didn’t happen here.

Instead, PLTR kept rallying. It climbed 17% over the next several sessions before cooling off.

This is the kind of strength I love for stocks. It tells us institutions were extremely eager to get involved with PLTR… even after its huge initial earnings pop.

Source: StockCharts

Source: StockCharts

I suggest picking up a half position in PLTR today. I believe it can hit $36 within the next 12 months.

Exit your position if PLTR closes below $21.50. That gives us a risk-reward ratio of 4:1 on this trade.

Action to take: Buy PLTR at current market prices.

Risk management: Exit your position if PLTR closes below $21.50.

Justin Spittler

Chief Trader, RiskHedge