“Pay attention to the smart money.”

You’ve probably heard this expression.

It’s a common saying among traders and investors.

Of course, the term “smart money” can mean different things to different people.

It can mean hedge funds or insiders, like a company’s CEO. But it also often refers to the bond market.

Now, I know a lot of traders find bonds boring.

But the bond market is incredibly important. It’s larger than the global stock market, and it’s dominated by huge institutions. Yet, many retail investors have never bought a bond in their lives!

So, what’s the bond market saying right now?

In many ways, it’s echoing the “risk on” sentiment of stocks. That’s what this issue is all about.

We don’t have a new trade today. Instead, I want to share a very important chart with you.

There are a couple things going on here. So, let me explain.

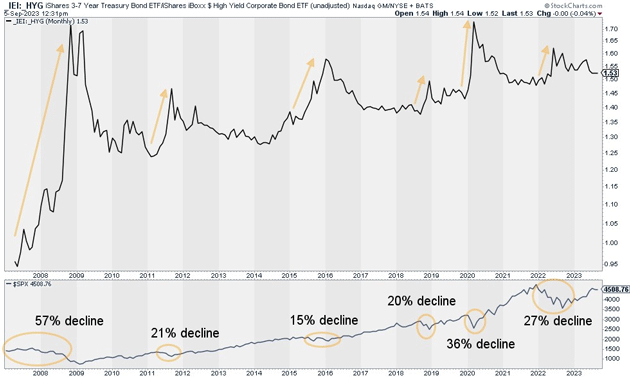

The larger box on top compares the performance of the iShares 3–7 Year Treasury Bond ETF (IEI) with the iShares iBoxx $ High Yield Corporate Bond ETF (HYG).

In other words, you’re looking at the performance of Treasurys versus junk bonds.

When this line is rising, Treasurys are outperforming junk bonds. This often happens when investors get spooked about something. It can indicate a “flight to safety.” (You can see how stocks perform when this happens in the second box.)

When it’s falling, it means junk bonds are outperforming bonds. This usually indicates healthy risk appetite… meaning it’s a good time to own or buy stocks.

For the past several months, this line has been falling. In other words, credit spreads have been narrowing. That’s good news for stock market bulls.

Source: StockCharts

Source: StockCharts

Watch out for a widening of credit spreads. That’s when the line on this chart rises.

You can see this happened just prior to—and during—the last six major market pullbacks… including the 2008 global financial crisis and the 2020 COVID market crash.

If it happens again, it will signal a “risk off” sentiment for stocks… and a time to exercise caution on our trades.

Justin Spittler

Chief Trader, RiskHedge