What’s the secret to successful trading?

Proper risk management is at the top of my list.

You also have to manage your emotions…

And never fight the trend.

You see, too many try to go against the grain. They buy stocks in free fall in the hopes they’ll catch the bottom.

That’s the exact opposite of what you should do.

Instead, strive to invest in the strongest groups. That’s what we’re doing today with my latest Trade of the Week: General Dynamics (GD).

General Dynamics is one of the world’s largest defense names.

We’re putting on this trade for a few reasons…

For starters, defense stocks have been red-hot lately. The iShares US Aerospace & Defense ETF (ITA) has gained 16% over the past six months, far outpacing the broader market.

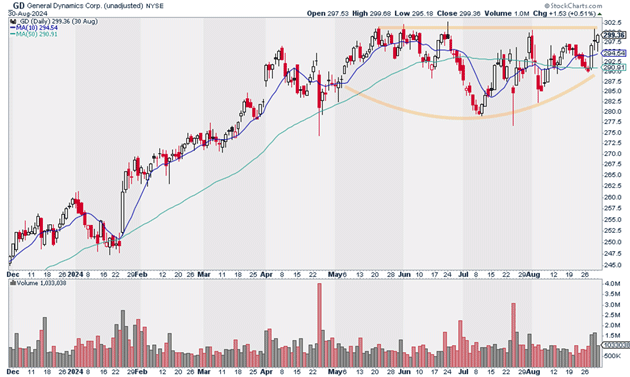

But unlike other names in its group, GD is not extended. As you can see below, GD is still building out a multi-month base.

I believe it’s only a matter of time before GD breaks out. We want to position ourselves before that happens.

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

That’s why I suggest picking up shares in GD today. I believe the stock could hit $360 over the next 12 months.

Exit your position if GD closes below $285. That gives us a risk-reward ratio of 4:1 on this trade.

Action to take: Buy GD at current market prices.

Risk management: Exit your position if GD closes below $285.

Justin Spittler

Chief Trader, RiskHedge