Volatility has come roaring back.

Yesterday, the Volatility Index (VIX) hit its highest level since the COVID crash.

Investors have taken notice, and many are taking shelter.

The iShares 20+ Year Treasury Bond ETF (TLT), which provides a one-click way to invest in Treasuries, has spiked 11% since the start of July.

Treasuries are considered a defensive asset, and they can help stabilize a portfolio during times of volatility. But they aren’t the only way for traders to protect themselves.

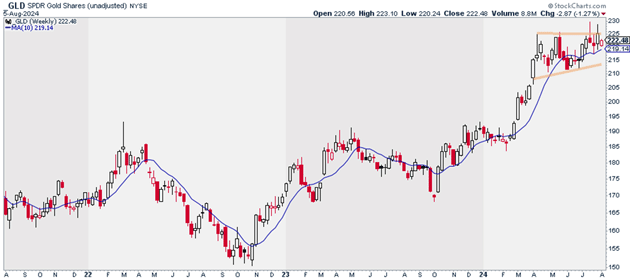

And that brings me to my latest Trade of the Week: the SPDR Gold Shares (GLD).

|

Real-Time Trades. Real Results. |

GLD tracks the price of gold. It’s the easiest way for traders to access the yellow metal.

We’re picking up GLD here for a few reasons. For starters, gold is widely seen as a safe haven asset. So, it could see a major bid in the coming months if volatility and geopolitical tensions remain elevated.

The price action on GLD is also very encouraging. As you can see below, GLD is printing a multi-week bull flag. This is a bull pattern that usually resolves higher.

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

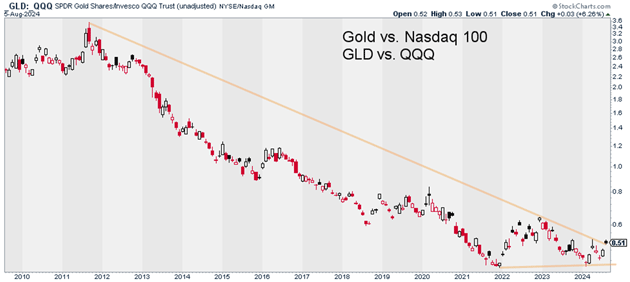

I also like the relative strength I’m seeing from GLD.

To understand why, take a look at this chart below. It shows the performance of GLD versus the Invesco QQQ Trust (QQQ).

When this line is rising, it means gold is outperforming tech stocks. When it’s falling, it tells us gold is underperforming.

We can see GLD is trying to break the downtrend it’s been in since 2011. If successful, this would mark a major change in character for gold. It would signify that gold is entering a prolonged period of outperformance.

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

I suggest just putting on a half position in GLD today.

I believe GLD could hit $260 over the next 12–18 months.

Exit your position if GLD closes below $210. That gives us a risk-reward ratio of 3:1 on this trade.

Action to take: Buy GLD at current market prices.

Risk management: Exit your position if GLD closes below $210.

Justin Spittler

Chief Trader, RiskHedge

Editor’s Note: If you’re interested in buying physical gold, consider our friends at Hard Assets Alliance. They’ve made buying gold extremely simple… no matter if you’re a beginner or someone who’s bought gold for years.

With Hard Assets Alliance, you can buy, sell, and store gold right from your computer. Fully insured, physical gold stored at the world’s most trusted vaults. And its network of wholesale dealers ensures you always get the best possible price.

We have a partnership with them that gets all RiskHedge readers free storage for 12 months. Discover more here.