Signs of spring are in the air.

For the first time in months, there was a glimmer of light in the sky when I was cycling home from the gym.

Let’s get after it…

- Confirmed: Silicon Valley’s best days are behind it.

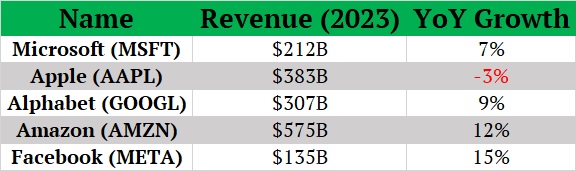

Tech giants Microsoft (MSFT)… Apple (AAPL)… Google (GOOG)… Amazon (AMZN)… and Meta (META) reported results last week.

Decent growth apart from Apple:

But trouble lies ahead.

While the headline numbers were solid, there was much talk on earnings calls about slashing expenses.

That should have investors saying, “Uh-oh.”

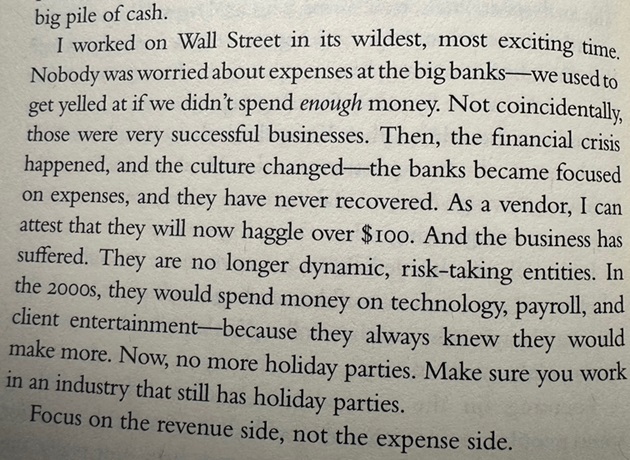

Every business peaks at some point. My friend Jared Dillian lived through it on Wall Street. In his new book No Worries—which I’m currently reading—he recalls how, at one point, banks couldn’t spend lavishly enough.

Then they got rocked by the financial crisis and started focusing on saving money instead of making it. This marked the beginning of the end. Read this quick excerpt:

Big tech is going through the same transition today.

These are no longer the fast-growing tech disruptors we once knew.

Meta even announced its first-ever dividend and a $50 billion stock buyback.

This is Meta basically admitting it’s out of ideas. It doesn’t know what to do with its money, so it’s returning it to shareholders.

This doesn’t mean its stock is doomed anytime soon. Companies that don’t invest in the future can boost profits, at least in the short term. And Wall Street only cares about what happens next quarter.

That’s why Meta and Amazon’s stocks surged higher after earnings.

But these big tech companies are retreating from the (innovation) frontier, like once-great empires in decline.

There are much better opportunities to be found buying up-and-coming disruptors profiting from megatrends. It’s like buying Apple or Amazon a decade ago.

That’s what we’re doing inside Disruption Investor.

- The AI killer that must be stopped…

I’m seeing renewed calls for the government to regulate artificial intelligence (AI).

I hate the idea of the government regulating AI.

Rule #1 for tech innovators: DON’T LET THE BUREAUCRATS IN. They’re innovation killers…

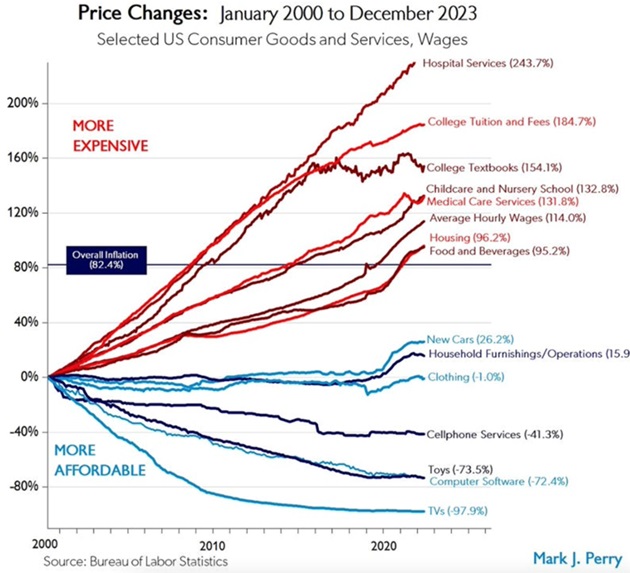

Here’s an updated version of what I call “the chart of the century.” It tracks changes in 14 important prices going back to 2000:

Source: AEI

Source: AEI

Every industry the government touches turns to stone.

You can see healthcare and college costs (in red)—both heavily regulated and warped industries—surged faster than anything else.

Compare this to the industries that are mostly free from government interference (in blue). Prices down; quality up.

AI has the potential to transform America. It can create personalized tutors that turn our kids into straight-A students. It can develop lifesaving drugs at warp speed (and already is).

It can also create trillions of dollars in wealth for companies and investors.

But if the bureaucrats get a stranglehold of AI, forget about progress. Innovation will be replaced with endless ethics committees.

This New York Times headline flashed across my screen last week:

Source: The New York Times

Source: The New York Times

To butcher a line from my favorite sci-fi book, Dune: “Bureaucracy is the innovation killer.”

We can’t let them win.

Time to regulate accelerate.

- Can you believe these words came out of a politician’s mouth?

My wife and I used to live in Argentina, and we still have many good friends there.

A century ago, Argentina was one of the richest countries on Earth—and as wealthy as America. But thanks to decades of socialist policies, Argentina’s economy is now about as good as war-torn Libya. No bueno.

But it’s on the cusp of a major change.

Argentina just elected a new president, Javier Milei. He’s a big fan of capitalism and freedom.

Milei recently delivered what techno-optimist Marc Andreessen called “the speech of the 21st century” at The World Economic Forum.

You should watch the whole thing, but here’s my favorite line:

“Far from being the cause of our problems… capitalism as an economic system is the only instrument we have to end hunger and extreme poverty across our planet.”

The worst lie ever told is that capitalism is bad for poor people. Truth is, it’s the best system in history for the less fortunate. It’s lifted billions of people out of poverty over the last 500 years.

I discussed this with a good friend in New York last week.

He reminded me just how quickly things can change: “You wouldn’t believe how bad things were in the US and the UK in the ‘70s. Everyone was predicting America’s decline. The IMF had to step in and rescue the UK in 1976.”

Then, two pro-market politicians—Ronald Reagan and Margaret Thatcher—got elected, shook things up, and the vibes shifted from bad to good.

America and London roared back, kicking off the historic 1982–2000 bull market, which saw the S&P 500 surge 900%.

I’m hopeful Milei can catalyze a similar shift toward optimism. Not only for Argentina, but the world.

Speaking of how quickly things can change, the Global X MSCI Argentina ETF (ARGT) has surged 30% since Milei’s election. I don’t own any, but maybe it’s worth a small punt:

Talk to you on Wednesday.

Stephen McBride

Chief Analyst, RiskHedge