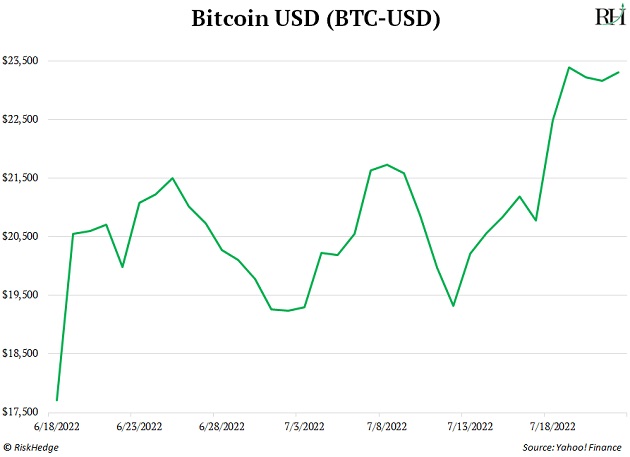

Have you checked crypto prices lately?

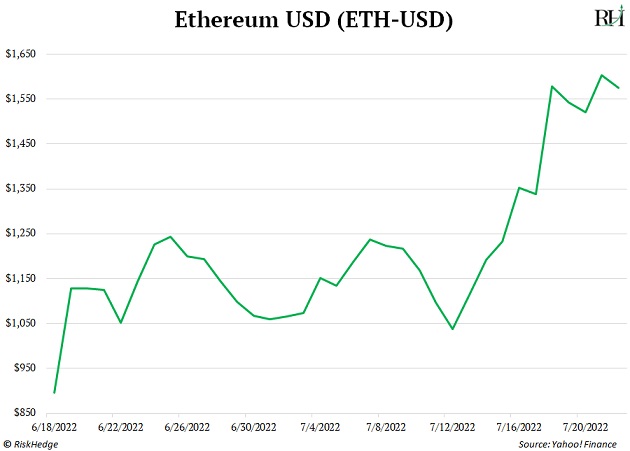

After a tough first half of the year in which bitcoin and Ethereum were more than sliced in half, prices are perking up.

Bitcoin fell to around $17,800 in mid-June. It’s rallied back to $23,200 as of this writing. That’s a 30% gain in a little over a month.

Ethereum’s up even more. It’s jumped from $896 to around $1,600 as of this writing. A quick 79% gain.

And many tinier coins are up many multiples of that over the past month, such as GRV (830%), SWRV (615%), KUT (396%), and more. Of course, many of these recent rallies include what RiskHedge Chief Analyst Stephen McBride calls “garbage coins,” and aren’t solid bets for building lasting wealth in crypto.

But it begs the question...

|

This Secret Tech Initiative is designed to change EVERYTHING. |

Is this the start of the next big crypto bull run?

Or is it a “fake-out rally” with more pain ahead?

Today, I’m sharing with you an excerpt of the crypto cycle research Stephen performed for his premium subscribers.

Because while crypto is the most volatile asset class in the world...

Prices don’t zig and zag randomly.

They follow predictable cycles.

Read on to find out where we are in this crypto cycle…

***

Stephen here...

Stephen here...

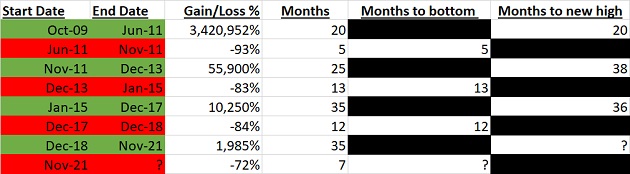

First, let me show you three key tables...

Don’t worry if they look overwhelming… I’ll break down the takeaways below.

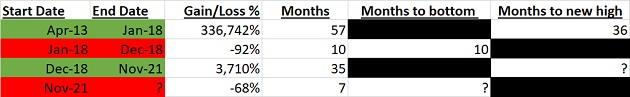

Table #1 shows bitcoin’s major cycles since 2009:

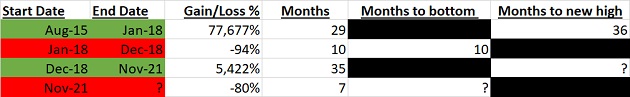

Table #2 shows Ethereum’s major cycles since it launched in 2015. Ethereum has only had one full bear market, so the data is based on a tiny sample size:

Here’s the same analysis for the market cap of the whole crypto market, excluding bitcoin and Ethereum. Keep in mind, the number of listed crypto assets has grown from six in 2013 to over 20,000 today.

Here are three big takeaways:

#1: Crypto bear markets are shorter than bull markets.

Bitcoin experienced four bull cycles and four bear cycles over the past 13 years. We’re currently in the fourth downturn.

The data shows bull markets last three times longer than bear markets, on average (29 months vs. 10 months).

Bitcoin and Ethereum take an average of 10 months to bottom once they peak for the cycle.

Crypto peaked last November, so we’re more than seven months into the current downturn. If this trend holds, prices could bottom around September (which would likely coincide with the most important event in crypto since bitcoin debuted).

This suggests we’re a lot closer to the bottom than we are to the top.

There’s a case to be made that crypto peaked earlier, back in May 2021. Most “on-chain” metrics, like trading volume, DeFi assets under management, and new active addresses all peaked in May 2021.

Although prices didn’t top out until November, crypto activity has been in a bear market for over a year.

Summing up: Whichever way you slice the data, we’re likely a lot closer to the bottom than the top.

#2: The long-term trend is up.

Across cycles, there’s a consistent pattern that’s never been broken. Each upcycle brings new highs in price. And just as important, each downcycle has led to “higher lows.” Prices bottom out at a level above the prior cycle’s highs.

Take bitcoin. Despite an 84% decline during 2017‒2018, bitcoin bottomed at a much higher level than its previous decline.

The latest bull market also brought fresh highs for bitcoin that were 250% higher than its previous peak.

The crypto market as a whole has also achieved higher highs and higher lows every cycle.

You see, crypto’s total market cap peaked at $830 billion in 2017. Last November, we topped out at $2.97 trillion.

At the December 2017 lows, crypto’s market cap plunged to $102 billion. Even after a 70% correction, we’re sitting at around $1 trillion today.

Summing up: Crypto is the most volatile market in the world, but its long-term trend is up.

#3: New highs take time.

We saw crypto prices take an average of 10 months to bottom after peaking for the cycle. But it takes longer to make new all-time highs.

After touching $20,000 in December 2017, bitcoin didn’t hit those levels again until the end of 2020, three years later.

But just because we might not see new highs for a year or two doesn’t mean you can’t make money.

Ethereum spent three years below its 2017 peak. Yet, it surged 14X between late 2018 and early 2021, when it finally made a new all-time high.

The same is true for many smaller crypto assets.

Summing up: We might not see new highs for a while, and that’s okay. There are many opportunities to make money in crypto.

Here’s what’s unique about this cycle

My research suggests we could hit new all-time highs quicker than past cycles.

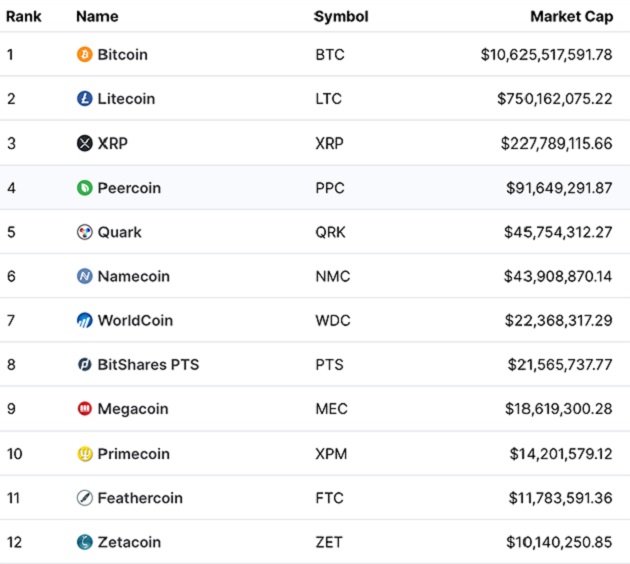

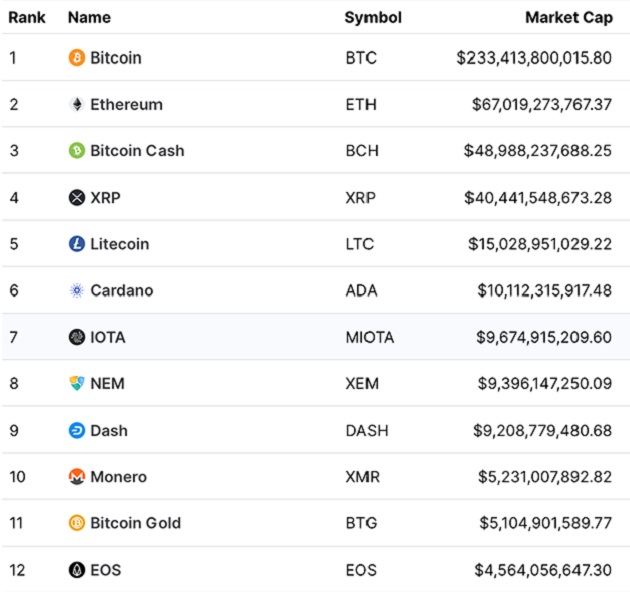

In past bear markets, the largest crypto assets were mostly worthless “cryptocurrencies” with no real use or value. Look at the top dozen cryptos in 2013 and 2017, for example.

The top 12 coins in 2013:

Source: CoinMarketCap

Source: CoinMarketCap

…and the top 12 coins in 2017:

Source: CoinMarketCap

Source: CoinMarketCap

With the exception of Ethereum, these are all digital coins that don’t do anything. Their sole use was speculation. So when that speculation collapsed, there was no reason for crypto investors or users to stick around.

This isn’t 2013 or 2017.

Today, we have real crypto businesses, with real products and users, producing real revenue. For the first time ever, we have productive crypto assets that aren’t tied to the bitcoin price.

For example, Ethereum raked in $560 million in transaction fees last month. That’s more than it made in 2015, 2016, 2017, 2018, and 2019 combined!

Uniswap, a “stock market” for cryptos, built on Ethereum, facilitated over $50 billion worth of trades during a recent 4-week span.

This solid foundation should support prices and help them recover quicker than past cycles. That makes buying quality cryptos for huge discounts extremely attractive.

Based on past cycles, we should expect markets to remain volatile over the coming months. But if you’re investing in crypto for the long haul like I am, do not get discouraged. Crypto has emerged from every cycle stronger than before.

It seems counterintuitive, but there’s never been a better time to be a crypto investor. Prices are down. But the sheer amount of innovation, brainpower, and experimentation happening right now is unprecedented.

Stephen McBride

Editor — Disruption Investor

PS: Go here to see why September 15, 2022, may well be the most bullish day for crypto in its history. Which is really saying something for an asset class that has produced 5,000,000% gains.

Don’t wait… because there’s a mountain of evidence showing the recent 50%+ gains in cryptos could be just the beginning. Could it all culminate in a blowoff top on September 15?