What happened to the leaders?

Over the past few weeks, we’ve seen a big selloff in growth stocks.

Leaders like Palantir Technologies (PLTR) and Oklo (OKLO) have plunged 37% and 53%, respectively.

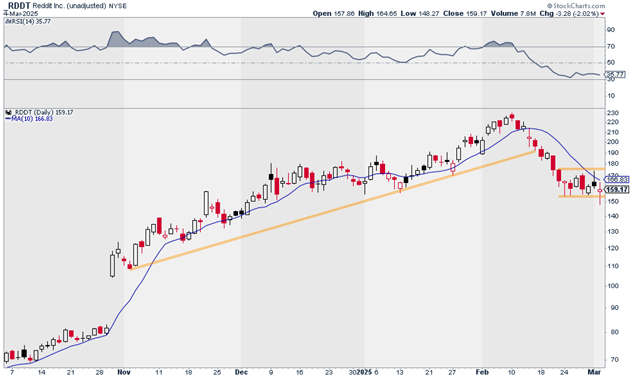

Reddit (RDDT), another former leader, has plummeted 31% over the past three weeks. By the looks of it, it could be headed even lower:

Source: StockCharts

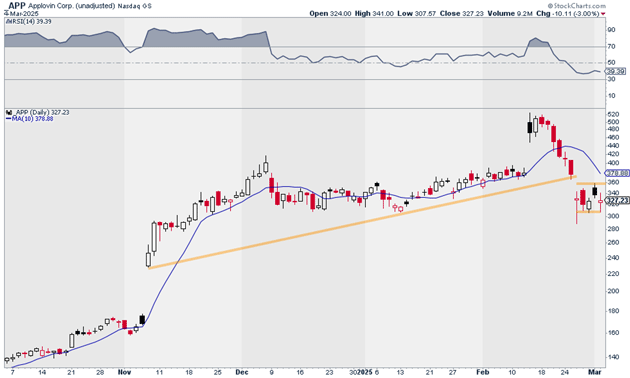

AppLovin (APP) also appears to be in trouble. After being one of the true market leaders this cycle, it’s starting to look like a short candidate:

Source: StockCharts

You could argue that these selloffs are warranted, even healthy. Many leading growth stocks have more than doubled or even tripled over the past year.

Also, leadership changes all the time in bull markets. It’s part of the rotation process.

There’s just one problem. When I look around the market, I don’t see many new leaders stepping up to the plate.

This needs to change—and probably in a hurry—if the market wants to head higher.

As I told my Express Trader members, my opinion on the whole market is that it doesn’t look great… but it doesn’t look awful, either. Evidence is mixed. In other words, it’s time to be cautious and selective.

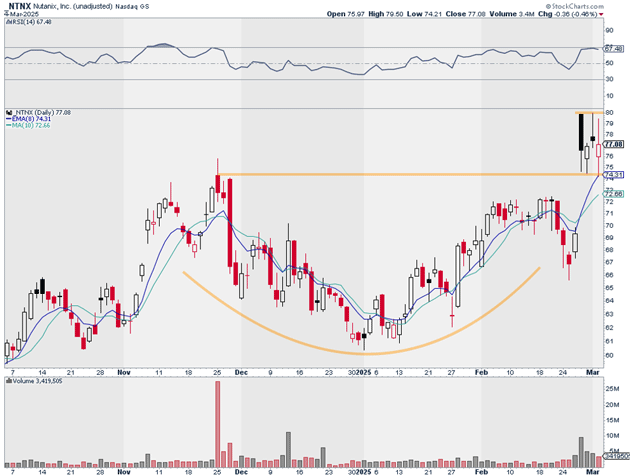

One name I’m watching closely is Nutanix (NTNX). NTNX is a $21 billion software company that recently reported strong earnings.

NTNX broke out to new all-time highs on the report and has been holding its breakout well. It’s in as good of a position as any to emerge as a big, liquid growth leader:

Source: StockCharts

Another name I just recommended in my Express Trader service is a clear leader among gold stocks, which are benefitting from rising gold prices.

Investors often flock to “safe haven” assets like gold during times of market or economic uncertainty, like we’re seeing now.

Depending on how the market performs over the next few weeks, I may recommend more stocks from “risk off” groups like consumer staples or utilities—areas of the market that make up things people “need” no matter what the broader economy looks like.

In Express Trader, my PRO Meter helps me determine when to go “risk on” or “risk off.” It takes the emotion out of investing and helps me zero in on what’s really going on in the market in any given week.

If you’d like to join us and get “finger on the pulse” trades at the start of each week, here’s how to sign up.

Justin Spittler

Chief Trader, RiskHedge