Last year was rough for growth and tech stocks.

After a red-hot 2020, the ARK Innovation ETF (ARKK)—which holds many top growth stocks—topped out in February 2021 and has gone downhill since.

Then there are the former market darlings…

Like trendy exercise-tech play Peloton (PTON)... work-from-home savior Zoom (ZM)… and telehealth pioneer Teladoc (TDOC)…

All of which recently completed the dreaded “round trip”—giving back their massive 2020 gains and sinking all the way back down to where they were at the start of COVID-19.

You know it’s been rough when Tiger Global, an elite investment firm focused on tech stocks, saw its hedge fund drop 7% in 2021. Its first annual drop since 2016.

So far, the worst of the volatility has been in growth and tech…

But many folks are nervous it could bleed into the overall market and tank the broader indexes, like the S&P 500.

Especially after the US Federal Reserve announced it’s going to raise interest rates more quickly than it originally anticipated.

If you’re even a little on edge about the market in 2022, this RiskHedge Report is for you.

I got all of our analysts to share their guidance on how to approach the new year.

As you’ll see, there isn’t one simple answer.

Each of our analysts focuses on different stocks and has different strategies in their newsletters.

Below, they’ll share some important tips. Whether you own growth stocks, microcaps, larger disruptors, or all of the above… you’ll find their words useful.

***

Chris Wood: In my Project 5X advisory, we’ll continue to take “free rides” (selling our initial stake when a position rises 100%+ and letting the rest ride risk-free)…

We won’t over-allocate to any one position…

And most important, we won’t forget the recent past.

There’s no sugar coating it: Microcaps have been beaten down since about February 2021. But it’s important to remember how quickly things change when the tide turns.

My long-time subscribers will remember during the “corona crash” of March 2020 I removed all our stop losses. I didn’t want us to sell all our stocks just because they were down. Instead, we stuck to our guns. We held on and we focused on buying early-stage, disruptive microcaps at bargain basement prices.

The strategy worked out great. All but one of the stocks we held on to achieved big gains, and the one loser lost less than 1%. We also picked up Personalis (PSNL) that March, which went on to give us 250% gains in just eight months. Two months later, we picked up Atomera (ATOM), dirt cheap, and we’re sitting pretty on that one. We took a free ride and have an unrealized gain of about 150%.

In fact, since the corona crash, we’ve closed 10 positions in Project 5X for an average gain of over 200%.

I say all this not to toot my own horn, but to prove a point. When things get dicey in the microcap world… which happens all the time… it’s crucial to stick to your guns. Conviction essentially becomes a form of risk management. And it’s key to making money in this space.

If there’s a reason to sell a stock—for example, your original investment thesis changed—then go ahead and sell it.

But if your only reason to sell is because the price went down, don’t.

Stephen McBride: I focus on owning great, world-class businesses for the long haul in my Disruption Investor advisory. I have a multiyear time frame, so I typically don’t worry about any short-term volatility.

Zooming out a bit, drawdowns are the price you pay for earning returns in the stock market.

If you look at pretty much every great stock in history, from Apple to Amazon to Nike, they all experienced roughly 50% drawdowns at one point. Yet they’re at or around all-time highs today and investors have been rewarded for holding on.

The only folks who held on through the tough times are those who had conviction in the business. Who did “work” on the stock, and continually checked their thesis.

I think it’s very hard to have an edge in the market these days. You have high-frequency traders that can trade at the speed of light… investment banks with huge teams that have loads more information than you… you name it.

If there’s one edge that everyday investors still have today, it’s conviction. Holding on when things get rough. Being a long-term investor.

I always remember a great quote from legendary trader Jesse Livermore…

He said, “After spending many years on Wall Street, and after making and losing millions of dollars, I want to tell you this: It was never my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight!”

I think that really speaks to owning great businesses with a multiyear plan. It’s the single best way to get rich in the stock market.

Justin Spittler: First things first: Many investors I talk to are worried about higher interest rates. But I don’t believe higher interest rates will deal a death blow to the stock market.

What I think is more likely is a continued rotation out of growth stocks. We’ve been seeing this for a year now. Growth stocks had an incredible 2020. But 2021 was a different story, with the ARKK fund falling more than 20%. And many of 2020’s most popular names falling 50%+.

I’ve written about rotations before. Rotation occurs when many investors simultaneously move money from one sector of the stock market to another. It’s called “rotation” because money typically rotates from sectors that are hot to sectors that have been lagging.

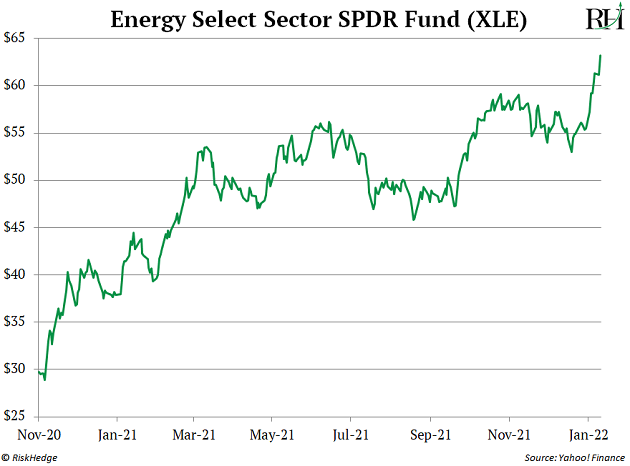

We’re currently seeing a rotation out of growth stocks and into sectors like financials, materials, and energy. This chart shows the performance of the Energy Select Sector SPDR Fund (XLE), which invests in companies like Chevron Corporation (CVX) and ExxonMobil (XOM).

You can see XLE is in a healthy uptrend right now. It recently broke out to new all-time highs.

I think these industries will continue to do well for the foreseeable future. That’s where I’m currently looking for opportunities in my Disruption Trader and IPO Insider advisories.

In short, you want to bet on industries that are strong and leading the way. This isn’t the type of environment where you should hunt for an outlier in an industry that’s lagging… thinking you can buck the trend.

Don’t get me wrong: Even with taking profits recently, we still have plenty of growth stock exposure in my advisories. One reason is because although interest rates could continue to go higher, most of what we’ve been seeing is already “priced in.”

In fact, the market started pricing in higher interest rates for growth stocks about a year ago. Many names have already pulled back significantly. Some are starting to form bases, while others need a bit more time. I think we could soon start to see pockets of strength… where the best growth stocks begin to separate themselves from the rest.

I’ll be looking for names whose businesses are growing fast… have strong balance sheets… and strong earnings, or are trending towards profitability.

In short: When looking at growth stocks in this environment you need to be very selective. If you’re putting new capital to work, only invest in the best of the best.

Chris Reilly

Executive Editor, RiskHedge