Yesterday was a hard day to be an investor.

By day’s end, the S&P 500 had fallen 7.6% for its worst day since 2008.

It’s no mystery why stocks cratered. Not only did coronavirus news get a lot worse over the weekend...

We also got shocking news from the Middle East. Major oil power Saudi Arabia announced it will ramp up oil production—which sent the oil price plunging a crazy 30%.

Lower oil prices tend to be good for consumers and for the US stock market. But investors don’t like surprises... and this was a shocker. Oil’s 30% plunge was its biggest one-day move since the Gulf War in 1991!

- In stocks, the selling pressure was so overwhelming that it triggered special “circuit breaker” rules...

“Futures” trading was halted before markets even opened at 9:30 am. Investors were unable to buy or sell. Markets were then halted again for 15 minutes during regular trading hours.

Yesterday was an emotional day for investors. If you regularly follow RiskHedge, you know our policy is to set emotion aside, step back, and look at the data.

Fortunately, there are historical parallels we can look to...

The last time futures trading was halted was on November 8, 2016. Most Americans remember that as the morning they woke up to new President Donald Trump.

As I said, investors don’t like surprises. Trump’s win was a shocker to practically everyone. Stocks tanked overnight, triggering the circuit breaker in futures.

November 2016 was an uncertain time... but it turned out to be an incredible buying opportunity in stocks. Trump’s election marked almost the exact bottom in the S&P 500, which would go on to rally 34% in the following 13 months.

The last time trading was halted during regular trading hours was in December 2008. Markets took another three months to bottom out. From its trough on March 9th 2009, the S&P staged a historic 11-year 400% bull market.

- Fact is, panic selling like we saw yesterday is more likely to occur closer to a market bottom than a top...

Let me be clear: I’m not saying you should blindly buy stocks.

In times like these, it’s more important than ever to be selective in the stocks you buy.

My suggestion: keep it simple.

I’m only betting on stocks that are part of huge megatrends.

- Megatrends reshape society…

They impact hundreds of millions of people. The biggest megatrends touch billions of people.

The biggest megatrends touch billions of people.

The rise of the internet was a megatrend. What started as a way for government researchers to share information is now one of the most disruptive forces on the planet.

Today, 4.5 billion people use the internet!

The internet opened up the door for some of the world’s most dominant companies today, including Google (GOOG), Amazon (AMZN), and Facebook (FB). And made early investors a fortune…

So, why bet on megatrends today with everything else that’s going on? Simple.

Megatrends are unstoppable. They power ahead no matter what’s happening with the economy or financial markets. It doesn’t matter if there’s a recession or if stocks are tanking.

The meteoric rise of Netflix (NFLX) is proof of this…

- Netflix is one of the most disruptive companies ever…

Netflix first laid waste to Blockbuster video in 1997. Then, it went after the cable industry.

In 2007, it launched its revolutionary streaming service.

Less than a year later, the global financial crisis began. The S&P 500 plunged 57% over the next two years. The tech-heavy Nasdaq dove 65% over the same period.

You’d think a small disruptor like Netflix would be pummeled during all this. But it bucked the trend in a BIG way.

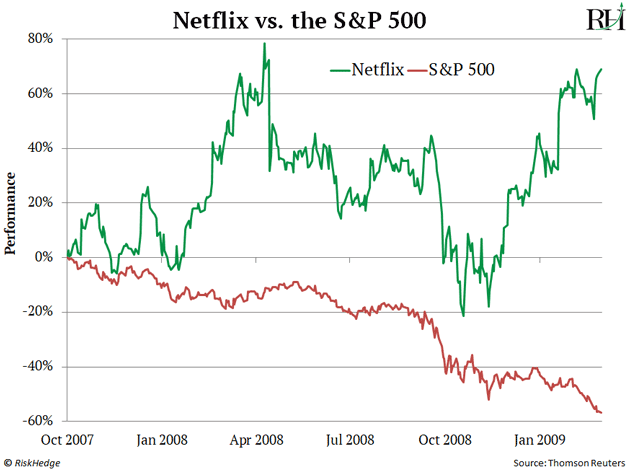

See for yourself. This chart compares the performance of Netflix with the S&P 500 during the last financial crisis.

Netflix surged an incredible 69% during that time. A small stake in Netflix would have anchored your portfolio during that turbulent time.

Of course, Netflix never looked back from there. It went on to surge more than 7,500% over the next 10 years… making it the #1 performing stock of the last decade. Netflix also crushed the S&P 500 by more than 24-fold during that stretch!

When folks see gains like this, they assume that they’ve missed the boat. But that couldn’t be further from the truth…

- It’s still very early days for cord cutting…

Last year, there were 181.2 million streaming subscribers in the US. By 2024, Statista expects 100 million more Americans to subscribe to streaming services.

But streaming isn’t just taking America by storm. It’s become global phenomenon.

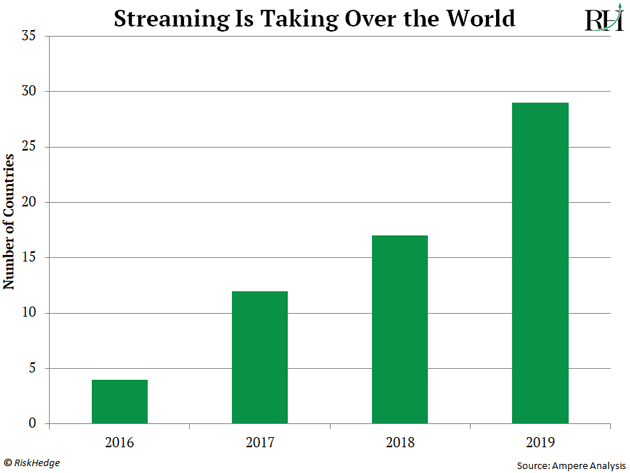

You can see what I mean below. This chart shows the number of countries where streaming has overtaken traditional television.

Steaming has already overtaken cable television in 29 countries. That’s up from just four countries in 2016!

This means there’s still over a hundred countries where cable outnumbers streaming!

- But it won’t stay that way for long…

According to Grand View Research, the streaming market is poised to grow 20%+ per year over the next seven years. By 2027, streaming will be a $184 billion market.

It’s no wonder Apple, Amazon, and Google—three of the richest companies in history—are pouring their vast fortunes into streaming…

Apple has poured over $6 billion into its streaming arm, Apple +. Amazon has invested $7 billion into its Prime Video streaming service. And Google, which owns YouTube, collects over $15 billion a year on streaming.

- You’d be hard pressed to find a more promising opportunity than this…

It’s one of the world’s biggest megatrends that’s still in the early innings.

These are the types of UNSTOPPABLE trends you want to bet on. Streaming will power on regardless of what’s happening with the broad market or economy. Negative news can’t stop it.

In fact, today, we have a rare situation where the biggest threat facing the world could actually supercharge the streaming megatrend.

Right now, there’s a full-blown panic over the coronavirus. People are nervous about taking vacations, eating out at restaurants, and leaving the house in general.

It could months before this anxiety fades away. And that means many people could be “homebodies” for the next few months.

What are all these people going to do at home? Most will stream movies and shows on Netflix… Disney+… Hulu… and HBO Now.

That’s obviously great for streaming companies. So, consider using the recent bloodbath as an opportunity to build long-term positions in top-tier streaming stocks.

- But there’s one tiny company that could emerge as the biggest winner from all this…

My colleague Chris Wood—a small-cap expert and one of the smartest guys I know—believes this stock is the next “superdisruptor.” And there’s still time to get in on the ground floor of this company which has locked down the “missing link” in streaming.

In fact, Chris believes this small stock could hand out 2,000%+ gains in the coming years.

He’s so certain of this that he’s holding an urgent online briefing on Monday, March 16 at 2 pm ET to discuss this rare opportunity.

I’ll be tuning in and I encourage you to as well. You can reserve your spot right here (free to RiskHedge readers).

Justin SpittlerEditor – IPO Insider

Denver, Colorado