** Buy these “politically insensitive” stocks

** Solar stocks look unstoppable

** How to play microcaps

We’re just eight days away from one of the most anticipated elections in history…

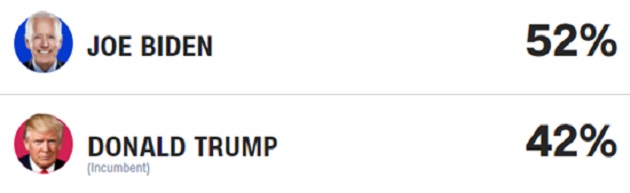

As I write, Biden holds a 10 point lead in polls over Trump:

Source: CNN Politics

Of course, Hillary Clinton had a commanding lead in 2016, too...

In any case, the TV talking heads will be covering this from every angle leading up to the big night.

We’ll let them do their thing.

Here at RiskHedge, our only mission is to make you money.

So for this special edition of the Monday RiskHedge Report, I’ve asked our team of analysts to share their top guidance right now…

How will things change in markets next Tuesday? What short-term profit opportunities are available?

Should you consider moving a big chunk of your money out of—or into—the stock market?

Read on to hear what Stephen McBride… Justin Spittler… and Chris Wood have to say…

Stephen McBride: Forget the Stats… Buy World-Class, “Politically Insensitive” Disruptors

In the coming days, you’ll hear a lot of “theories”...

For example, some say it’s best to buy stocks on October 1 of the second year of a presidential term… and sell on December 31 of the fourth year.

Others will point out how stocks performed under different presidents. In election years since 1956, the S&P 500 has surged 11.8% when a Republican is elected… and 7.2% when a Democrat wins.

Stephen says you can take these overly generalized stats and ignore them.

He’s studied the data back as far as 1897, and one thing is crystal clear. There is no golden, predictable pattern when it comes to presidents and the stock market.

Stocks have SOARED when both Republicans and Democrats were in power. Stocks have TANKED when both Republicans and Democrats were in power.

His advice? Own world-class disruptors that thrive no matter who’s in the White House.

Some companies live and die on election results. But buying these types of stocks is like flipping a coin. Wouldn’t you rather own companies that perform well no matter who is president?

The world’s best disruptors are what I call “politically insensitive.” They’re totally impervious to elections and the economy.

Here are some of his favorites today…

This election won’t make an iota of difference for “payment disruptors” PayPal (PYPL), Mastercard (MC), and Visa (V). The use of “dirty” cash is falling off a cliff right now. Instead, folks are whipping out their Mastercards and Visa cards at the checkout. PayPal and its Venmo “app” continue to eat the lunch of stodgy old banks.

Do you think these disruptions will reverse depending on who wins on November 3? Not a chance.

Computer vision is also untouched by politics. Right now, world-class scientists and engineers are inventing groundbreaking disruptions like self-driving cars and superhuman doctors. And dozens of disruptors are using NVIDIA (NVDA)’s powerful chips to teach computers to “see.”

Do you think they’ll stop solving these difficult problems because of the US election? Not a chance.

Justin Spittler: “This Sector Will Continuing Soaring… You Can Take It to the Bank”…

Back in February, RiskHedge Chief Trader Justin Spittler predicted “a death spiral” had begun…

He was talking about the inevitable death of old “dinosaur” energy stocks that sell dirty fuel like coal and oil.

At the same time, he predicted a great “awakening” for solar stocks. He suggested buying the popular solar fund Invesco Solar ETF (TAN). Since then, TAN has rocketed 88%.

Justin says if Trump wins, solar stocks will continue to march higher, just as they have been.

But if Biden wins, they could go ballistic…

As you may have heard, Biden wants to spend $2 trillion on clean energy and infrastructure. A Biden presidency would likely light a fire under solar stocks. But Justin reiterates that this is one of the surest long-term megatrends you can bet on—no matter who wins:

I’ve been pounding the table on solar all year, and this trend will only accelerate. If Biden wins, we’ll probably see a big jump in solar stocks just on investor sentiment alone.

But nothing will change the long-term opportunity here. America is already embracing solar. Every investor should put at least a little money in solar stocks. TAN looks good at these levels after last week’s drop.

Justin will have more to say about this in tomorrow’s RiskHedge Report. Stay tuned…

Chris Wood: Here’s What to Expect from Microcaps…

Chris Wood is our microcap guru…

And microcaps, in general, have been standout performers during election years.

According to research from Citigroup, the average return for the Russell 2000 Index—the barometer for small-caps stocks—is 15% in the year after a presidential election since 1980. That's about four percentage points better than large-cap stocks.

How will microcaps fare after this election?

Here’s Chris:

Let me start by saying: I don’t do politics; I do investments.

It’s never smart to mix the two. What matters here is uncertainty. Investors hate uncertainty and chaos.

So, if we see more riots… uncertainty about the outcome… or hiccups in the process of continuing or transferring power, all stocks will take a hit—microcaps included.

But in Project 5X, we’re not concerned with short-term price swings. That’s because we treat every stock as if we’re investing in a business. And great businesses that are changing the world will always come out on top.

Chris looks for big, disruptive trends turning industries on their heads, things like 5G, artificial intelligence, and streaming.

These disruptive trends are so massive they’re going to continue no matter what other craziness is going on in the world.

So we may see a pullback in the short term if tensions rise… But Chris says you’ll do exceptionally well if you use it to pick up the small disruptors powering today’s biggest megatrends.

That’s all for this week. But tell me: What stocks are you betting on right now? Do you think a Trump or Biden victory will open up any new opportunities we haven’t discussed? Let me know at chrisreilly@riskhedge.com.

Chris Reilly

Executive Editor, RiskHedge