You know Dogecoin (DOGE), the speculative crypto token with a fluffy dog mascot?

It’s now worth more than Target (TGT)… America’s oldest bank, BNY Mellon (BK)… and America’s largest homebuilder, D.R. Horton (DHI).

Some investors look at this and conclude crypto is just one giant casino. I get it.

One crypto token called “AI Prophecy” has surged 3,000% since Election Day. Many other “memecoins” with silly names are doubling and tripling.

But here’s what most people miss: This memecoin circus wasn’t an accident. It was engineered by regulators. They purposely created a twisted system where joke tokens flourished while real innovation froze.

The good news is crypto just broke free from its regulatory prison. We’re entering a new era where quality crypto businesses solving real problems can shine. Now, these cryptos can appreciate 500% or more not because of gambling… but because they truly deserve it.

- Charlie Munger—Warren Buffett’s right-hand man—always said, “Show me the incentives, and I’ll show you the outcome.”

For the past four years, America’s crypto rules created the worst possible incentives.

Anyone could make a worthless token named after their pet hamster. But trying to build a platform that allows anyone to seamlessly send money across borders? That could land you in jail. The US Securities and Exchange Commission (SEC) would hunt down and sue innovators who built something useful.

We lived in a bizarro world where the only projects regulators allowed were cryptos that obviously had no underlying value. It’s as if trading GameStop (GME) meme stocks was fine but investing in Amazon (AMZN) or Apple (AAPL) was illegal.

Crypto banks were shut down by the government. Founders and funds were sued. Protocols were subject to constant surveillance sweeps.

This wasn’t an accident. Their plan: create a circus atmosphere filled with joke coins. Then point at it and say, “See? Crypto is nothing but a giant casino. Let’s ban it.”

Thankfully, they failed.

- Crypto just got its “get out of jail free” card.

The US presidential election results freed crypto from its regulatory handcuffs.

The incoming Congress will be the most pro-crypto we’ve ever seen. And Gary Gensler, the SEC chairman who made it his mission to strangle crypto innovation, exits on inauguration day.

For the first time in years, entrepreneurs can build without fear of a lawsuit landing on their desk. Think of it as crypto’s legalization day.

The market already smells this freedom. Just look at the charts of small, quality cryptos that were under the SEC’s thumb.

|

VitaDAO (VITA), a project revolutionizing biotech funding, jumped 300%.

Render Network (RNDR), “Uber for AI chips,” surged 100%.

The Graph (GRT), which works like "Google of blockchain," shot up 100%.

These aren’t memecoins. They’re real businesses solving real problems. And now they can operate in the daylight instead of regulatory shadows.

The next Amazon, Uber (UBER), or Airbnb (ABNB) might not be a traditional tech company. It might come from a crypto project that was just too legally risky to build until now.

Get ready for an explosion of innovation and wealth creation in crypto markets. The wave of innovation that was bottled up for four years is breaking free.

- Bitcoin (BTC) went live in early 2009.

That very same day, investors could buy it for fractions of a cent. I know many folks who did and made lifechanging money.

A few years back, almost every crypto held an initial coin offering (ICO), crypto’s version of an IPO.

That’s what got me hooked on crypto: the chance to invest in the next Google when it was just two guys in a garage. ICOs offered ground-floor access to potentially world-changing projects.

This is the opposite of how the stock market works nowadays. By the time Uber or Airbnb go public, they're already worth billions. All the explosive early growth has been captured by insiders.

ICOs let ordinary investors get in on the ground floor.

Then the SEC de facto banned ICOs, calling them “illegal securities.” Instead of an open auction that anyone can buy into, early stage tokens were handed to venture capitalists (VCs) behind closed doors.

By the time a token became publicly tradable, VCs were often up 10X or more on their positions. Once again, regulations had turned a fair (risky, but fair) market into an insider’s game.

But the coming wave of regulatory clarity will once again give ordinary investors the chance to get in early on quality projects. Get ready for the return of ICOs.

The era of dog tokens and joke coins won't disappear. But the momentum is shifting toward substance over speculation.

- Most investors still get crypto completely wrong.

They think it’s all digital Monopoly money. They don’t realize dozens of real crypto businesses generate millions of dollars in revenues each month.

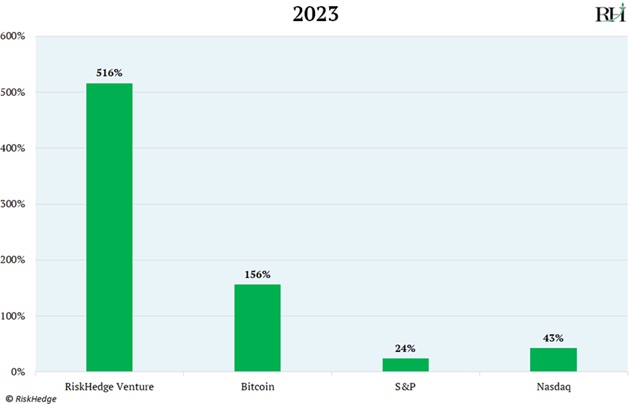

These are the cryptos we hunt for in RiskHedge Venture. Even under hostile regulations, our portfolio beat bitcoin’s performance in 2023. Here are our results:

With the coming regulatory changes, we’re entering a golden age for innovative cryptos. And not 1 in 100 investors is prepared for this opportunity.

Our latest picks—shared on November 14—are already up 60% and 20%, respectively. Both are huge winners from the coming regulatory shift.

You can access these picks and all my crypto research with a subscription to Venture, which is on sale now at a special election discount. You’ll also get immediate access to the full Venture portfolio, which includes 16 buys. Details here.

Stephen McBride

Chief Analyst, RiskHedge