Chris Reilly here, standing in for Stephen McBride.

Billionaire Stan Druckenmiller might be the greatest investor alive today.

“Druck” strung together 30 straight profitable years from 1980 to 2010. During that time, he earned returns of 30% per year.

If you took $10,000 and compounded it at 30% per year for 30 years… you’d amass a $26.2 million fortune.

Yesterday, Druck told CNBC his firm cut its stake in Nvidia (NVDA)... calling it “one hell of a run.”

After soaring 239% in 2023, the “AI chip kingpin” is up roughly 90% this year:

Nvidia is now the world’s third largest company. It sits right behind Apple (AAPL) and Microsoft (MSFT):

Source: companiesmarketcap

Longtime readers know Stephen McBride recommended Nvidia back in 2018, saying, “If I could only buy one stock for the next five years… this would be it.”

It’s been a monster—and it’s hands down the clear-cut leader of the artificial intelligence (AI) boom.

But it’s time to take profits if you’re up big...

- Earlier this year, Stephen recommended his Disruption Investor members sell half their position in NVDA.

It was the second time he recommended taking profits on NVDA.

Not because Nvidia won’t continue to drive AI for years to come—but because it’s the prudent thing to do. Stephen:

Part of good investing is taking easy profits when they come. By selling half your position, you’ll significantly reduce your risk and still be able to participate in Nvidia’s long-term upside.

If you’re sitting on big NVDA gains, consider doing the same if you haven’t already.

And keep an eye on that “world’s largest company” list I shared above. Stephen says Nvidia becoming the world’s most valuable company could be a “top signal.” There’s no fundamental reason this would mark the end of the AI boom. But it would be a clear sign that sentiment has gotten stretched to the max and investors are expecting too much.

For now, expect 2024 to continue to be AI’s breakout year. In Disruption Investor, Stephen recommends companies raking in cash from the AI infrastructure boom. Upgrade here.

- If you listen to this old Wall Street adage, you’re likely leaving money on the table...

“Sell in May and go away.”

The theory behind it is simple. Stocks tend to rise during the fall and winter months… and they tend to struggle in the spring and summer.

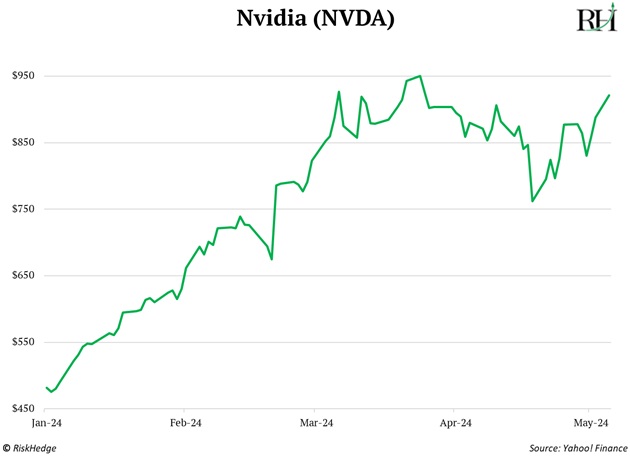

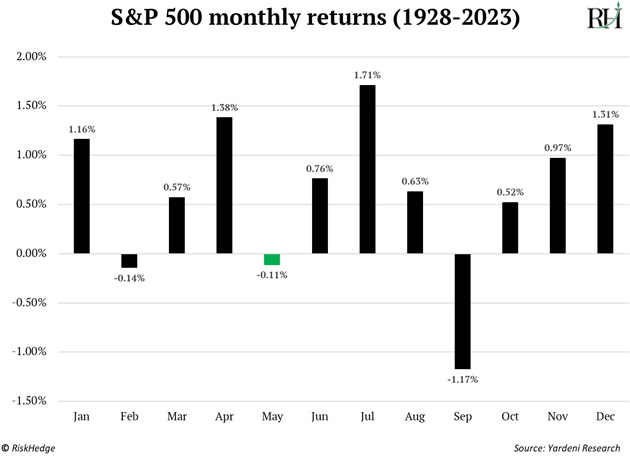

While it has historically been true, nearly 100 years of data suggests “sell in May and go away” isn’t necessarily the right move. This chart shows the average S&P 500 return each month dating back to 1928.

As you can see, while May is the third worst-performing month, stocks have typically followed up with a great three-month stretch (June–August):

In other words, investors who obey “sell in May and go away” are missing out more often than not.

Here’s more from the new issue of Cornerstone Club—our simple “rules-based” advisory designed to take the emotion out of investing:

It’s true that May through October is the worst six-month stretch of the year, on average. But markets still move higher in those months 65% of the time. In election years, that jumps to 78%.

It’s not exactly comfortable to expect stocks to do fine as we approach what’s likely to be a historically chaotic election… but the data is the data.

Now, it’s important to remember that we’re simply looking at the average monthly returns in the S&P 500 since 1928.

The key word here is “average.” Stocks can, and often do, defy averages.

|

In 2002, for example, the S&P 500 fell 24% during the May–September stretch.

But in 2020, you would’ve kicked yourself if you had sold in May. Stocks rebounded 24% from the COVID crash from May–September 2020.

So, use this data as a guidepost... not as gospel.

And no matter what, always heed Stephen’s #1 rule: Invest like you might be wrong.

That means taking “free rides” on positions up 100%+, cutting your losers early, and making sure you don’t have too much capital tied up in one stock.

That’s a winning formula for sustained investing success, no matter what month we’re in.

- Oof... have you checked in on Starbucks (SBUX) lately?

The stock just plunged 14% after a big earnings miss. Global revenue dropped 2% and net income fell 15%. Traffic at US stores was also down 7%. Not good.

Zooming out, the stock’s down over the past five years. Meanwhile, the S&P 500 is up 80% over the same time frame.

Some quick thoughts from Stephen:

Starbucks is a milkshake company masquerading as a coffee chain. It did a great job at convincing Americans to drink dessert for breakfast and pay $10 for it. But it’s gone nowhere for years. And it’s slowly being disrupted by independent coffee shops across the world.

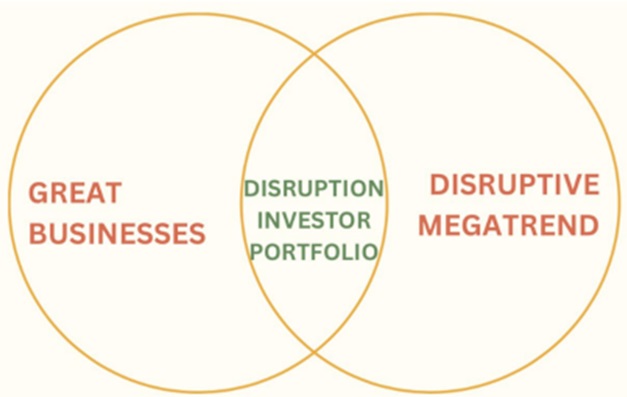

Starbucks isn’t going anywhere. It’s still a great business. Americans will always be hooked on coffee (milkshakes)... but Starbucks is not the type of company Stephen and his team target in Disruption Investor.

They only recommend great businesses at the heart of fast-growing, world-changing trends (think AI and biologics). Where these two circles overlap is the sweet spot:

Upgrade here to access the Disruption Investor portfolio.

Chris Reilly

Executive Editor, RiskHedge