It seems like human nature to be intrigued by the difficult and complex—and that also goes for investment strategies. If you can describe it with a bunch of Greek letters or “quantify” it through extensive technical analysis, it must be good.

But as is the case so often in life, the simple things are often the best. As we move through a year filled with market uncertainty, “simple” may be exactly what your portfolio needs to survive the next downturn in good shape.

In 1981, prolific financial author and investment advisor Harry Browne and my good friend, fund specialist Terry Coxon, partnered up to introduce one of the most powerful yet straightforward investment concepts I’ve ever come across.

It’s called Permanent Portfolio. As the name suggests, it’s designed to yield inflation-beating returns and persevere in almost any investing environment: expansion, crisis, deflation, or inflation.

Yet, despite its remarkable track record, few investors seem to adopt it today.

It may be too elementary for institutional investors and hedge fund managers who have to somehow justify their immense salaries and bonuses. But for the retail investor, Permanent Portfolio is an easy-to-implement, long-term strategy that yields solid returns with minimal risk.

You don’t even need an investment advisor to help you. No wonder the financial community doesn’t want anything to do with it.

The Permanent Portfolio Concept

The core of this concept is the proper asset allocation, which looks like this:

- Put 25% of your money into a broad US stock index (S&P 500 or Russell 3000)

- Put 25% into long-term Treasury bonds

- Put 25% into cash or short-term Treasury bills

- Put 25% into gold

Yes, it’s that simple.

Then, once a year, you rebalance your portfolio by selling appreciated assets and reinvesting the proceeds in depreciated asset classes.

Note that the concept aims to remove emotion from decision making. There’s a set date every year on which Permanent Portfolio investors buy and sell positions based on this single rule. That way, they systematically sell high and buy low.

The strategy is simple, low-cost, and can be applied to any portfolio.

Extremely Low Risk—and an Average Return of 8.53%

Over a 45-year period from 1964 to 2009, the Permanent Portfolio earned an average return of 8.53%, with a standard deviation of 7.67%. In the same time frame, a typical 60/40 stock-bond portfolio yielded a slightly higher return of 8.83%—but with a 46% increase in deviation!

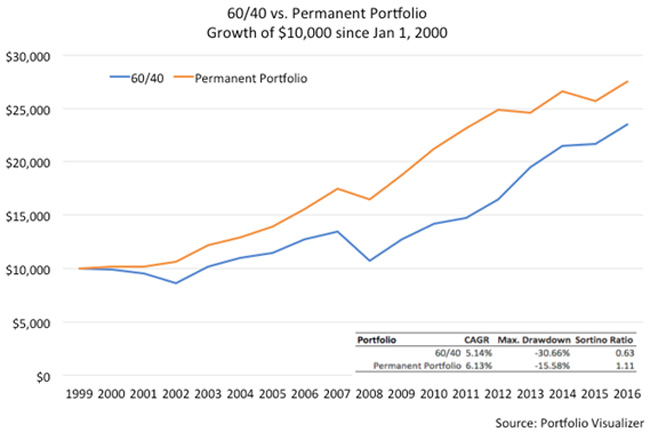

The Permanent Portfolio beats the 60/40 allocation in shorter periods, too. From 2000 to 2016, it would have grown at 6.1% per year—despite the dot-com crash and the 2008 financial crisis.

Compare that to a 5.1% annual rate of growth for the typical 60/40 allocation.

During this period, a $10,000 investment in a Permanent Portfolio would have grown to $27,478, compared to $23,457 in the 60/40 portfolio.

Above all, the maximum loss a Permanent Portfolio would have experienced would have been 15.8%. Meanwhile, 60/40 investors would have experienced a haircut of 30.4%.

Peace of Mind in Times of Volatility

In periods of prosperity, stocks outperform. In periods of deflation, bonds do well. In periods of inflation, gold shines. During a recession or a liquidity crisis, cash is king.

However, the Permanent Portfolio weathers all types of market conditions… that’s the whole point of it.

This is a time-tested strategy that has yielded solid returns for the past 50 years. Granted, its long-term gains might be a bit below the stock market’s average return, but it will let you sleep peacefully in volatile times like these.

Obviously, the trick here is that you invest in four almost uncorrelated asset classes. Stocks and bonds have not seen a significant correction in years, so hedging against one is smart. After a five-year correction, gold still appears to be a relative bargain, and cash will always protect you in a liquidity crisis as we saw in 2008.

To take advantage of all these trends, all you have to do is adopt the Permanent Portfolio strategy.

One last important note: While I recommend investing in index ETFs, bonds, and stocks, I strongly prefer physical gold to a gold ETF. Your gold bullion gives you something no other financial asset provides: It’s not someone else’s liability and thus has no counterparty risk.

For your gold investment, I recommend looking for full-service organizations that offer easy ways to buy, store, and sell physical gold with all the convenience of gold ETFs.

Before you buy the physical gold to make up 25% of your portfolio, make sure to do your homework first. Find out everything you need to know about which type of gold to buy and which to stay away from at all costs… how to safely store your gold… and much more… in the revealing e-book, Investing in Precious Metals 101. Click here to get your free copy now.