Stephen’s note: On Wednesday, I sat down with RiskHedge publisher Dan Steinhart to discuss the current state of the crypto market—and where I see it heading after bitcoin’s (BTC) scheduled halving event less than four weeks away.

Today, we discuss the annual performance of my crypto advisory, RiskHedge Venture.

***

Dan: Let’s start by reporting the final results of RiskHedge Venture, your crypto advisory, for 2023.

Last year was great for crypto overall. Bitcoin was the best-performing major asset in the world. Here’s how bitcoin and Ethereum (ETH) performed versus stock markets in 2023:

Bitcoin: 156%

Ethereum: 90%

S&P 500: 24%

Nasdaq: 43%

Meanwhile, RiskHedge Venture produced a total return of +516%.

That is a great performance. You blew every possible benchmark out of the water.

I should also mention you held 13 cryptos during 2023. Twelve were profitable; one was not.

Tell us how you did it.

Stephen: I can boil it down to two principles:

- Knowing where we are in the crypto cycle and investing accordingly.

- Buying the right cryptos.

Dan: Let’s talk about the cycle first. I’ve seen a lot of cycle analysis that attempts to predict if and when bitcoin will hit $1,000,000.

Stephen: This is a very popular question. I think bitcoin will likely appreciate to $1,000,000 someday. But in all honesty, it’s not that interesting of a question to me.

I spend a lot of time and resources analyzing bitcoin, but for a different reason. It’s the dominant asset in crypto. It makes up 52% of the total crypto market. As bitcoin’s price goes, so goes the rest of crypto.

Dan: Bitcoin has a reputation for being highly volatile, and therefore hard to predict. I know you disagree with this assessment.

Stephen: It depends on the timeframe. In the short term, bitcoin is extremely volatile and unpredictable. No one can say with a useful degree of accuracy where the price of bitcoin will be one week from today.

But very few people realize that over a longer time period, bitcoin’s price is highly predictable. At least, it has been so far.

Dan: Go on…

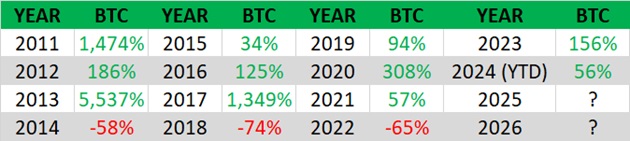

Stephen: Bitcoin goes through a repeating four-year cycle. Let’s paste the table of bitcoin returns by year here, so readers can visualize it:

Dan: This table shows bitcoin going up three years in a row followed by one down year. Three up, one down. Rinse, repeat. This cycle has never not held true so far.

Stephen: Exactly. And while 16 years is a small sample size, this isn’t a coincidence. It’s supply and demand. Specifically, it’s driven by bitcoin’s preprogrammed halving cycle.

|

Dan: Can you concisely summarize why the halving is so important?

Stephen: Every four years, the new supply of bitcoin being created by miners gets permanently cut in half.

This is scheduled to happen in less than a month, on or around April 19.

The prior three halvings have all preceded big rallies in the price of bitcoin—660% at a minimum, and several thousand percent on the high end. The whole crypto market followed suit.

Dan: So each halving has acted as a “starting gun” for the most explosive part of crypto’s cycle. And you expect the same for bitcoin’s fourth halving, which is less than four weeks out?

Stephen: Yes, and there’s a new wrinkle this cycle. The halving will reduce new supply, as always. But it comes at a time when demand for bitcoin is skyrocketing, thanks to the debut of bitcoin ETFs.

The first bitcoin ETF launched in January. Already, there are 10 of them. They’re a big deal for one simple reason: They give American retirement accounts easy access to bitcoin.

Dan: It used to be difficult for American retirement accounts, like 401(k)s, to access bitcoin. These ETFs make it easy. American 401(k)s hold $7 trillion. And individual retirement accounts (IRAs) hold another $13 trillion.

Stephen: This is one of the biggest pools of money in the world. It’s THE biggest pool of retail investor capital.

For the first time, it can easily flow into bitcoin. And eventually Ethereum. And most likely many other cryptos after that.

Dan: We can cover the coming Ethereum ETF another time. Your second key to success is “buying the right cryptos.” Please elaborate.

Stephen: I focus on what I call “crypto businesses.” They do useful things, serve real customers, and make real revenue.

Dan: So the exact opposite of so-called “meme coins” like Dogecoin (DOGE), Shiba Inu (SHIB), and hundreds of others.

This is the part of crypto that’s still not well understood. Many cryptos are connected to real businesses and pass the benefits through to owners, just like a stock.

Stephen: Ethereum is the perfect example. Last year, it achieved a huge milestone. It grew to $10 billion in revenue faster than Facebook (META) and Microsoft (MSFT).

Most people don’t even know that Ethereum has revenue in the first place. It helps put into perspective how early we still are in crypto… hence the opportunity.

Dan: Congrats again on a phenomenal 2023. A +516% total portfolio gain in one year is quite an achievement.

In the final installment of this talk on Monday, we’ll look at your whole track record from the day you launched RiskHedge Venture—including the crypto winter of 2022.

Lastly, an important announcement: As of today, we are accepting new members to your crypto advisory, RiskHedge Venture. It’s been closed to new members for most of the last two years.

Go here to review the benefits of membership and see if it’s right for you.

|