Today, we’re putting on a starter position in $59 billion Latin American bank/fintech company Nu Holdings (NU).

It’s headquartered in Brazil but also serves customers in Mexico and Colombia.

We’re putting on this trade because rotation is underway. Rotation is when investors move money from one sector of the stock market to another.

It’s called “rotation” because money typically rotates from sectors that are hot to sectors that have been lagging.

One sector that’s benefiting most from this is financials. Just look at how strong JPMorgan Chase (JPM) and Goldman Sachs (GS) have been lately!

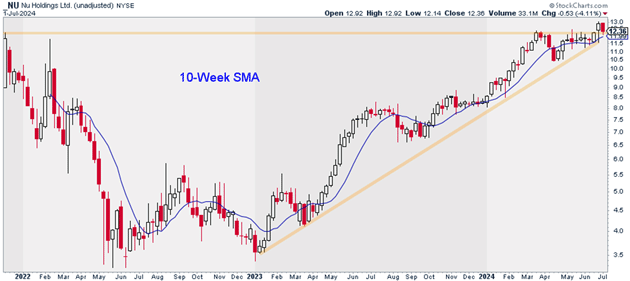

NU is another huge winner in this ongoing rotation. Look at its weekly chart below.

You can see NU broke out to new all-time highs last week after consolidating below its IPO highs for several months:

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

This is a MAJOR breakout for NU. It tells me NU could be headed much higher from here in the coming months, possibly longer.

And that’s why we’re putting on this trade today.

I suggest just putting on a starter position in NU. I believe NU could hit $20 over the next 12–18 months.

Exit your position if NU closes below $11.50. That gives us a risk-reward ratio of nearly 9:1 on this trade.

Action to take: Buy NU at current market prices.

Risk management: Exit your position if NU closes below $11.50.

Justin Spittler

Chief Trader, RiskHedge