The rollercoaster ride continues.

Ever since President Trump’s tariff announcements on April 2, it’s been nothing but extreme volatility in the stock market.

Coming into Friday (April 11), the S&P 500 went six straight days with a trading range over 5%.

You have to go back to 2020, 2008, and 1987 to find the last time that’s happened for four straight days, let alone six. That’s during COVID, the financial crisis, and Black Monday.

On Wednesday, stocks soared 9.5% after Trump announced a 90-day pause for most tariffs. But other than that, it’s been mostly red.

With all this crazy action, you’re probably wondering what to do.

Buy the dip? Move to cash? Do nothing?

Today, not only will you hear from Stephen McBride, but you’ll get important guidance from our full team of experts.

I (Chris Reilly) am pulling back the curtain to give you a sneak peek into our “RiskHedge 6”—the six premium services we publish (Cornerstone Club, Disruption Investor, RiskHedge Live, Express Trader, Disruption_X, and RiskHedge Venture).

Specifically, you’ll see how each service is handling the current volatility and what to do about it, whether you’re in disruptor stocks and crypto for the long haul or fast-moving trades...

***

“Unless the world ends, great businesses always recover and go on to make new highs. The best disruptive stocks—like the ones we invest in at Disruption Investor—tend to recover even faster and stronger.”—Chris Wood

In our flagship Disruption Investor advisory, Chris Wood and Stephen McBride recommend world-class businesses profiting from disruptive megatrends.

Think of the tech selloff of 2022. Tons of folks cut amazing stocks like Nvidia (NVDA) from their portfolios because they believed the headlines that tech was dead and artificial intelligence (AI) was a fad.

|

But even with Nvidia’s recent 35% selloff, it’s still up about 750% since its 2022 lows. (It’s been in the Disruption Investor portfolio since 2020, and we’ve taken profits on it twice on the way up).

Right now, Chris and Stephen are being nimble and staying humble. Their strategy of buying the top disruptor stocks hasn’t changed. But as they said, “While others are still clinging to yesterday’s winners, we’re already positioning for tomorrow’s champions.”

While everyone’s focused on the tariff selloff, Chris and Stephen see a bigger disruption happening, as they explained in their latest issue, “The next major inflection point.”

That includes buying into unloved megatrends like cyber and solar.

They’re also buying China and holding onto their insurance play—which the guys recently recommended taking a “Free Ride” on when it was up 203%.

***

Justin Spittler, our Director of Trading, runs two premium services, RiskHedge Live and Express Trader.

RiskHedge Live is our live trading room where Justin shares his trading ideas and analysis in real time, so you can make trades with him—never missing a thing.

Right now, in both services, Justin has taken a more defensive stance, closing out some trades and keeping readers up to date on the overall market’s pulse.

Here’s a sneak peek in “the room” from last Tuesday:

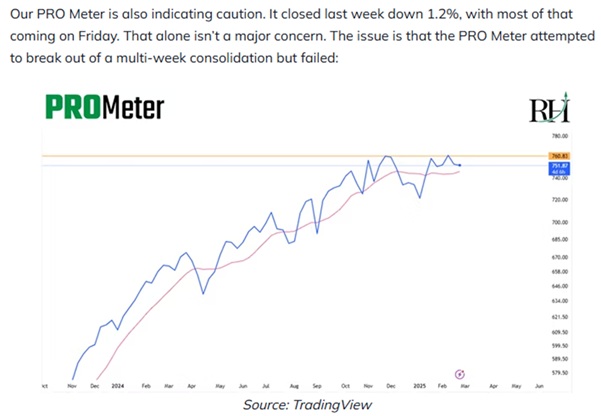

In Express Trader, where Justin shares his top three trades to make for the week, he’s been warning readers about a downturn before Trump’s tariffs. His PRO Meter (which he uses to gauge the market) started indicating caution in February.

From his February 24 issue:

He’s taken a defensive stance since then, recommending an international stock and gold miner. And he calls the market “guilty until proven innocent.”

***

“I’ve never seen a bigger disconnect between prices and fundamentals than what exists in crypto today.”—Stephen

In Stephen McBride’s latest RiskHedge Venture issue (our premium crypto advisory), he reiterated patience. Crypto is the world’s most volatile asset, and this recent selloff is nothing new. It pays to have conviction.

Specifically, he said:

My guidance right now is to sit on your hands and do nothing. And if you have some dry powder, buy some more of your favorite cryptos.

These are great prices for quality cryptos. The hard thing is that great prices never feel great at the time.

He gave four leading “DePIN” projects to watch in 2025 and much more.

Stephen and his members invested through the brutal 2021/2022 bear market in crypto and it paid off, with Stephen guiding the whole way.

If you’re invested in this space, stay patient and stay focused. Right now, crypto markets are choppy. But Stephen says, “Our core thesis, that decentralization is a powerful megatrend and crypto is its financial engine, remains firmly intact.”

***

In our newest advisory, Disruption_X, Stephen and Chris Wood hunt for small stocks with 10X upside. They target smaller stocks with a market cap between $200 million and $20 billion.

If you read Stephen’s essay from Friday, you know he’s cautious—if not outright bearish—on the handful of big tech stocks that dominated returns for years.

But his stance on small disruptor stocks is the opposite. On their recent Members’ Call, both Chris and Stephen emphasized that small, disruptive, American tech stocks look extremely attractive.

Folks assume that all US stocks are expensive because big US tech stocks that have hogged the spotlight are expensive. Incorrect. In fact, the small-cap Russell 2000 Index hasn’t hit an all-time high since November 2021.

Stephen says smaller stocks “are trading not just at cheap levels relative to the market, but cheap levels relative to their historic valuation.”

In Disruption_X, Stephen and Chris recommend four small companies (a space play, a robotics play, and two AI plays) to profit.

***

Cornerstone Club is completely different than anything else we publish—or anything anyone publishes, for that matter.

We don’t recommend stocks. It’s a rules-based investing system that tells you how to allocate your money each month into a variety of ETFs, representing the “world of investments.” It’s headed by RiskHedge publisher Dan Steinhart, and he has personally used this method to invest for years.

Because it’s a rules-based system, Cornerstone helps take the emotion out of the game, which is crucial right now. You simply follow the rules of the system and invest in what it recommends each month.

As Dan explained in this month’s issue—published on April 1:

Since early 2023, Cornerstone has been mostly fully invested—and mostly in stocks—despite the parade of scary headlines. That’s been the right stance. But the situation has changed: Price weakness in stocks is actually confirming investors’ worries for the first time in years.

Cornerstone got even more defensive this month, suggesting an allocation to 7–10 year US Treasuries (IEF) for the first time in years.

Chris Reilly

Executive Editor, RiskHedge