Chris Reilly here...

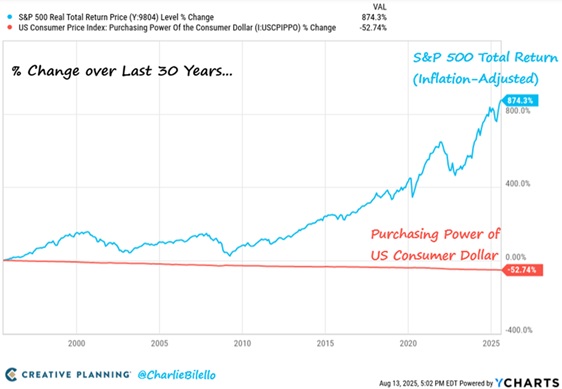

We start with an important chart courtesy of Charlie Bilello—Chief Market Strategist at Creative Planning...

It’s a clear reminder why you can’t rely on savings to build wealth.

You need to invest.

As you can see, the purchasing power of the dollar (orange line) has been more than cut in half over the past 30 years.

Meanwhile, the S&P 500 (blue line) has risen 874% during the same time frame. That’s 8% per year... after adjusting for inflation.

Source: @CharlieBilello on X

Yes, it’s true that saving are the foundation of wealth and a prerequisite to investing. If you don’t put money aside, you’ll never be able to buy stocks.

But at some point, you need to put your money to work for you.

As our Chief Analyst Stephen McBride says all the time…

You’ll probably never get rich renting out your time.

Working hard and saving money is necessary. But it’s often not sufficient. Owning a piece of a successful business—aka owning stocks—is the main path to wealth that’s open to anybody.

If you’re unsure about investing in the stock market, now’s the time to get off the sidelines.

Break the inertia and start investing. No excuses.

If you’re just getting started, I suggest first looking to buy an index fund that owns a lot of stocks. That way, you’ll own a tiny fraction of hundreds of businesses.

After that, I suggest looking at disruptor stocks, our bread and butter at RiskHedge…

So, how can you filter out the top disruptor stocks?

According to Chris Wood, Stephen’s co-editor on Disruption Investor (upgrade here), it boils down to three words.

Here’s Chris Wood with more...

***

Ever notice how you rarely see metal braces anymore?

Not that long ago, it seemed every other teenager had painful metal braces cemented to their teeth.

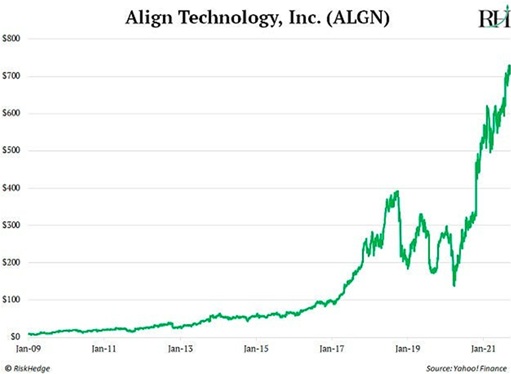

Then, a company called Align Technology (ALGN) created something new. It invented a better way to essentially make braces out of plastic. It’s called Invisalign… and, just like the metal ones, these “braces” straighten your teeth.

Only, when you smile, you don’t flash a mouthful of metal—because they’re made of clear plastic.

Invisalign also can straighten your teeth faster than traditional braces (one to two years compared to three years).

From 2009 to 2021, Align’s stock shot up from $8.52 to $737.45, handing investors peak profits of 8,555%.

Remember booking vacations before the internet?

What a pain. The only way to find out which airline flew where was to pick up the phone and call. It was a huge hassle.

Then, online disruptor Priceline (BKNG) came along. With a few clicks, you could compare any flight or hotel in the world. Simply put, Priceline made traveling a lot easier and cheaper—and its stock took off like a rocket and never looked back.

From 2001 to 2021, BKNG soared for peak gains of 29,000%:

See the three keywords in both examples?

BETTER. FASTER. CHEAPER.

That’s the blueprint to finding the next great disruptive stock. Of course, it’s easier said than done to find these stocks…

But the greatest disruptors of all time made big jumps in all three of those areas.

Alphabet (GOOGL) wasn’t the first search engine… but it was by far the best.

Google’s PageRank algorithm provided much better search results than any competitor, so its popularity soared.

And it went on to become one of the best-performing stocks of its time.

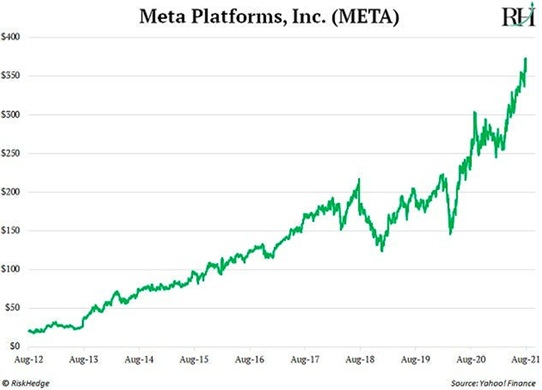

Meta Platforms (META) wasn’t the first social media platform. But it was much faster at innovating than its competition, thanks to superior engineering.

And its stock soared 1,688% from August 2012 to August 2021:

Then there’s Illumina (ILMN)…

Scientists have known for decades that DNA holds the keys to our health. The problem was that it used to be incredibly expensive and time consuming to read DNA.

The Human Genome Project, which officially completed in April 2003, took 13 years and $2.7 billion to read one person’s DNA. Then Illumina, the leading maker of DNA mapping machines, made a solution.

One Illumina machine—the NovaSeq X—can do all that work in a few hours for $200.

|

And Illumina thinks it will be able to sequence an entire genome for just $100 within a couple years. That’s about 130,000,000th of what it cost just 20 years ago… or 99.999997% less.

Illumina’s tech has been making DNA sequencing cheaper for years. And it led to an explosion in its use in healthcare and its stock:

And you can’t forget about Amazon (AMZN)…

Almost everything Amazon does is about being better, faster, and cheaper. And it’s led to Amazon becoming one of the greatest stocks in history.

So as you research your next stock, ask yourself: Is the company doing things better… faster… and/or cheaper than anyone else?

If you can answer “yes” to one, you’re on the right track. If you answer “yes” to all three, there’s a good chance you have a winner on your hands.