Look at this mystery chart.

We have Nvidia (NVDA)… bitcoin (BTC)… and Vistra Corp. (VST), which sells electricity.

Can you guess which one’s up the most over the past year?

Source: TradingView

…

Shocker… Vistra (green line), the boring power provider, is beating the market’s hottest winners!

It’s up around 400%:

If you think this is a fluke, check out the top-three-performing S&P 500 stocks so far this year: Constellation Energy Corp. (CEG), Vistra, and GE Vernova (GEV).

[Update: VST and other AI stocks are selling off this morning because of the DeepSeek news. More on this soon.]

All power providers... all considered as exciting as watching paint dry.

But really, they’re artificial intelligence (AI) stocks in disguise.

- Want to know AI’s dirty secret?

It’s an energy hog of epic proportions...

When you ask ChatGPT a question, you’re tapping into vast data centers filled with special GPU chips that run so hot, they need constant cooling to keep from melting down.

One of Nvidia’s latest AI processors uses as much electricity as two households. Companies like Meta Platforms (META) are building gargantuan clusters of 100,000 GPUs all linked together.

Even a quick chat with ChatGPT uses 10X more electricity than a Google (GOOG) search.

Microsoft (MSFT) operates more than 300 data centers around the world. And its energy usage has more than doubled since 2020. Microsoft now devours more electricity than entire countries and territories, like Iceland or Puerto Rico.

And as companies race to build ever-larger AI models, their energy needs are soaring.

Longtime RiskHedge readers know the secret sauce that makes AI better is something called “scaling.” In plain English, that means the bigger you make these AI systems, the smarter they get.

Today’s AI models need 1 billion times more computing power than the ones from a decade ago. And this trend isn’t slowing down anytime soon.

Microsoft alone will spend $80 billion building AI data centers this year. Mark Zuckerberg recently said Meta’s next AI model will need 10X more computing power than its current one.

Houston, we’re going to need a whole lot more power.

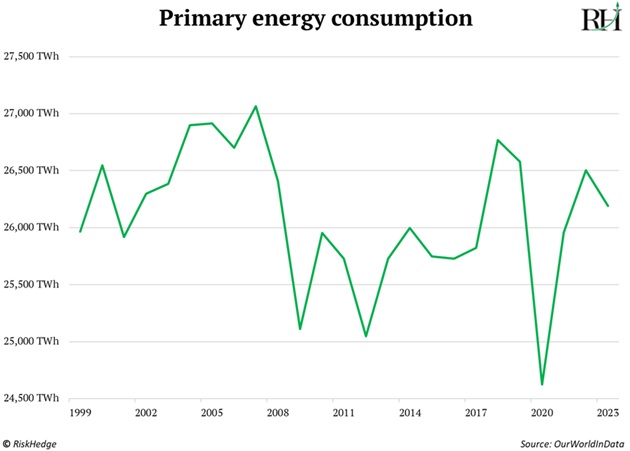

- Power utilities were the definition of a sleepy industry.

Over the past 25 years, US electricity consumption has fallen 1%:

But with power-thirsty AI in the driver’s seat, US energy demand is forecast to jump 16% in the next five years. That’s HUGE for an industry that hasn’t grown in 25 years.

A recent McKinsey report estimates we’ll need to add the equivalent of three New York Cities to the power grid just to feed AI’s appetite by 2030!

But you can’t just snap your fingers and build new power plants in America. The permitting process alone typically takes a decade.

Now that’s all changing. On his first day in office, President Trump signed an executive order to fast-track power plant approvals. America is about to become an AI superpower.

This explains why Constellation Energy, Vistra, and GE Vernova are soaring right now.

|

These aren’t regulated utilities. They’re independent power producers that can sell electricity at market prices. And when you have tech giants desperate for power, those market prices get interesting.

These stocks can be winners over the next few years.

But the world’s largest tech companies are so desperate for power, they’re becoming energy companies themselves.

Amazon (AMZN) didn’t just buy electricity; it bought an entire nuclear power plant in Pennsylvania. Microsoft is bankrolling the revival of the famous Three Mile Island nuclear plant. Google and Meta are going all-in on mini nuclear reactors to power their AI ambitions.

We’re watching the biggest transformation in America’s power landscape since the electrification of the 1930s. That’s our opportunity.

- Here’s what one of Boston’s top money managers told me last year…

Everyone expects AI to cause a huge energy crisis. You’re telling me we’re smart enough to create superhuman AIs but can’t figure out how to build the energy to power them? Doesn’t make sense.

I agree. Great companies solve important problems. And businesses that help make AI more efficient will make investors a lot of money.

Keeping AI computers cool is the best way to cut energy consumption. Roughly 40% of a data center’s massive energy bill goes just toward keeping the computers cool.

AI servers run 5X hotter than traditional data centers. Gone are the days of just blowing cold air around. Now, you’ll see these intricate networks of cooling tubes—like a high-tech circulatory system—keeping thousands of AI chips from melting down.

Here’s what it looks like inside Google’s data center:

Source: Data Center Frontier

These tubes are filled with special liquid that touches the hottest parts of the computers directly, soaking up heat way better than air ever could.

“Liquid cooling” is 17X more effective than traditional air systems. It’s a complete revolution in how we build and cool AI’s digital brains.

This is why we bought liquid-cooling leader Vertiv Holdings (VRT) is Disruption Investor last February. Congratulations to Disruption Investor members who have already doubled their money buying its stock.

|

My (Stephen’s) Next Chapter: For the past 8 months, I’ve been working on a new project behind the scenes. It’s something I’ve wanted to do for years and now I can finally break my silence. Because you’re a Jolt reader, I’d like you to have a front-row seat. The opportunities I’m seeing... click here to continue. |

Vertiv’s liquid cooling can slash energy usage by up to 40%. For tech giants running data centers that consume more electricity than entire countries, that’s worth hundreds of millions of dollars.

Less than one in five data centers currently use liquid cooling. Our research suggests every new state-of-the-art AI warehouse will have to adopt this technology.

Continue to invest in the great businesses keeping AI’s lights on and its computers cool. That’s what we’re doing in Disruption Investor.

- 2025 is going to be another big year for AI…

And while I focus on the larger disruptive stocks in Disruption Investor, I’m getting ready to launch a brand-new advisory focused on smaller, “dark horse” disruptors.

I’m talking potential 10-baggers growing 20% annually that are still flying under Wall Street’s radar. AI is a top focus right now, and there will be many opportunities.

If you want a front-row seat to my new advisory—and special bonuses along the way—go here now so you don’t miss a thing.

Stephen McBride

Chief Analyst, RiskHedge