It’s cool-off time for the hottest trade on the planet.

Last year, artificial intelligence (AI) was the trade.

Names like Nvidia (NVDA) and Super Micro Computer (SMCI) delivered massive gains within a matter of months.

I expect AI stocks to be the biggest winners over the next few years. But I think they’ll take a backseat to other industries for the next few months.

In other words, I expect money to rotate out of red-hot AI stocks in the near term into other areas, including energy and basic materials.

That brings me to my latest Trade of the Week: Nucor Corp. (NUE).

Nucor is America’s largest steel producer and the largest publicly traded steel stock. It has a current market value of $46 billion.

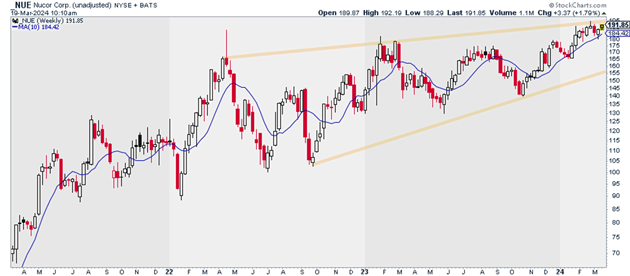

We’re picking up shares of NUE today to capitalize on the coming rotation into basic materials. NUE also has an incredible chart.

You can see what I mean below. NUE has been trending higher since the fall, and it’s on the verge of a major breakout:

Source: StockCharts

Source: StockCharts

I suggest picking up a half position in NUE today. I believe it can hit $250 within the next 12 months.

Exit your position if NUE closes below $179. That gives us a risk/reward ratio of 4:1 on this trade.

Action to take: Buy NUE at current market prices.

Risk management: Exit your position if NUE closes below $179.

Justin Spittler

Chief Trader, RiskHedge

|