It’s been a volatile year for investors so far.

The S&P 500 just turned green on the year after dipping into bear market territory.

Former leaders like Apple (AAPL), Amazon (AMZN), and Google (GOOG) are down.

And Tesla (TSLA) went from +12% to -42%. It’s since recovered most of its losses.

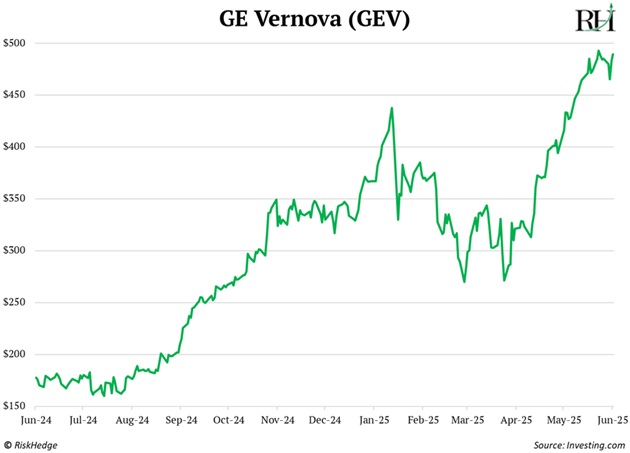

One stock that paid no heed to Mr. Market’s wild swings and kept hitting new highs is GE Vernova (GEV).

Look at its chart, a thing of beauty:

When I hear the name “GE,” I think stagnation. A once-great company that’s fallen on hard times.

But GE Vernova is a backdoor way to profit from today’s hottest trend: artificial intelligence (AI).

- Remember the chip shortage?

When ChatGPT launched almost three years ago, big tech was tearing the hinges off Nvidia’s (NVDA) doors to make more chips.

The next shortage you’ll hear about is… electricity.

Meta Platforms (META) founder Mark Zuckerberg said, “Energy, not compute, will be the No. 1 bottleneck to AI progress.”

Back in January, Microsoft (MSFT) CEO Satya Nadella said, “I’m [power] constrained.”

AI’s thirst for energy is off the charts.

Models like ChatGPT are powered by hundreds of thousands of high-end chips packed tightly in vast data centers. These systems generate so much heat, they need specialized vents and fans humming 24/7 to keep cool.

And that, my friends, sucks up a humongous amount of energy.

GPT‑4o serves up roughly 700 million queries per day, which consumes as much energy as 35,000 US homes do in a whole year.

And that’s just one model!

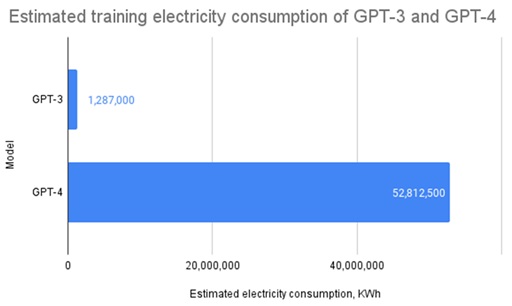

As AI models get better, they’ll suck up even more power. GPT-4 is estimated to have consumed 40X more electricity to train than its predecessor:

Source: Towards Data Science

- So how are we going to power all these huge AI factories?

Too many people treat energy like a team sport. They’re “team solar” or “team fossil fuels.”

I’m an “all of the above” kind of guy. Cheap, abundant energy is the bedrock of all innovation. We need all the energy we can get our hands on.

Yes to solar panels and batteries, which keep the light on when the sun isn’t shining.

Yes to reviving “Project Independence” and building 1,000 nuclear power plants in America.

Yes to the fracking revolution, which transformed the USA into the world’s #1 energy superpower.

And that’s where GE Vernova comes in. It’s the spinoff of General Electric’s (GE) energy division, which IPO’d last year.

GE Vernova’s bread and butter is boat-sized natural gas turbines—the kind utility companies install to power entire cities. These turbines burn natural gas to generate electricity for the grid.

Source: RTO Insider

Natural gas turbines aren’t as “sexy” as sun energy or garage-sized nuclear reactors, which can power whole cities.

But they’re the best way—for the next five years, at least—to satisfy AI’s huge energy appetite, for the following reasons:

Speed. You can install a new gas turbine plant in just two years. By contrast, a nuclear plant takes at least a decade or longer due to regulatory delays.

Reliability. AI data centers can’t rely entirely on solar, as it’s intermittent. And we haven’t built nearly enough batteries to solve solar’s “night” problem. Gas turbines run regardless of weather or time of day. You can turn them on and off as you like.

Cost. A new gas plant costs around $1,000 per kilowatt of capacity. Compare that to solar, which is 2X–3X more expensive when you include storing energy in batteries. Or to nuclear, which is at least 7X more costly to get running.

- I love dominant disruptors…

Great businesses often dominate their industries.

Think Google, which controls 90% of the search market. Or Visa (V), which owns 60% of the US credit card market.

GE Vernova fits that bill, too. It’s made over half of all gas turbines in operation around the world.

In December, the CEO of GE Vernova revealed they’ve secured 9 gigawatts of gas turbine reservations in just one month. That’s enough to power 7.5 million US homes for a year!

What’s behind the surge in demand:

“These orders are directly tied to load growth of serving the big tech demand associated with AI.”

|

- GE Vernova doesn’t just sell turbines.

The big money is made servicing them.

Roughly 70% of the company’s profits come from long-term services. Once a utility installs a turbine, GE Vernova signs it up for decades of maintenance, upgrades, and monitoring.

To put numbers on it, every 1 gigawatt of turbine installed locks in $350 million in services revenue.

It’s like selling the razor once and getting paid for the blades for the next 30 years.

- I’ll let you in on a little secret…

Big tech loves to brag about how clean their AI is. They put labels on their data centers like “100% renewable-powered.”

But it doesn’t mean the power actually flowing into those data centers is clean.

Say Google runs a massive data center that needs 1 gigawatt of electricity. To claim it’s green, Google might sign a contract with a solar farm somewhere else, maybe hundreds of miles away.

On paper, it looks like a match: 1 gigawatt in, 1 gigawatt out.

But in real life, when the sun goes down or demand spikes, that same data center has no other choice but to pull electricity from the local grid, of which 60% comes from natural gas and coal.

As I said, when it comes to energy, I’m an “all of the above” kind of guy.

I celebrated solar hitting the milestone of supplying 10% of the world’s energy needs.

I cheered when I heard Meta had inked a 20-year deal to buy nuclear power from an Illinois reactor.

But when it comes to powering AI’s energy needs for the next few years, natural gas is in a pole position.

GE Vernova is my #1 pick in this sector.

Stephen McBride

Chief Analyst, RiskHedge

Editor’s note: RiskHedge Director of Trading Justin Spittler recommended GEV in his RiskHedge Live trading room last month, and the position’s up 25%+.

Our members love RiskHedge Live because they get new trades from Justin the moment he spots them, and his trading room has turned into a great community.

If you’re interested in joining, your special discount is still available at this page.