Are you an equal-opportunity trader?

Not everyone is.

Some folks are only interested in growth stocks.

That can be a winning strategy when growth stocks are working. But growth stocks aren’t always working. At times, they take a back seat to value stocks.

Other traders never leave the comfort of their own country. They’ll only ever own US stocks.

A lot of the time, this works great. Not all of the time.

In fact, US stocks aren’t working at all right now. Both the S&P 500 (SPY) and the tech-heavy Invesco QQQ ETF (QQQ) are down four weeks in a row.

The good news is that a lot of international stocks are doing great. Chinese stocks are easily the biggest standouts.

Alibaba (BABA)—China’s largest publicly traded company—has climbed 68% higher since the start of the year. PDD Holdings (PDD)—China’s second-biggest stock—is up 31% so far in 2025.

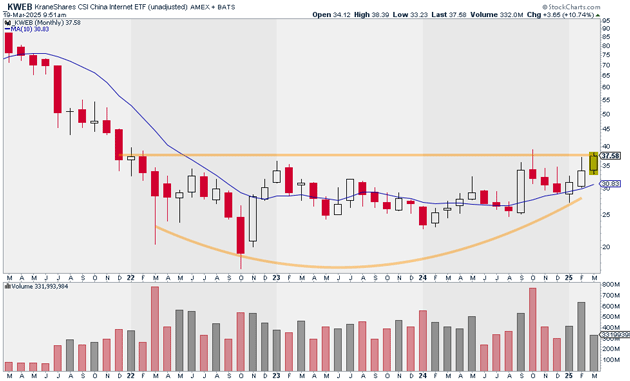

And there’s good reason to think this move in Chinese stocks is just getting underway. Here’s the KraneShares CSI China Internet ETF (KWEB)—a fund that invests in a basket of Chinese tech stocks:

Source: StockCharts

KWEB is already up nearly 11% this month. It’s now on the verge of breaking out of a more than three-year-old base.

This is the complete opposite of what we’re seeing in US stocks right now. Instead of huge bases, we’re seeing massive topping patterns.

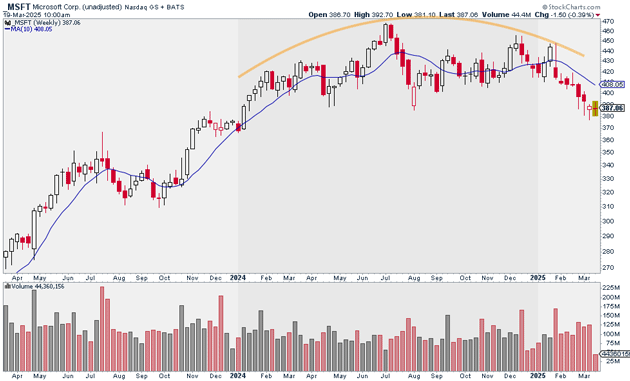

Just look at this long-term chart of Microsoft (MSFT)—one of America’s largest and most important tech stocks. It’s spent the past several months forming a huge top.

If this continues to resolve lower, that’s going to be a huge problem for US stocks as a whole.

Source: StockCharts

Of course, many folks will tell you to steer clear of Chinese stocks. They’re too risky. Some will even go as far as to call them “uninvestable.”

This negative sentiment is actually a huge positive. As long as most traders think you’re crazy for owning them, Chinese stocks still likely have a ton of upside.

If you’re looking to capitalize on today’s emerging “China trade,” I just recommended a standout Hong Kong-based stock in my Express Trader advisory.

It’s coming off an impressive weekly performance and showing clear signs of relative strength—and should perform well as money rotates out of the US market.

Justin Spittler

Chief Trader, RiskHedge