Chinese stocks are one of this year’s hottest trades.

The KraneShares CSI China Internet ETF (KWEB) has already climbed 12% in 2025. That’s nearly 4X what the Invesco QQQ Trust (QQQ) has returned this year.

Many individual Chinese stocks have performed even better.

Alibaba Group Holding (BABA) is already up 33% this year. PDD Holdings (PDD), which owns the discount Chinese online retailer Temu, is up 21%. And JD.com (JD) has gained 18%.

What makes these returns even more impressive is that Chinese stocks have rallied in the face of the trade war. They’ve kept climbing despite constant tariff headlines.

If you missed these big moves, I don’t blame you.

Chinese stocks are taboo for many folks, and not just because many traders suffer from a “home bias.”

For the past several years, Chinese stocks have massively underperformed. There’s been little reason to mess with them. You would have been much better off owning US tech or growth stocks.

Still, it’s hard to argue with the recent price action. And there’s a good chance this rotation into Chinese stocks has legs.

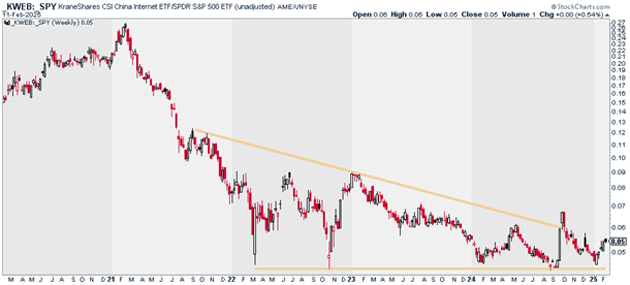

Take a look at this chart. It compares the performance of KWEB with the S&P 500 (SPY). When this line is rising, it means Chinese stocks are outperforming US stocks.

We can see that this ratio appears to be putting in a bottom. It even tried to break out in the fall before pulling back.

Source: StockCharts

Source: StockCharts

If this ratio can successfully climb out of this, it’s going to be really hard to ignore Chinese stocks. But don’t just take my word for it.

David Tepper—one of the world’s greatest traders—recently doubled down on his big China bet. In fact, Alibaba is now the largest holding in his hedge fund, Appaloosa Management.

At 15.5%, Tepper’s stake in BABA is twice as large as his 8.8% holding in Amazon (AMZN)—his second-largest position. PDD is his third-largest holding at 8.0%.

Tepper isn’t someone traders can afford to ignore. He often makes big, contrarian bets.

For instance, Tepper loaded up on beaten-down financial stocks in 2009, just as the US economy was emerging from the worst financial crisis since the Great Depression. That year, Tepper went on to return 132%.

If you’re looking to play Chinese stocks, I’d stick with a fund like KWEB or the majors like BABA, PDD, or JD. Smaller Chinese stocks often come with a lot of baggage.

Justin Spittler

Chief Trader, RiskHedge

PS: Looking for a simple, no-nonsense way to play today’s market? With my new Express Trader advisory, you get three of my best trades every Monday. No guesswork, no complicated strategies—just clear, easy-to-follow instructions. Learn more here.