Bitcoin (BTC) came within putting distance of all-time highs yesterday, hitting $69,000 before pulling back.

It’s been a wild ride over the past three years. Hats off to everyone who toughed it out during the downturn.

Great things are ahead for crypto. I’ll have lot more to say on this very soon.

The rest of the market? Not looking so great. Apple (AAPL), Google (GOOG), and Tesla (TSLA)—three of the most important tech stocks—are plumbing multi-year lows.

We dodged a correction in February, but I still expect a broader stock market pullback soon.

- How high can bitcoin go this year?

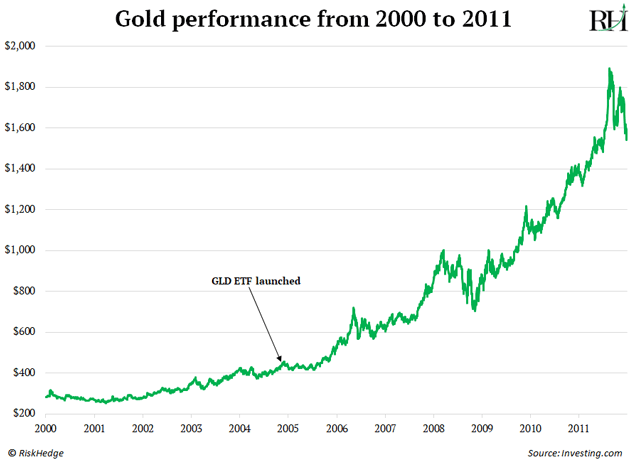

The first Gold ETF (GLD) was a game-changer when it launched in 2004.

GLD was a one-click way to trade gold. Money poured in and gold quadrupled in price over the following decade.

GLD was the fastest ETF to accumulate $10 billion in assets. That was, until the bitcoin ETFs debuted a few weeks ago.

GLD took three years to reach $10 billion. BlackRock’s (BLK) iShares Bitcoin ETF (IBIT) did it in seven weeks.

The bitcoin ETF is GLD 2.0. A catalyst that pushes billions of dollars into a new asset—and ignites a multi-year boom.

Scores of wealth managers and financial advisors can buy bitcoin for the first time ever. Americans are now holding BTC in their 401(k) retirement accounts, which was all but impossible to do before.

As I’ve said since BTC was sitting at $35,000, it can hit $150,000 by year-end.

That’s about a 2X gain from here. But I prefer to own crypto businesses with real products producing real revenues, like Ethereum (ETH). Ethereum is outperforming bitcoin this year.

More soon.

- It’s time to bet on America!

I had breakfast with Wall Street veteran Nick Colas in NYC a few weeks ago.

We were discussing Larry Summer’s famous quote, “Europe's a museum. Japan's a nursing home. China's a jail.”

Nick followed up… “and America’s a business.”

A lot of investors I’ve met recently are down on America’s prospects.

They see the political mudslinging, college campus madness, and sky-high national debt and conclude America is washed up.

I completely disagree.

America is undergoing an innovation renaissance.

All the leading AI companies—from ChatGPT creator OpenAI to chip giant Nvidia (NVDA)—are American.

Robo-taxis are cruising around the streets of major US cities…

Elon Musk’s SpaceX is launching rockets from US soil every other day…

Every startup working on next-gen nuclear reactors is US-based…

And American biotech firms are developing vaccines to preempt deadly diseases… pills to kill cancer… and antibiotics to overpower superbugs.

I’m an optimist not because I believe the world will automatically get better. That’s complacency.

I’m positive about our future for one specific reason: entrepreneurs continue to invent world-changing technologies that make us wealthier… healthier… and safer.

America dominates innovation. So much so that when a non-US firm makes a breakthrough, it’s headline news.

For all its problems, I just don’t see America losing. Not when you have the smartest entrepreneurs and best companies on your side.

Amazon (AMZN) invests more money into research & development than every French company, plus the government of France—combined!

This Irishman is unapologetically bullish on America.

In Disruption Investor, we’re aiming to profit from it by buying the very best businesses profiting from megatrends. Upgrade here.

- The next great trillion-dollar company?

Elon Musk’s Starlink is helping America’s farmers.

These days, more and more farms are equipped with innovations like self-driving tractors and pesticide-spraying drones.

Problem is, lousy internet access in rural areas precludes almost three-fourths of American farms from using them.

SpaceX is launching thousands of small satellites into space to create a network that provides cell and internet access anywhere on Earth.

Tractors driving around fields in the middle of nowhere might be a long way from a cell tower. But they have a clear view of satellites in the sky.

Two big takeaways here…

#1: Avoid broadband companies.

Traditional cable providers aren’t set up to provide high-speed internet to rural areas.

Elon leapfrogged them by launching thousands of what amount to mini cell towers into space.

Many of the 55 million Americans who live rurally will ditch Comcast, Charter, and AT&T for Starlink.

Add in “countryside” companies (like John Deere), and we have a serious disruption on our hands.

#2: SpaceX to $1 trillion.

Starlink is owned by Elon Musk’s company SpaceX.

SpaceX is valued at $175 billion. It’s America’s most valuable private company.

By 2030, SpaceX will be one of the world’s 10 most valuable companies.

Already, Starlink has 2 million paying customers. And SpaceX’s revenues hit $9 billion last year across its rocket launch and Starlink businesses.

Expect revenues to at least 10X over the next decade as it pioneers a new space age.

- Today’s dose of optimism: America continues to awaken from its innovation slumber.

SpaceX just launched three rockets into space in one day. That’s unprecedented.

And it’s preparing for the next launch of its skyscraper-sized rocket Starship, which is intended to take people to Mars someday.

I love seeing big, bold, brash companies that prove naysayers wrong.

Civilizations die when they stop believing in the future.

Lucky for us, a new American frontier is opening up.

Stephen McBride

Chief Analyst, RiskHedge