A belated happy St. Patrick’s Day from Dublin.

My wife is in New York so I’m on daddy duties, with a helping hand from my in-laws.

While those around me celebrated Ireland’s national holiday, I toasted to another special event…

- Elon Musk’s SpaceX successfully launched a skyscraper-sized rocket into orbit.

I’m a sucker for man-made beauty, and SpaceX’s Starship launch last week was breathtaking.

Source: SpaceX

Source: SpaceX

SpaceX is the single most important company in America today. It’s the Roger Bannister of innovators.

We used to think it was impossible to run a mile under four minutes. Then Roger Bannister did it in 1954, and something strange happened. Over 40 runners beat the clock in the next few years.

The barrier was never physical. It was psychological.

By launching the largest-ever flying object (5,000 tons) into orbit, SpaceX showed it’s possible to do really hard things.

Imagine all the innovators inspired by this achievement who’ll go on to found billion-dollar companies.

Today, when we look up from our iPhones, we see a physical world that looks virtually the same as 50 years ago.

Airplanes are barely faster… highways are crumbling… and we’ve built one new nuclear plant since 1980.

Now, America’s innovation renaissance is gaining steam.

Boom Supersonic is building jets that fly from NYC to London in three hours. It’s already received 130 orders from airlines, including United Airlines (UAL) and American Airlines Group (AAL).

Meanwhile, startup Figure is making self-learning robots that teach themselves to make coffee and fold laundry.

We’re inching toward that “Jetsons” future where Rosey the robot vacuums the carpet and cleans our dishes.

Over the past decade, our brightest kids spent their days gamifying apps and optimizing digital ads in Silicon Valley. What a waste of talent.

Now they’re working on big, bold, brash technologies that will lead to human flourishing. Rockets to take us to Mars… supersonic jets… truck-sized nuclear reactors that can power whole cities… and lifesaving drugs.

My prediction: Businesses that make physical “stuff” will soon rule the roost. This will unlock huge opportunities for us.

A decade from now, America’s most valuable companies will be far larger than Microsoft (MSFT), Apple (AAPL), and Google (GOOG) are today. That’s because they’re hunting down much bigger markets, like healthcare and energy.

It’s already happening. SpaceX, valued at $175 billion in the private markets, is worth more than Verizon (VZ)… Uber (UBER)… Nike (NKE)… or Boeing (BA).

I’ll have a lot more to say about this shift—and the ways to profit from it—in Disruption Investor.

- Exhibit #319 on why you should avoid the news.

SpaceX achieves one of the greatest engineering feats ever… and here’s what three of America’s most popular news outlets are talking about the next day:

Sources: The New York Times, CNN, The Wall Street Journal

Sources: The New York Times, CNN, The Wall Street Journal

Refuse to swallow the despair and fear you’re being fed. It’s time to dream big.

- I hope you don’t own Boeing stock.

In the past week or so, separate Boeing airplanes…

- Lost a tire mid-flight.

- Had to make an emergency landing after an engine caught fire.

- Saw its landing gear break into pieces just seconds after touching down.

- Took a nosedive mid-flight, hospitalizing 50 passengers.

Amateur hour.

It’s time to build a new Boeing.

I know that’s a tall order, but there’s never been a more opportune time.

We have startups working on Mars-bound rockets… supersonic jets… and even flying cars. I know for sure they could craft a better airliner than the 747.

Building physical products is risky and hard. Rockets blow up, cars crash, and regulations squeeze innovation.

But the hardest opportunities are often the most valuable. Boeing is America’s largest exporter and its fourth-largest defense contractor.

Building a new, better Boeing is a trillion-dollar opportunity. With this shift toward physical innovation, take what you think is possible and multiply it by 100.

For now, avoid Boeing (stock).

I’m monitoring this new wave of startups tackling huge, established, real-world industries. More soon.

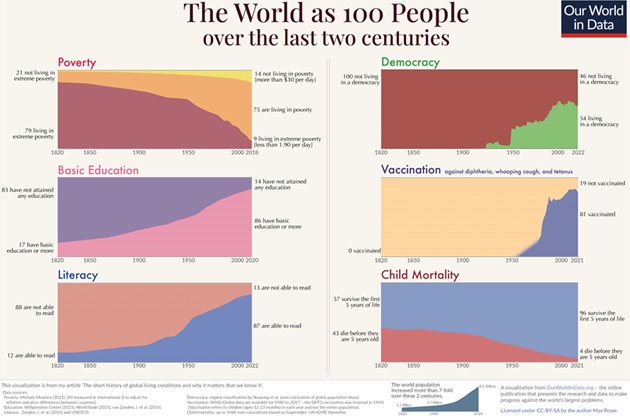

- Today’s dose of optimism…

Our World in Data just published a new graph showing how far we’ve come over the past 200 years:

Source: Our World in Data

Source: Our World in Data

Two stand-out stats:

In 1800, the global child mortality rate was above 40%. Today, it’s 3.4%. The world’s best-scoring country back then (Belgium: 33%) suffered from child mortality twice as high as the worst-scoring country today (Angola: 17%).

In 1800, Belgium had the world’s highest life expectancy, at 40. In 2024, no country has a lower life expectancy than this.

Let’s keep pushing forward.

Stephen McBride

Chief Analyst, RiskHedge