Today, we’re taking a patient approach and easing into one of today’s hotter large-cap commodities stocks.

I’m talking about Freeport-McMoRan (FCX).

Freeport is one of the world’s largest copper mining companies. We’re picking up shares in FCX today for a couple reasons.

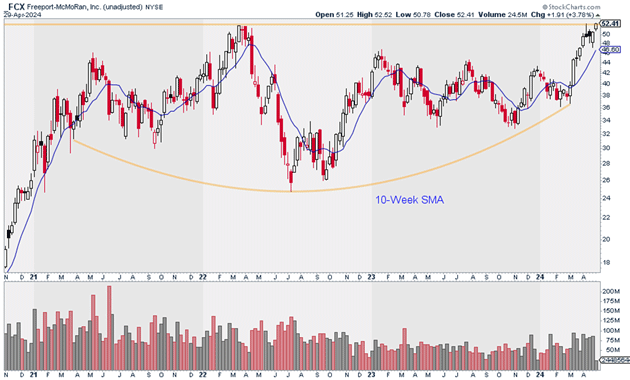

For starters, commodities are strong. Copper, in particular, has rallied 27% since February. FCX also has a great chart.

As you can see, it’s on the verge of breaking out of a base that dates back to early 2022. If successful, FCX could head much, much higher in the coming months.

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

I suggest building out a starter position in FCX today over the next few weeks.

I suggest this patient approach because FCX has been on a tear as of late. It’s working on its 8th consecutive green candle in a row and is a little extended relative to its rising 10-week moving average.

In other words, FCX could pull back a bit or consolidate before making its next major push higher.

Still, I remain very bullish on FCX. I believe the stock could hit $70 within the next 12 months.

Exit your position if FCX closes below $46. That gives us a risk/reward ratio of nearly 3:1 on this trade.

Action to take: Buy FCX at current market prices.

Risk management: Exit your position if FCX closes below $46.

Justin Spittler

Chief Trader, RiskHedge