Bull markets love to shake out “weak hands.”

These are people who panic during pullbacks. They sell their positions just before the market reverses course in a big way.

Knowing how to spot a shakeout is one of the most profitable things you can do as a trader.

Often, they happen because of bad news, like a “poor” earnings report.

That brings us to our new Trade of the Week: Palo Alto Networks (PANW).

Palo Alto is one of today’s best cybersecurity stocks—and one of the year’s top-performing tech stocks.

This year, PANW has rallied an impressive 87%. That’s more than double what the Nasdaq has returned in 2023.

But we’re not chasing PANW here.

You see, PANW reported earnings last week. It initially sold off because its billings came in lighter than Wall Street expected. PANW fell 6% on a day when most stocks were ripping higher.

This sharp sell-off caused many to turn bearish on the stock. But it was a textbook shakeout.

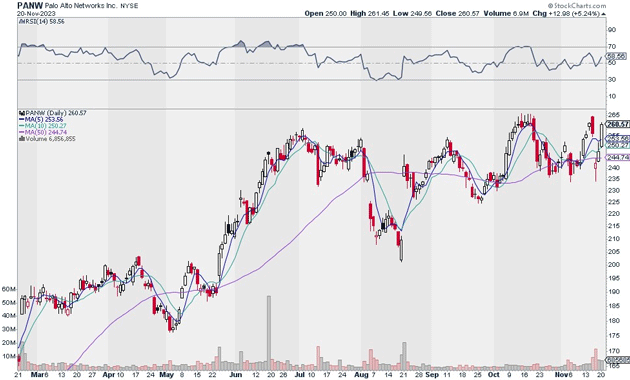

See, there was follow-through on the move lower… and PANW has rebounded strongly the past two trading sessions:

Source: StockCharts

Source: StockCharts

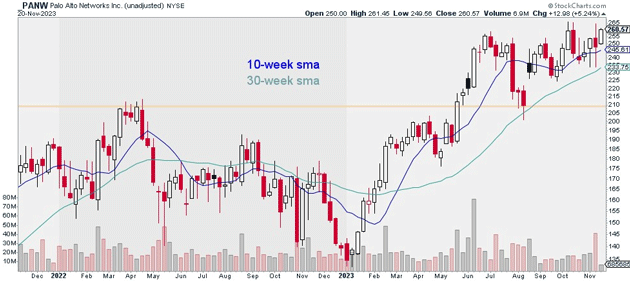

It’s now trading back above its short-term moving averages. More important, PANW’s bullish structure on its weekly chart is very much intact:

Source: StockCharts

Source: StockCharts

It’s also worth repeating that PANW is a long-term leader in the cybersecurity space. This is one of my top industry groups, both in the near and long term.

I suggest buying a starter position in PANW today. I believe it can hit $365 within the next 12–18 months.

Exit your position if PANW closes below $235. That gives us a risk-reward ratio of 4:1 on this trade.

Action to take: Buy PANW at current market prices.

Risk management: Exit your position if PANW closes below $235.

Justin Spittler

Chief Trader, RiskHedge