It’s being called “the largest IT outage in history.”

On Friday, cybersecurity giant CrowdStrike (CRWD) released a faulty software update, causing major outages on Windows computers worldwide.

Everything from major airports to hospitals to 9-1-1 call centers were impacted.

Shares of CrowdStrike plummeted on the news, falling 23% in two days. And there’s no telling where the stock will bottom.

According to CNN, costs from the IT outage could top $1 billion. This is clearly a problem for CrowdStrike—especially in the near term.

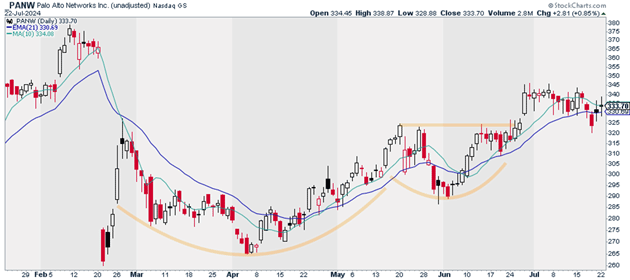

But CrowdStrike’s major mishap spells big opportunity for other cybersecurity stocks, including my latest Trade of the Week: Palo Alto Networks (PANW).

Palo Alto is the largest cybersecurity company by both revenue and market value. It’s also one of the strongest cybersecurity stocks on the planet.

PANW has rallied 38% over the past year. And despite the recent pullback in technology stocks, it’s trading just 12% off its all-time highs.

It’s only a matter of time before PANW challenges those former highs. And I believe the CrowdStrike news could serve as the catalyst for its next major leg higher.

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

I suggest just putting on a starter position in PANW today. We’re starting small because the major indices—the S&P 500 and Nasdaq—could remain under some pressure in the near term.

I believe PANW could hit $450 over the next 12 months.

Exit your position if PANW closes below $295. That gives us a risk-reward ratio of more than 3:1 on this trade.

Action to take: Buy PANW at current market prices.

Risk management: Exit your position if PANW closes below $295.

Justin Spittler

Chief Trader, RiskHedge