“I almost cried when she pressed on the window,” my wife said.

It was Mother Day’s here in Ireland this past Sunday.

It’s a day when the restaurants are usually bustling with families. But like pretty much every city in the world, everything is shut down right now.

My grandparents are taking extra precautions and staying indoors. However, my wife and I couldn’t resist taking my daughter to them.

But instead of going into the house, we chatted through the window. My daughter and her grandmother “high fived” each other on opposite sides of the glass. It was cute, but also weird.

Coronavirus has uprooted all our lives in some way. (Be sure to check out today’s mailbag to see how your fellow readers are getting by.)

Maybe you’re working from home… homeschooling your children… or if you’re like a growing number of Americans over these past few weeks, you may have even started ordering your groceries online…

- This pandemic just triggered a disruptive megatrend in the $1.5 trillion/year US grocery market.

This is a “breakout moment” for online groceries.

And there’s one specific stock that will be the biggest beneficiary.

This is a world-class disruptor I recommended in my Disruption Investor advisory. It’s been soaring to all-time highs during this bloodbath—and my research shows, the biggest gains are yet to come.

I’ll explain in a moment. But first, let’s take a look at this enormous disruption…

- Did you ever hear of Instacart?

It’s basically “Uber” for groceries.

The company’s employees—aka “grocery shoppers”—go to the store and pick up all your requested items for you. Then they deliver it all straight to your doorstep.

With the coronavirus gripping the nation, this type of service has never been more popular.

Last week, Instacart’s sales growth rates jumped 10x compared to February of this year. CEO Apoorva Mehta said, "The last few weeks have been the busiest in our history.”

And get this… to keep up with surging demand, Instacart is adding 300,000 new employees over the next three months.

But they’re not the only company rushing to meet demand…

- Even “hall of fame” disruptor Amazon (AMZN) is struggling to handle record online orders.

Millions of Americans use Amazon’s Pantry service to get groceries and household items delivered to their door.

But on Tuesday, Amazon suspended its service as it couldn’t keep up with the orders.

In other words, Americans are ordering so many groceries online they essentially “broke” Amazon!

Keep in mind, Amazon delivered 3.5 billion packages last year. It had sprawling warehouses the size of 17 NFL fields. Yet online purchases swelled to the point where many of these depots are now empty.

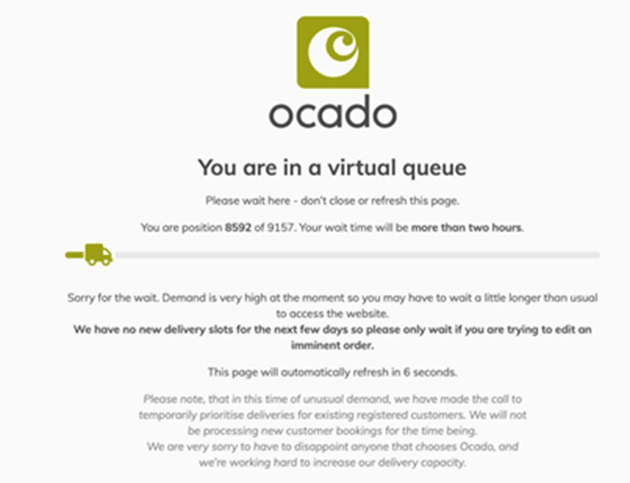

It’s a similar story in Europe. Online grocer Ocado’s (OCDO.L), which runs fully robotic storehouses, has seen such a large spike in demand, it’s had to set up a “virtual queue” for customers to access its website.

On Monday, there were more than 9,000 people waiting in line just to access the website!

Ocado’s stock recently hit all-time highs after it announced sales doubled in the past month.

- This is a breakout moment for many big, new disruptive trends that will change the world.

And online groceries is one of the most important of all.

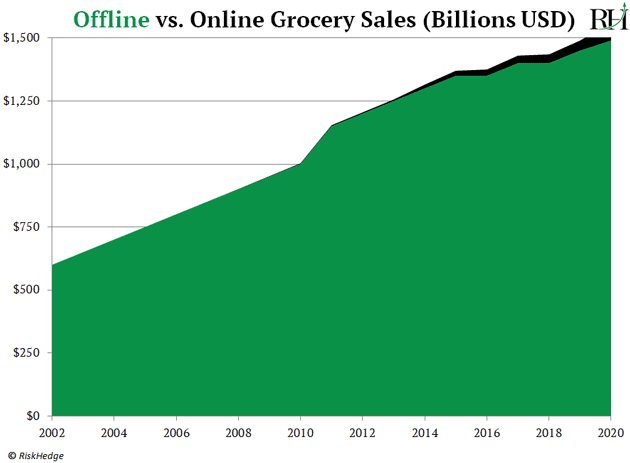

I first showed you this chart last year, predicting online groceries were going to explode:

Now it’s happening.

The breakout moment is here.

The coronavirus is flipping one of the world’s biggest industries on its head.

And there’s a clear winner from this disruptive megatrend.

It’ll thrive now and long after this pandemic is over.

- I’m talking about America’s largest grocer… and one of my favorite stocks on the planet…

Walmart (WMT).

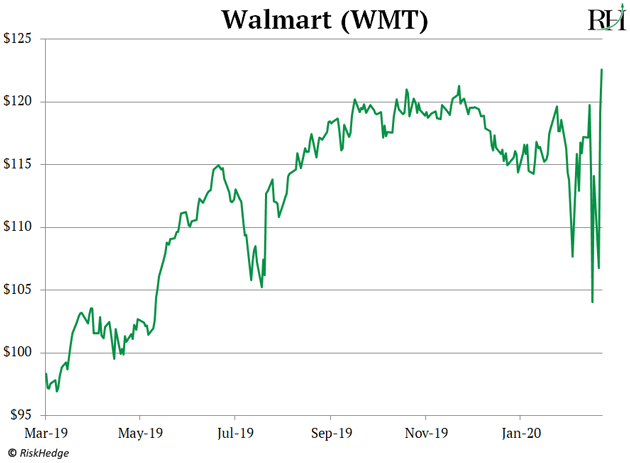

As I mentioned earlier, Walmart is thriving in today’s volatile markets.

In fact, last Monday—when the stock market plunged to record lows—Walmart struck an all-time high!

- Walmart has always been one of the world’s most dominant businesses.

But the recent rush into online groceries has catapulted the stock to new highs.

App research firm Apptopia found downloads of Walmart’s grocery app shot up 160% last week.

In fact, it’s now hiring 150,000 new employees to man its warehouses as it wrangles with surging online demand.

As you likely know, Walmart is the largest grocery chain in America. It has over 5,300 stores across the country. And it’ll sell roughly $350 billion worth of groceries this year.

Roughly 90% of Walmart’s sales happen in its physical stores. But it’s been making a huge push into online groceries. For example, e-Commerce revenues shot up 37% last year, driven by strong grocery sales.

And this year, it will sell over $50 billion worth of goods through Walmart.com. In fact, it’s overtaken eBay to become America’s second-largest online seller.

Walmart already dominates the market for online groceries. Research firm eMarketer found the number of Americans buying online groceries from Walmart doubled in 2019. That’s almost double the number of customers than its closest rival, Instacart.

As I said, online grocery sales will surge in the coming years. And when it comes to predicting who will dominate this market, the answer is clear:

- Nobody can touch Walmart.

Walmart has a store within 10 miles of 90% of American households. This sprawling footprint gives it the ability to deliver fresh groceries to millions of Americans every day.

By the end of this year, same-day grocery delivery from Walmart will be available to over 200 million Americans!

Walmart has only launched online delivery in less than one-third of its stores so far. As it rolls it out nationwide, the 40% growth in its online business could easily double.

2020 is going to be a breakout year for online groceries. And Walmart is hands-down the best way to play this disruptive megatrend.

Stephen McBride

Editor — Disruption Investor

Reader Mailbag

I hope you and your family are holding up okay during this crisis.

I think it’s important that we all stick together during this time. So starting today, I’ll be starting a special “mailbag” where we can all share updates and personal stories about how we’re getting by.

Read on to hear from your fellow readers. And keep the updates coming stephen@riskhedge.com...

Hi Stephen. I’m glad to know that you’re doing well in Ireland.

Here in Alpharetta, Georgia, a suburb of Atlanta, things went down quickly over a week. We are in the fifth day of a semi-lockdown. Kids are home studying. What matters is that family is safe together.

The market has certainly given me aches and pains all over my body over the last three weeks. Every day is a struggle. Nonetheless, reading newsletters from your team has an interesting calming effect. I know that I am not alone in this fight, whether it’s against COVID-19 or the vicious economic downturn.

Just like the rest of the US, the confirmed cases in the state of Georgia have grown quite rapidly over the last two weeks. It just exceeded 1000 this morning!

We have three rather reputable hospital systems in the metro Atlanta area. I know for sure that they are all calling for help to get essential medical supplies, N95, gloves, gowns, ventilators, etc. Hospital beds will soon get saturated, I am sure.

Social distance may have kept us apart for now, however, the world is as connected as ever.

I look forward to reading your upcoming correspondence.

Keep up the good work. Stay safe and strong. —Jeffrey

I work for a boat building company in southeast Kansas. We were informed this morning that orders were still coming in, so we'll continue to work unless things change. If anyone working for the company should travel to a "hotspot," they'll be given two weeks off WITHOUT PAY. That's the company's way of punishing you for taking a chance that could put others at risk. I sent my wife to her parents, as she has a compromised immune system and her parents rarely go anywhere. So, now I'm alone with two dogs and a cat. —Ron

As a beautiful spring morning rises, so is the number of people getting sick. We still have our bars open but not for long, I think. No death toll here yet. Except all the toilet paper is sold. Lucky we have lots of paper mills. I have not sold anything. I’m working at my home now, but Monday I have to go back to the refinery. We have a 10 people limit on gatherings. The mood of the country is waiting and fear for things to come.

Godspeed or whatever you want to believe. —Jyri

I have very much enjoyed your consistent investment approach and your guidance during this crash. Your reports are well written and engaging. I have taken stakes in several companies on your list, and I’m optimistic about the future.

Thank you for the wonderful reports. Please keep safe.

Here in Toronto, our government shut down all non-essential businesses and is throwing money at COVID-19… unfortunately, the money is mis-directed towards COVID-19 clinics that right now cannot source protective gear for its workers, swabs to test patients, or labs to analyze the swabs fast enough (i.e. emergency docs/staff are basically sitting around, while getting paid big bucks). I hope this crisis sheds light on weaknesses in our first-world medical systems, and I hope that we integrate relevant technologies to improve patient throughput. —Derrick

I appreciate all of the feedback, and I’d love to hear more of your stories. You can send them at stephen@riskhedge.com.

Stay healthy and stay safe.