Did you catch the big news?

President Biden signed an executive order (EO) on March 9 regarding the regulation of crypto.

“Regulation” has been a big bogeyman for crypto. Folks have long speculated new rules will crush crypto markets.

But what happened when the EO was released? Cryptos dipped lower before shooting higher.

Ethereum is up about 6% since the morning the executive order was signed. Bitcoin (BTC), the world’s largest crypto, has held strong, jumping 6% over the past week.

I’ve argued for months regulation will be a great thing for the crypto industry... ultimately leading to higher prices.

That’s because regulation will provide much-needed clarity to the crypto industry. This clarity will attract millions of money managers who haven’t put a penny into crypto yet.

|

EARLY OPEN: SIC 2022: Pre-Order Your Virtual Pass Today! “Goodbye Normal” is the fitting theme for the 5+1 action-packed days of this year’s Strategic Investment Conference. Watch and interact with over 40 world-class speakers in 35 live sessions. What will happen in the economy and markets over the next 12 months? What is the future of energy? How can you protect your assets and find the best undervalued companies for outsized profits? Click here for more details and to pre-order your Virtual Pass at a 44% discount. |

Most of the world’s largest investors haven’t touched crypto because of the regulatory uncertainty. And they refuse to invest in crypto before the government sets the rules.

Ken Griffin, the billionaire founder of Citadel Securities, told Bloomberg back in October: “We don’t trade crypto because of the regulatory uncertainty… if crypto was regulated, I would trade it.”

There are hundreds of Ken Griffins out there… biding their time until a regulatory framework comes to crypto.

-

Biden’s EO kicks off that regulatory framework.

In a nutshell, the order directs several federal agencies to study the effect of digital assets on the American economy and provide legislative recommendations.

From combing through the paper, it’s clear Washington wants to harness crypto’s game-changing tech. One of the main objectives outlined in the EO is to “drive US competitiveness and leadership in and leveraging of digital asset technologies.”

Does that sound like a big scary crypto ban is coming? Nope. Instead, the US government wants to use crypto to remain the richest, most powerful country in the world.

In fact, the language in this EO reminds me of when Washington woke up to how powerful the internet would be.

In the early 1990s, the internet was the Wild West. It was a transformational new technology that regulators hadn’t figured out how to deal with yet—much like crypto today.

President Clinton signed the Communications Decency Act into law in 1996. This established a framework for who can be held responsible for online content. It resolved a lot of the uncertainty around publishing and doing business on the internet.

I’m betting this EO will clear up the uncertainty around owning crypto assets. It will be seen as the green light for Wall Street to finally get into crypto in a big way.

As JPMorgan’s Head of Global Markets, Troy Rohrbaugh, said: “As we get more regulatory clarity, as our clients become more significant investors in these products… we plan to move with them.”

And guess who’s moving into crypto just as a regulatory framework is being put together? Citadel and Ken Griffin. He recently told Bloomberg, “It’s fair to assume that over the months to come, you will see us engage in making markets in crypto.”

-

The bottom line is… the regulation bogeyman that’s been hanging over crypto for years is now gone.

Folks had a warped idea regulation would somehow be the end of crypto. The reality is new laws usually mark the beginning, not the end. At some point, every industry was new and unregulated.

For example, modern stock market regulations were first introduced in 1934 with the creation of the SEC. That didn’t crush the stock market. Instead, it helped turn investing in the stock market into a common thing that any family can do. US stocks have appreciated at least 45,000% since 1934, depending on how you calculate the gains.

Government regulation is usually a good thing for investors in an industry… and sometimes it’s great.

-

Remember all the uncertainty surrounding Obamacare?

Before Obamacare, health insurance firms were under fire from Washington. Investors worried looming regulations would crush profit margins and put some insurance companies out of business.

When Obamacare was signed into law… the total opposite happened. Obamacare was the best thing ever to happen to healthcare stocks.

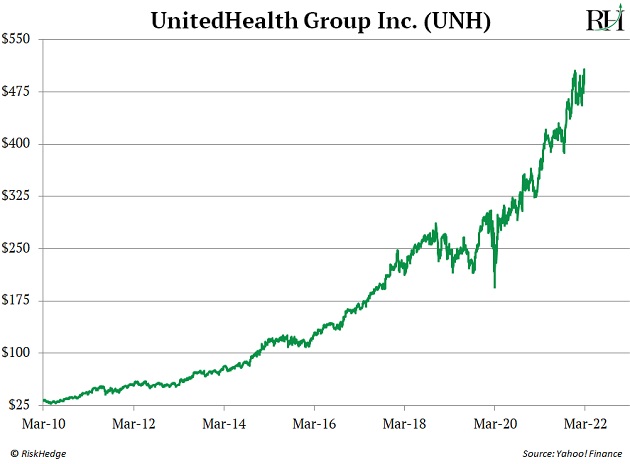

The Affordable Care Act passed in March 2010. Since then, UnitedHealth (UNH), America’s largest health insurer, has soared 1,426%.

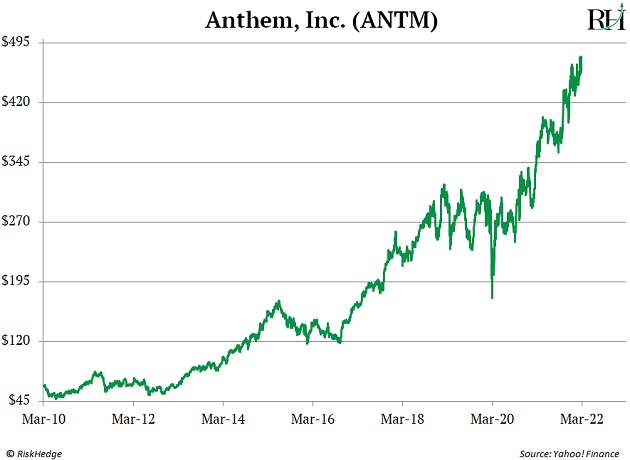

Anthem (ANTM), America’s second-largest health insurer, has soared 651%.

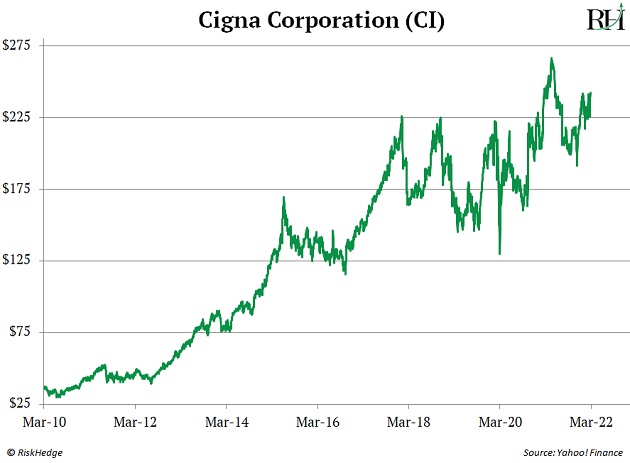

And Cigna (CI), another huge health insurer, has soared 552%.

Why?

Obamacare removed uncertainty. It set the rules. Investors could confidently buy health insurance stocks knowing the rules wouldn’t be changed.

Obamacare sparked a generational boom in healthcare stocks for another reason…

It required Americans to buy health insurance. In other words, Obamacare forced millions of American families to become customers of health insurance companies.

In a similar way… crypto regulation will force more investors to get involved.

For years, billionaires like Ken Griffin had the perfect excuse to not invest in cryptos.

“Why’d you miss out on bitcoin’s 1,000,000% gains?” an investor might ask a highly paid hedge fund manager.

“Regulatory uncertainty” was the go-to excuse.

It’s been perfectly acceptable for professional investors to miss out on bitcoin’s 1,000,000% rise.

That won’t be the case anymore. The world’s largest money managers will have to consider investing in it… or risk being left behind.

Stephen McBride

Editor — Disruption Investor