Did you hear about Elon Musk’s big investment?

The Tesla founder and richest man on the planet just took a 9% stake in Twitter (TWTR)…

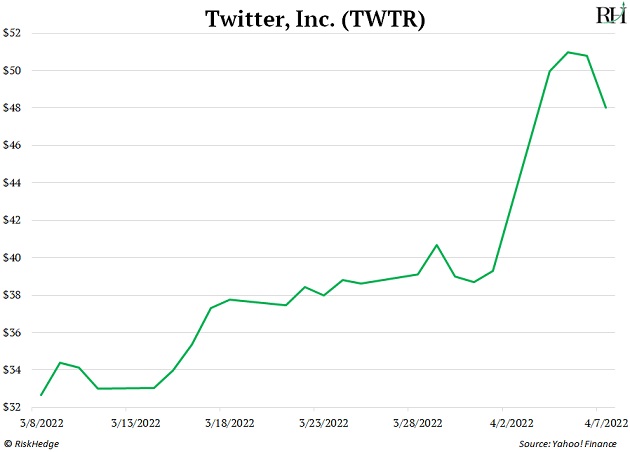

Sending the social media stock rocketing 30% in a flash, as you can see below:

Elon is now the platform’s biggest shareholder. His stake is valued at over $3 billion.

Now, according to CNN, “Musk's filing did not disclose the purpose of the purchase or any plans for the company.”

|

[The Power Law?] It’s why just two teams have won nearly half of all NBA championships... Why a handful of book authors are constantly on the best-seller lists... And why only 1% of stocks are worth owning. |

Still, the media’s having a field day:

- “Trump's supporters are asking Elon Musk to reinstate the former president's Twitter account”—Business Insider

- “10 Things for Elon Musk to Do at Twitter”—WSJ

- “What would free speech look like on Elon Musk’s Twitter?—LA Times

Because this has become one of today’s biggest financial stories, we’re shaking things up today.

I’ve brought in our three senior analysts—Stephen McBride, Chris Wood, and Justin Spittler—to share their thoughts.

Here are their takeaways… including whether or not Twitter is a “buy…”

Stephen McBride: The hype around Elon Musk becoming Twitter’s largest shareholder is more proof that individuals are more powerful than ever.

Stephen McBride: The hype around Elon Musk becoming Twitter’s largest shareholder is more proof that individuals are more powerful than ever.

Longtime RiskHedge readers might know when I’m not working, I do CrossFit, the popular strength and fitness workout. During the recent global CrossFit Open, which had some 300,000 participants, I finished in the top 1% of competitors.

A while back the CrossFit world champion appeared on Joe Rogan’s podcast. He mentioned he took a supplement called beta-alanine. Within a few days the supplement was sold out across the world. Some stores did a year’s worth of beta-alanine sales in a week!

All because one guy mentioned it on a podcast.

When speaking at a press conference last year, soccer star Cristiano Ronaldo removed two Coca-Cola bottles from the table and encouraged folks to drink water instead.

The next day Coke’s (KO) stock shed $4 billion in market value.

During last summer’s Tokyo Olympics, amateur videos uploaded by individual athletes got more views than NBC’s full coverage of the Games.

We’re entering the age of individual power. A period where one person’s words and actions can create, or destroy, billions of dollars in value.

This power was once reserved for governments and giant corporations. But thanks to the rise of alternative media platforms, certain people now wield it.

For example, 100 million people follow Cristiano Ronaldo on Twitter alone. This makes anything he says or does way more powerful than some bland government statement or company press release.

Think about who folks trust or look to for guidance these days.

Trust in governments and institutions is at an all-time low. I see nothing but skepticism toward large companies like Google and Facebook.

This trust is rapidly shifting toward individuals.

This might be good. It might be bad. But I can say for sure it’s going to be disruptive...

Chris Wood: Elon Musk is exactly what Twitter needs.

Chris Wood: Elon Musk is exactly what Twitter needs.

The company’s been stale for years. And Musk is a true visionary who could shake things up for the better.

Musk was offered a seat on Twitter’s board of directors, but declined. However, you’re kidding yourself if you think Musk—now Twitter’s largest shareholder—won’t have a big influence on policy.

That said I’m still not buying Twitter stock today.

For starters, it’s already a large-cap company with a market value of about $40 billion.

I go after small companies because they have much more upside.

In fact, the top 10 performing US stocks this year (and most years) are small stocks valued at less than $1 billion… and often less than $300 million.

Because of their small size, they’re able to grow in ways that are simply impossible for large companies.

What’s more, Twitter isn’t what I’d consider an innovative company.

A company doesn’t have to be small to be innovative. Take Apple…

The company is preparing to take the augmented reality (AR) market by storm… and lead the way as AR smart glasses replace smartphones in the coming decade.

But Twitter is no Apple. Twitter’s user base is growing slower than its competitors. Which means advertisers may allocate more money to other platforms… which would hurt revenue growth.

Finally, the stock looks pretty fairly valued around $50/share today.

So I’m not a buyer until the company does something big to juice user base growth.

Justin Spittler: Although Twitter’s stock surged on the Musk announcement, I don’t consider it a “buy.”

Justin Spittler: Although Twitter’s stock surged on the Musk announcement, I don’t consider it a “buy.”

As you can see in the chart below, TWTR rallied into its 200-day moving average. This key level acted as a cap on the price.

Source: StockCharts

Source: StockCharts

That shouldn’t come as a surprise. Twitter stock was trending down before the announcement… and it’s still trending down… because it’s below a falling 200-day moving average.

If Twitter decisively breaks above its 200-day moving average, I would get interested. Until then, I wouldn’t chase Twitter. In fact, it’s never a good idea to buy a stock just because of a big announcement. Investors who do that usually lose money.

If you want to buy TWTR, wait. Wait for an entry point that offers a decent setup to manage risk. Right now, the stock is in no-man’s-land. It’s nowhere near a support level you could use as your line in the sand to sell if it breaches.

Trading without good risk management is called gambling… and that’s what Twitter buyers are doing here.

Chris Reilly

Executive Editor, RiskHedge