“Nowhere to hide”…

Those might be the three best words to sum up the markets in 2022…

- Markets have nowhere to hide from this terrible inflation —Bloomberg

- ‘Nowhere to hide’ for investors in market turbulence —Financial Times

- Investors Want to Run Away, but There’s Nowhere to Hide —Forbes

Fears of inflation and rising interest rates have pummeled nearly everything:

US stocks are now officially in a bear market, with the S&P 500 down around 20% from its January peak. The tech-heavy Nasdaq has fared even worse, down more than 25% this year.

|

Being a stock market winner means backing companies that change the world and transform huge industries. We call these “megawinners”—stocks that can multiply your money. If you’d like to see how to find the stock market’s next megawinners—including details on Stephen McBride’s top three—click here. |

Treasury bonds are suffering their worst plunge in over a century. And bitcoin’s been cut in half in just the past three months.

Gold has been a decent hedge, but even the “ultimate safe haven asset” is only about breakeven this year. And going all cash? That’s a guaranteed way to lose 8.6%/yr, based off the recent inflation report.

So, what can you do?

One, don’t panic-sell great stocks. While these market cycles are painful—they’re inevitable, healthy, and always end.

As RiskHedge Chief Analyst Stephen McBride told his Disruption Investor members: The S&P fell 15%+ on 26 occasions since 1957. Stocks were higher a year later 92% of the time. They gained 20%, on average, in that following year.

However, if you own less-than-great stocks that require easy money conditions and a one-way bull market to thrive… consider cutting them ASAP.

Two, now’s a great opportunity to start thinking about “going shopping.” Many dominant stocks have fallen to levels that qualify them as cheap. Some have hit levels of cheapness I never thought we’d see again.

If you choose the right stocks here and buy and hold them for 2‒4 years… you’re highly likely to see big gains.

Of course, the trick is knowing which stocks are great. Which stocks are all but guaranteed to come out stronger on the other side…

That’s where today’s special RiskHedge Report comes in.

Stephen and tech veteran Chris Wood will share their pick for the world’s first $5 trillion company.

These are two of the most dominant companies on the planet, and they’re not done growing yet…

For Stephen and Chris, it’s not if these tech giants will hit a $5 trillion market cap, but when.

Which company will get there first?

Stephen’s, which would require its stock to rise around 330% from here?

… or Chris’s, which would hand investors around a 120% gain?

Decide for yourself below…

***

Stephen McBride: I believe Amazon (AMZN) will become the world’s first $5 trillion company.

Stephen McBride: I believe Amazon (AMZN) will become the world’s first $5 trillion company.

I know what you’re thinking: “Buy Amazon, really Stephen? Hasn’t the easy money already been made?”

Over the past 28 years, Amazon’s grown into “the everything store.” A place to buy almost every conceivable item online… and get it delivered to your doorstep in a flash. The disruptor is on track to sell over $700 billion worth of stuff through its online store this year.

That will continue to grow as the biggest categories of spending like groceries, autos, and healthcare move online.

But what if I said you can buy a share in its online business essentially for free?

You see, Amazon is far from a one-trick pony. Its cloud computing division, Amazon Web Services (AWS), makes up one-third of profits. Amazon pioneered this business back in 2006. And this year will rake in over $80 billion. Amazon’s “side business” makes more money than Nike, Coca-Cola, and McDonald’s!

Selling cloud computing to other firms is Amazon’s cash cow. It makes up 15% of revenues… and over one-third of its profits.

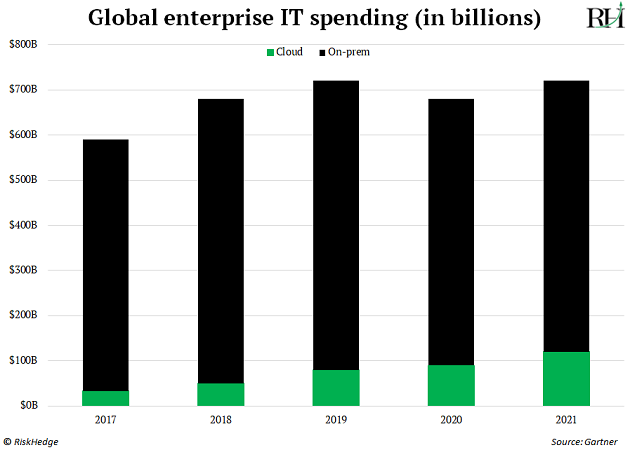

Like online shopping, we’ve been hearing about cloud computing for years. You’d be forgiven for thinking everything runs on the cloud these days. But you’d be wrong.

Roughly 90% of computing is still off-cloud, as you can see here:

Virtually every company in the world will move to the cloud. We’re in the middle of the multidecade shift. With a 40% market share, a big chunk of those firms choose AWS... paying Amazon billions of dollars each year.

AWS will rake in roughly $80 billion this year… while growing 35%+. You rarely see businesses this big grow this fast. It would be like Nike, Coca-Cola, or General Electric growing 35%. That almost never happens.

If it were a stand-alone business, AWS might be one of the world’s 10 most valuable companies.

I ran the calculations… and if you gave AWS the same valuation as other “cloud” stocks like Salesforce, it would be worth roughly $1.2 trillion. Amazon’s entire market cap today is $1 trillion.

Investors buying Amazon at these prices essentially get the world’s largest online retailer, and an ads business larger than YouTube. They also get Amazon’s $30 billion/year “Prime” subscription service, and physical stores, which include Whole Foods and Amazon Fresh grocery shops… FOR FREE.

With the continued growth of internet shopping and cloud services, Amazon has a real shot at becoming the world’s first $5 trillion firm.

Chris Wood: Apple (AAPL) is the largest American company by market cap ($2 trillion), above Microsoft, Google, and Amazon. While those are all contenders to become the world’s first $5 trillion company, none of them—or any company for that matter—will do it before Apple.

Chris Wood: Apple (AAPL) is the largest American company by market cap ($2 trillion), above Microsoft, Google, and Amazon. While those are all contenders to become the world’s first $5 trillion company, none of them—or any company for that matter—will do it before Apple.

Apple is still growing at double-digit rates, which is extraordinary for a company that generated nearly $400 billion in sales last year.

Fact is, nobody can compare to Apple’s expertise in both hardware and software.

This combination allows the company to build the best devices that sell at the highest prices.

And it makes Apple the most profitable device maker in the world.

Apple’s net profit margin averaged 23% over the past five years. Samsung, its nearest competitor, averaged 12%.

And people still love Apple’s products…

Folks across the world were using a whopping 1.8 billion Apple devices at the end of 2021. That’s up nearly 10% from 2020. And it shows the strong “stickiness” Apple has created with its ecosystem of devices, apps, and services.

Meanwhile, Apple is still innovating. Regular readers know its virtual reality (VR) and augmented reality (AR) products will be a game changer.

Apple has been exploring virtual reality and augmented reality technologies for at least 20 years. It’s finally close to releasing a mixed reality (VR + AR) headset and a pair of sleek AR glasses.

The mixed reality headset will probably come out in 2023 and the AR glasses will follow in 2024.

As I’ve said before, I believe AR glasses will eventually replace our smartphones.

And I expect Apple to dominate the colossal new AR glasses market. Apple is the king of making sleek, powerful, and simple-to-use products people love.

There are about a billion iPhone users in the world today. That’s an enormous user base. Many of them will be easily converted to AR glasses… and generate billions in sales in the process.

Apple will leverage its enormous user base to grow sales of these products fast. If it ramps up anything like the iPhone did after its release in 2007, Apple will be selling over 100 million units of each product annually by 2029.

That, combined with continued strong growth in Apple’s other businesses, is a surefire way to achieve a $5 trillion valuation.

Chris Reilly

Executive Editor, RiskHedge

Do you agree with Stephen or Chris? Will a different company become the world’s first $5 trillion company? Share your thoughts with me at chrisreilly@riskhedge.com.