Did you survive the “growth scare?”

Over the past few weeks, we’ve seen an aggressive rotation out of growth stocks.

Leading names like Palantir Technologies (PLTR), AppLovin (APP), and Reddit (RDDT) all fell more than 50% from their recent highs.

The good news is that many growth stocks have stopped falling. Some are already bouncing back in a big way.

I’ve personally used this pullback to increase exposure. But I’m not “dumpster diving” like some traders. Instead, I’ve focused on the names showing relative strength, i.e. the ones that held up the best during the selloff.

These names have the best chance of becoming leaders during the next leg higher.

So, what are these names? Well, two stick out like a sore thumb: Netflix (NFLX) and Spotify (SPOT).

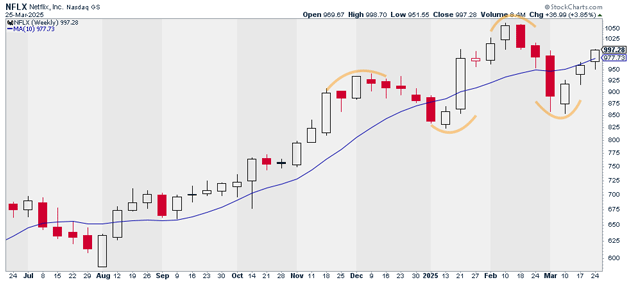

NFLX never printed a “lower low” during the pullback. It’s still in a very healthy uptrend. In fact, it’s in the process of reclaiming its rising 10-week moving average:

Source: StockCharts

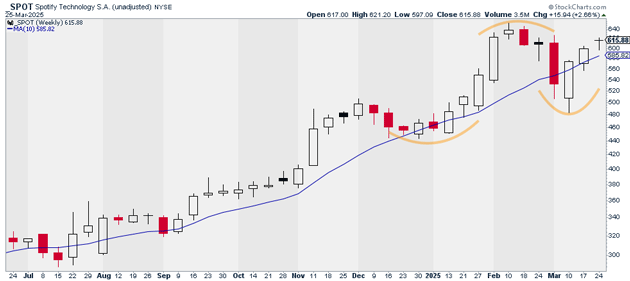

SPOT is even stronger than NFLX. It’s also put in a higher low, and it’s headed for its second straight weekly close above its rising 10-week moving average:

Source: StockCharts

You’d be hard-pressed to find two stronger growth stocks than these.

But maybe we should stop calling them that. Instead, should we start thinking about NFLX and SPOT as “consumer staples” stocks?

Consumer staples companies sell things like toilet paper and toothpaste. They’re safe stocks because people are still going to buy these products during economic slowdowns.

Most traders don’t view Spotify and Netflix this way. But are these companies really that different?

If the economy slows, people go to restaurants less often. They take fewer vacations. They buy new clothing less often.

But they don’t watch fewer movies at home and they don’t listen to less music. These services are so cheap nowadays, people don’t cut them in a recession.

This could explain why NFLX and SPOT are holding up like champs while most growth stocks have gotten clobbered.

Justin Spittler

Chief Trader, RiskHedge

PS: The market is showing signs of life. If you’re looking for my premium trades that go beyond the obvious names, check out Express Trader. Every Monday, I share my three strongest trades to place that week. Want in? Join here.