Elon Musk’s SpaceX has broken another record.

It’s now the most valuable private company in the world, worth around $350 billion.

SpaceX is now bigger than Coca-Cola (KO), Wells Fargo (WFC), and Salesforce (CRM).

And I believe it’ll become a $1 trillion company by 2030.

- SpaceX is single-handedly building the space economy.

Every 2.3 days in 2024, a SpaceX rocket blasted off somewhere in America. This year, it’ll complete more missions than NASA’s Space Shuttle program did in its entire 30-year history.

Imagine if every time you flew, the airline had to build a new plane. That’s how space travel used to work. Every rocket flew once, then crashed into the ocean. SpaceX changed the game with reusable rockets...

SpaceX built the largest and most powerful rocket ever—Starship. It’s 100 ft. taller than the Statue of Liberty, weighs 11 million pounds, and is powered by 33 raptor engines. Just one of these engines produces twice the thrust of an entire Boeing 747.

Last year, SpaceX caught this monster rocket with a pair of giant mechanical arms as it fell from the sky. Full-grown men look like ants walking on these arms:

Source: Marcus House on X

Before SpaceX, putting a pound of cargo into orbit cost at least $30,000. Today, SpaceX routinely does it for $1,200—a 96% cost reduction! Elon Musk’s goal is to slash costs by another 99% to nearly $10/kg. I wouldn’t bet against him.

- By slashing costs, SpaceX opened the space economy to everyone.

There are now over 5,000 space startups in the US alone. And most of them rely on SpaceX to send their cargo to space.

SpaceX is essentially running a cosmic taxi. It launched 13 rockets in December alone. Booking a trip into orbit is almost as easy as preordering an Uber. You just visit SpaceX's website, type in the weight of your “parcel” and when you want to send it. You’ll get an instant quote.

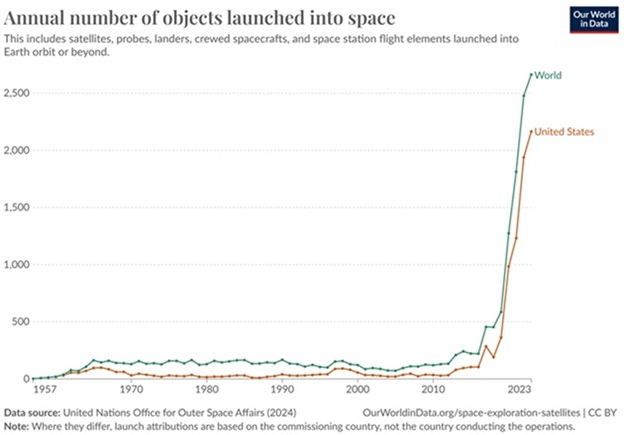

Thanks to SpaceX, more objects reached space in the past two years than in all of previous history:

Source: Our World in Data

- SpaceX accounts for 95%+ of these launches...

It’s launching a rocket the size of a high-rise into orbit almost every other day. And it’s doing it with a near-perfect 99.7% success rate.

SpaceX raked in $8.7 billion in 2023. Payload Research estimated revenues were on pace to reach $13.3 billion in 2024.

A big chunk of SpaceX sales—around $6 billion—comes from its lucrative Starlink division. Starlink offers the first satellite internet fast enough to support streaming, online gaming, and video calling. It’s a go-to solution for cargo ships, airlines, and those living in remote areas. In the last year, Starlink subscribers doubled to 4 million.

|

Bottom line, SpaceX is a great business. I expect its revenues will reach $130 billion over the next decade as it pioneers a new space age. And as I said, I see it hitting a $1 trillion market cap by 2030.

If you want to invest in a dominator while the space industry is still in its early stages, now is a good time to do it.

- “But Stephen, SpaceX stock doesn’t trade on the stock market... how can I invest in it?”

You’re right. SpaceX is a private company.

But there are a couple ways to invest in it.

The most direct option is to buy SpaceX shares on pre-IPO marketplaces.

In the early days, startups are strapped for cash. Most of the money is spent on expanding the business and there’s little left for employees. So startups will typically offer company shares as compensation.

Until recently, it was difficult for employees to sell those shares. In most cases, they would have to wait until the initial public offering.

But lately, a number of pre-IPO marketplaces have popped up where early investors and employees can offload their shares. Some of the most popular ones are Hiive, Forge, EquityZen, and Nasdaq Private Market. You can find folks selling SpaceX shares on any of these four.

Buying on a pre-IPO marketplace is the most direct way to buy SpaceX shares before they become available to the general public.

The downside of these platforms is that the minimum investment can range from $10,000 to $50,000. They also charge you a 2%–5% transaction fee.

- An easier, “backdoor” way to invest in SpaceX is to buy the Destiny Tech100 ETF (DXYZ).

This ETF invests in the top pre-IPO tech companies.

It includes companies like OpenAI, Discord, Revolut, Epic Games, and so on.

But its largest holding by far is SpaceX. It takes up 37% of the entire portfolio.

The ETF also includes two other space companies—Axiom Space and Relativity Space—which make up 8.5% of the portfolio.

I first recommended the DXYZ ETF in August. It’s up around 400% since then.

You can buy the Destiny Tech100 ETF through most brokerage accounts. It currently trades at around $60 per share.

One downside is that this is a closed-end fund. Meaning it can trade above or below the actual value of companies inside it. And it comes with a high 2.5% yearly management fee.

Consider taking a stab… but put this in the “fun money trade” bucket. A cool opportunity, but don’t throw more than 100 bucks into it.

- Thanks to Space X, the final frontier is open for business...

Space is one of the fastest-growing, most exciting industries, and it’s a key area of focus for me and my team right now. We’re currently researching “dark horse” investment opportunities in this exciting sector...

I’ll be sharing everything in my newest advisory focused on finding little-known disruptors with the potential to 10X or more.

Go here now to make sure you don’t miss the launch.

Stephen McBride

Chief Analyst, RiskHedge