“Bull markets climb a wall of worry.”

You may have heard that phrase before. It refers to how stocks will rise in the face of negative headlines during bull markets.

That’s exactly what’s been happening lately.

In the past few weeks, stocks have shrugged off a mini banking crisis, a “hawkish” Fed press conference, OPEC’s controversial decision to cut oil production, and—most recently—rising tensions between China and Taiwan.

When you see this kind of market behavior, you should buy stocks… not run from them.

Specifically, you should focus on today’s top “leaders,” which brings me to today’s Trade of the Week.

Fortinet (FTNT) is one of today’s leading cybersecurity companies. It helps businesses like Siemens and Alaska Airlines fend off cyber threats.

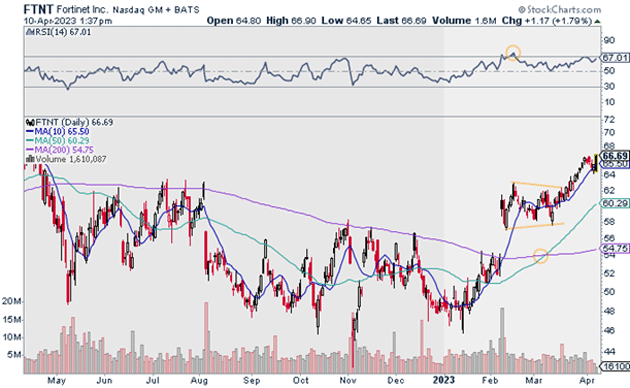

Below is a daily chart of FTNT. It’s throwing off multiple strong signals…

A few weeks ago, it experienced what’s called a “golden cross.” This is when a stock’s 50-day moving average crosses above its 200-day moving average. It’s a bit of a lagging indicator, but it often signifies the beginning of a new uptrend.

FTNT is also emerging from a base it’s been building since last May. In fact, it broke out to its highest price in nearly a year yesterday.

Source: StockCharts

Source: StockCharts

This is the kind of strength I look for in stocks. And I expect FTNT to continue higher from here. To understand why, let’s zoom out.

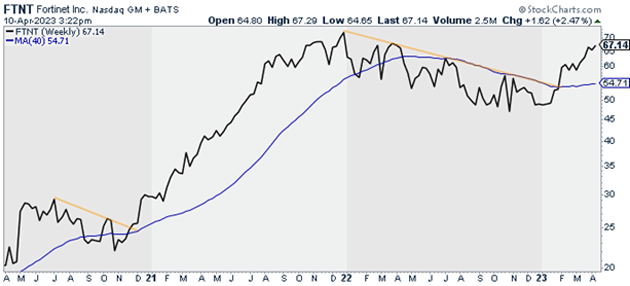

Below is a weekly chart of FTNT. As you can see, FTNT went through a similar consolidation pattern in 2020. When it broke out of that, FTNT went on to rally for almost a year straight.

Source: StockCharts

Source: StockCharts

I’m expecting a similar run to play out in FTNT today. The only difference is that the most recent consolidation period went on for much longer. So, we should expect FTNT to run higher and longer this time around.

Another reason I’m recommending FTNT is because it’s a clear industry leader in a strong and growing market…

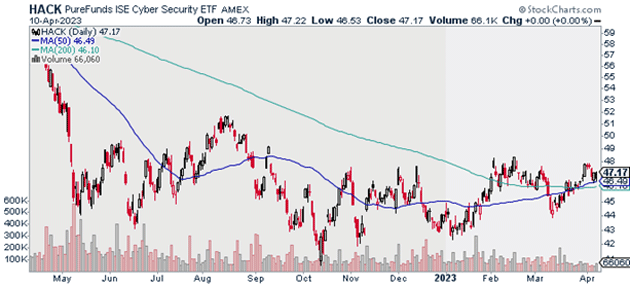

The chart below shows the performance of the popular cybersecurity ETF (HACK), which invests in a basket of cybersecurity stocks.

HACK has been building a base since last May, and is just now beginning to climb out of that consolidation pattern. In fact, it recently reclaimed its 50- and 20-day moving averages. This tells me cybersecurity stocks—as a group—could be in the very early stages of a new uptrend.

Source: StockCharts

Source: StockCharts

If that happens, FTNT should deliver some of the biggest gains in the space, as it’s already firmly established itself as a market leader. I could see it climbing to at least $90 from here, giving us a risk-reward ratio of 3:1 on this trade.

Action to take: Buy FTNT at current market prices.

Risk management: Exit your position if FTNT closes below $59.

Justin Spittler

Chief Trader, RiskHedge