This is easily the most important RiskHedge Report I’ve written this year. I hope you’ll read it closely.

Today, I’m going to show you how we’ll come out of this bear market better than 99% of investors.

But first, I need to make something very clear: This has nothing to do with “calling the bottom” in stocks.

While I believe we’re in the vicinity of the bottom... and we’re very likely closer to the bottom than the top... I might be wrong.

Pinpointing a bottom with certainty is impossible. I refuse to risk my money on a guess, and so should you.

Stocks could easily drop another 20% from here as investors come to grips with how the coronavirus has frozen the economy. Or, the worst could be behind us.

Either way, it’s going to be okay. Because I’m going to show you a safe way to invest that’ll set you up to profit no matter how long the “coronavirus effect” lingers.

- Let’s focus on what we do know…

Right now is a once-in-a-decade opportunity to start building positions in world-class disruptors trading at huge discounts.

But it’s not the time to jump in full steam ahead.

See, we just witnessed something unprecedented—an entire “average” bear market crammed into three weeks!

Last month, US stocks dipped into a bear market for the first time since 2009.

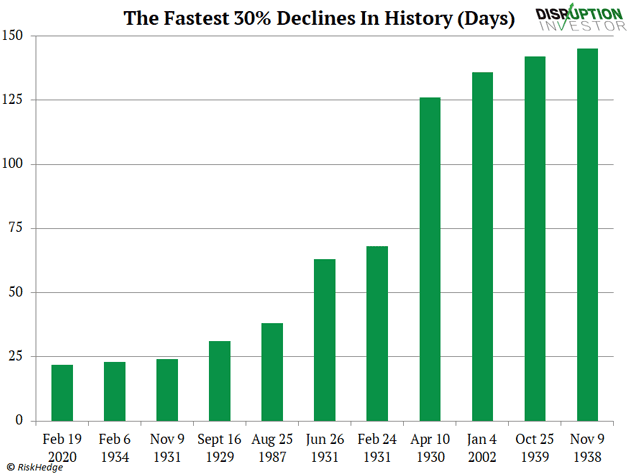

Stocks plummeted 30% in 22 days, something that has NEVER happened before, as you can see:

There have been 19 bear markets (the “official” definition is when stocks drop 20% from record highs) since 1929. They typically last a little over one year, during which, stocks drop 37%, on average.

The health of the US economy typically determines how bad things get for stocks. When bear markets arrived during a recession, stocks fell 37% over 18 months, on average. But when the economy is chugging along, the average decline is cut to 24%, and only lasts seven months.

The bad news is the coronavirus hit “pause” on the US economy. Although the lagging data won’t show it for months, we’re already in a severe and sharp recession.

But please keep in mind: Stocks have already experienced an “average” recessionary bear market. It typically takes stocks five and a half months to drop 30% from their highs. This decline was shoved into three weeks!

This is extremely important to understand.

- It presents an incredible opportunity for us.

It means we can now buy shares of world-class companies at a 30%+ discount to where they were just weeks ago.

We don’t need to wait months and months to get in on these bargains. We can start building our positions TODAY and set ourselves up for big gains ahead.

As I mentioned, now’s the time to use this rare window to start accumulating shares of world-class disruptors on sale.

And we’ll do it in a way that turns any further downside to our advantage.

- This strategy is called “dollar-cost averaging”…

In short, dollar-cost averaging is a proven tool for buying stocks in uncertain markets like we’re seeing today.

With this technique, you place a fixed dollar amount into an investment on a regular basis.

Say you plan to invest $10,000 in one stock.

Instead of buying $10,000 in one go, you’d split it up into, say, four chunks of $2,500 over four months.

You’d be “scaling in” slowly as opposed to “going all in” from the beginning.

By investing this way during downturns, you accomplish two things: you lose LESS money on the way down and you make MORE money from the recovery to follow.

Let’s look at the power of this strategy using the most disruptive company on the planet: Amazon (AMZN)…

- I’m not here to tell you how Amazon could have turned you into a millionaire…

I know you’ve heard that story countless times.

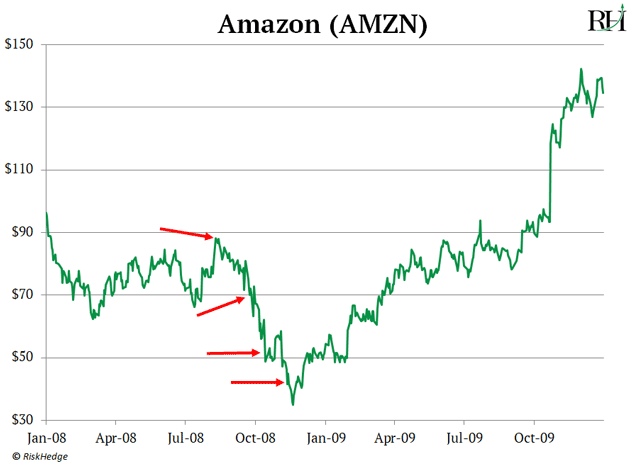

Instead, I want to zoom in on what happened to Amazon during the 2008 financial crisis.

No one talks about how AMZN fell off a cliff like nearly every other stock that year.

In just four months, the stock crashed more than 60%!

If you invested a $10,000 stake “normally”—putting in the full allotment from the get-go, at the peak in August, at around $90 a share—you’d be left with just $3,900 come November, when shares dropped to $35.

That’s a tough loss to stomach.

- But here’s what would have happened if you used the power of dollar-cost averaging…

You’d split up that same $10,000 into four separate $2,500 investments.

You’d invest your first “tranche” of $2,500 at $90 a share…

A second tranche in September at $70 a share…

A third installment in October at $50…

And finally, a fourth in November at $40.

You’re risking less money each time… and you’re getting in at better entry points.

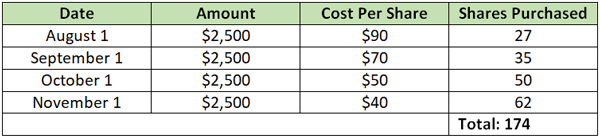

Here’s how it looks:

By doing it this way, you’re lowering your average cost.

In other words, you’re accumulating more shares for less money, as you can see here:

You end up buying in to Amazon at an average price of only $57.47 per share! ($10,000 / 174 total shares purchased)

That means instead of losing 60% in the downturn, you’ve cut your losses to 39%.

- And more importantly… you’re set up to collect bigger profits.

AMZN went on to explode to $135 a share by the end of 2009.

In the first example, $10,000 all-in at $90 per share turns out to a solid 50% gain. A nice $5,000 profit.

Not bad.

But remember, by using our dollar-cost averaging strategy, our cost basis isn’t $90. It’s much lower… $57.47.

We’d book much bigger gains of 135%... handing us a much bigger $13,500 profit.

- I hope you see why this strategy is perfect for today’s uncertain markets…

Remember, we can’t know exactly when this market will bottom. And that’s okay. We don’t need to know the exact bottom to make the right move today.

The fact is, what you do NOW will define the next five to ten years of your investing life.

Now’s the time to start establishing positions in the most dominant and disruptive companies on earth.

We only get roughly one opportunity a decade to buy great stocks at “fire sale” prices.

The last was 2008–2009.

Don’t let this one slip through your fingers.

If prices drop another 20% from here, dollar-cost-averaging will turn the decline to our advantage.

And if the bottom happens soon—we’ll set ourselves up for big profits by “planting our seeds” today.

It’s a win-win.

And hands down the No. 1 way to stack the odds in our favor right now.

Stephen McBride

Editor — Disruption Investor

P.S. In my Disruption Investor advisory, I just recommended two of the most dominant companies on the planet using this exact strategy. I never thought we’d get a chance to buy these stocks at the current prices they’re trading for… but here we are.

The last time these stocks sold off 25%+ was during the financial crisis. They went on to surge 135% and 260% over the next two years. I think we could see even bigger gains ahead.

In short, these two powerhouses belong in every serious investor’s portfolio right now. You can access these names—and all of my research on how to navigate through today’s markets—with a risk-free trial to Disruption Investor.

Reader Mailbag

Today, one of your fellow readers shares how she’s spending her time under quarantine…

Many thanks for sharing your research and knowledge for all of us to benefit from!

I hope you are enjoying sheltering in place... I’m loving the simple, more inward life, with extra meditation, more time cooking, and more time to grow my new nonprofit... all the good stuff!

Take good care of yourself and your dear family! My best always—Judy

And another comments on last week’s RiskHedge Report, in which I predicted we’d soon see the largest cyberattack in history…

Hi Stephen, I think you’re onto something here with a possible cyberattack on the US. I’m not a conspiracy theorist, but I think the Virus was intentional and how did it circle the globe so fast? I was just telling my wife I was thinking there would be an attack from the Chinese government right as the Covid-19 peaks in a couple weeks... like it was all coordinated from the beginning… Thanks for reading. —Ken

You can share your stories—and any questions you have for me—here: stephen@riskhedge.com. I look forward to reading them all.