Inflation sucks.

Not only does it shrink your savings and paycheck…

Not only does it jack up prices of things we must buy… like food, gas, and medical care.

The last six months have left no doubt that high inflation is poison for markets.

|

[Time Sensitive] The Wall Street Journal wrote, “Tech’s decade of stock-market dominance ends.” Now, for the first time in over 20 years, an overlooked class of stocks is set to rocket higher. (From Our Partners.) |

As you surely know, US inflation has spiraled out of control. It hit 8.6% in May—the highest in over 40 years.

Meanwhile, the S&P 500 just wrapped up its worst first half a year since 1970.

There’s a lot more to inflation than things getting more expensive, as RiskHedge Chief Trader Justin Spittler explains:

The inflation rate is one of the most important pieces of data in all of finance. A small tick in the rate can cause billions of dollars to flood out of some investments and into others.

That’s because the inflation rate affects EVERYTHING. It anchors investors’ expectations about the returns they need to generate. When inflation is running at a rock-bottom 1%... investors may be satisfied earning 5% per year.

But when inflation soars to over 8%, nobody’s going to be happy earning 5% a year... because they’re losing money!

That sums up today’s market situation perfectly. Pretty much everyone is losing money. Name any asset class—stocks, bonds, crypto, even real estate more recently—and its price has suffered.

That’s why today’s issue is so important. It in, we’ll look at the mounting early evidence that the worst inflation may be behind us… and what it means for your money.

In fact, Justin says we’re most likely witnessing “peak inflation.”

If he’s right, markets should expect some relief after a brutal first half.

-

The official inflation statistics from the US government are often criticized for being understated...

We won’t weigh in on that today. But we’ll offer another critique: Government inflation readings are slow. They fail to warn you about inflation until it’s too late.

There are much timelier ways to see inflation coming around the corner.

Take commodities prices. Commodities are the building blocks of our world. Steel, oil, natural gas, copper. They’re the “inputs” that form the foundation of the economy.

As I showed in May of last year, prices for lumber, corn, copper, and aluminum were shooting through the roof. Lumber was up 300% from the previous year. Corn was up 100%. Aluminum struck a 10-year high.

Although the CPI was only running around 4%... commodities were sending a clear warning signal. Much higher inflation was imminent.

-

But now, the opposite is happening. While the CPI is sky-high, commodity prices are plunging.

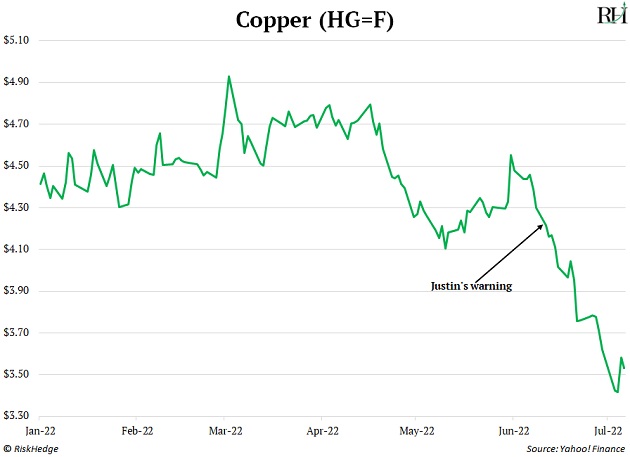

In his June 13 video update to Disruption Trader members, Justin analyzed copper. Copper is one of the most important commodities because it goes into everything from piping to electrical wire... to cars, smartphones, and TVs.

Many seasoned investors look to copper as a bellwether—a leading indicator for the economy. And according to Global X ETFs, “copper is historically one of the best-performing assets during inflationary periods.”

In his update, Justin showed copper had declined past key levels… and was trading below important moving averages. He warned it could be the start of a downtrend.

Copper has declined 15% since:

Justin also warned about shaky price action in agricultural commodities. Sure enough, corn, wheat, and most other food input prices have plunged in the last couple weeks.

As has oil, natural gas, and pretty much every other important commodity.

Remember, all of these commodities were soaring in 2021. It was a clear inflation “red alert” for anyone paying attention. But now, Justin says they’re breaking down and have potentially put in a major top.

-

Importantly, bond prices are agreeing with commodities…

US Treasury bonds have historically been a safe-haven asset. Investors take cover in them when markets look stormy.

But Treasuries haven’t done their job lately thanks to inflation. TLT—a fund that tracks longer-term US Treasury prices—has crashed. It’s down 23% this year, and 40% since March 2020.

That’s a huge, almost unprecedented move in what’s supposed to be one of the most stable investments.

Bonds hate inflation because bonds pay a fixed rate of income. The current yield on a 10-year US Treasury is 3%. That’s not a bad return if inflation is 0%. But when inflation surges above 8%... buying bonds that pay 3% is a guaranteed way to lose money.

If high inflation is going to continue, we’d likely see it in declining bond prices.

But for the first time in a long time, we’re seeing the opposite.

Buyers are stepping in. Justin says TLT appears to have found its footing, up 4% over the past month.

-

Finally, Justin put all the pieces together into one telling chart…

He charted the TLT bond fund vs. a popular commodity fund, ticker DBC.

When this line is rising, bonds are outperforming commodities. When it’s falling, commodities are outperforming bonds.

For the past year or so, commodities crushed bonds. According to Justin, it’s been a historic underperformance by bonds. Exactly what you’d expect to see in times of high inflation.

But in May, the ratio stopped falling. And in June, bonds beat commodities by a meaningful margin for the first time in over a year:

Source: StockCharts

In short: Investors appear to be rotating out of commodities and back into bonds.

That’s the kind of behavior you see when inflation is peaking.

-

If inflation has truly peaked, markets will look a lot different in the second half of the year…

Are you prepared?

Because we could see a reversal of the trends that defined the first half of 2022.

Instead of falling stock, bond, and crypto prices, the opposite could happen.

This Wednesday, July 13, keep an eye on the headlines. We’ll get an important clue when the government releases its monthly CPI update.

If it shows a meaningful decline in the current sky-high 8.6% rate of inflation… peak inflation is in play.

And that changes everything in markets.

Chris Reilly

Executive Editor, RiskHedge