Is 2025 the year of energy stocks?

It’s looking that way...

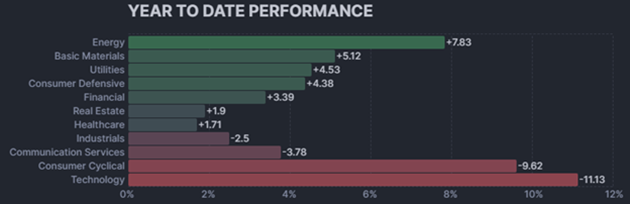

So far, energy stocks have gained 8% this year. They’re the best-performing major sector by a wide margin:

Source: Finviz

Source: Finviz

And this could just be the beginning.

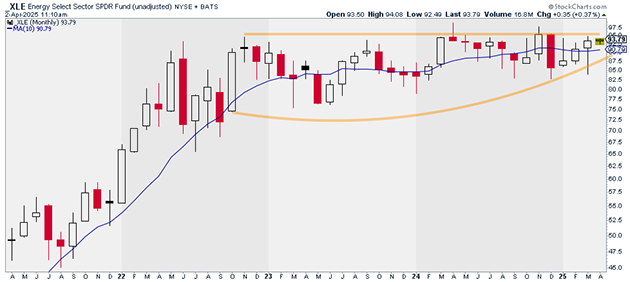

You see, energy stocks haven’t even broken out yet.

The Energy Select Sector SPDR Fund (XLE) is still trading in a three-year consolidation pattern. A breakout from this range would signal a major change in character. It would likely ignite a powerful long-term rally.

Source: StockCharts

Source: StockCharts

Many traders aren’t even entertaining this possibility.

That’s because US stocks have been under pressure all year. The S&P 500 is down nearly 5% so far in 2025, while the Invesco QQQ Trust (QQQ) is down more than 8%.

But it’s not uncommon for energy stocks to zig when the market zags.

In 2022, XLE gained 58%, while the S&P 500 fell nearly 20%.

|

If complex trading strategies are holding you back, it’s time to try a simpler approach. With Express Trader, get my top 3 trades each week—sent straight to your inbox, ready for action. |

Could we see a repeat of that this year?

It’s possible. Just understand that 2025 is playing out much differently than 2022.

Back then, the main concern was rapidly rising inflation. Today, the headline risk is a slowing economy. Two very different things.

And this isn’t some hot take of mine. The market is saying this loud and clear.

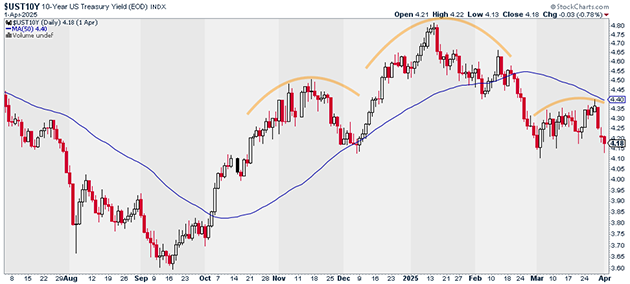

The yield on the US 10-Year Treasury is down 10% since the start of the year. And based on the massive “head and shoulders” pattern in its chart, it looks like it’s headed even lower:

Source: StockCharts

Source: StockCharts

This wouldn’t be happening if the market was truly worried about inflation. Rates would be rising.

In short, the market isn’t currently pricing in higher commodity (energy) prices. So, I would wait for further confirmation in energy stocks before backing up the truck.

Justin Spittler

Chief Trader, RiskHedge

PS: There’s no question 2025 has been a tough year for traders. But there are still ways to profit… if you know where to look. That’s where Express Trader comes in. Using my PRO Meter, I’m able to find new trades no matter what the market is doing. Join today, and you’ll get my top three trades every Monday.