Editor’s Note: With the S&P 500 on the cusp of correction territory (down nearly 10% from its peak), many readers are asking if it’s time to play offense or defense.

Corrections are normal and expected—and learning how to protect your portfolio during downturns is part of being a successful trader. Justin’s essay below will help you keep a cool head if the market throws more “sucker punches”...

He also shares how he’s handling the volatility in his premium advisory, Express Trader...

***

“Protect yourselves at all times, gentlemen.”

If you watch boxing, you know this is the last thing the ref tells both fighters before the start of Round 1.

It’s a simple, but powerful statement.

It means never let your guard down… not even for a second.

Fighters who ignored this advice have paid the price dearly.

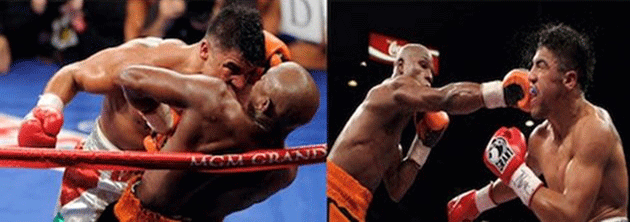

Remember when Floyd Mayweather knocked out Victor Ortiz after Ortiz tried to hug Mayweather in the middle of a fight?

Source: The Times

Source: The Times

Ortiz was trying to be a good sport after headbutting Mayweather just moments earlier.

Silly mistake.

Mayweather made Ortiz pay the price… delivering a brutal left hook to the chin.

Some called it a “sucker punch.” But if you know boxing, it was fair game.

Ortiz let his guard down during the middle of a fight. He didn’t protect himself.

The same rules apply to trading.

- You must protect yourself above everything else.

Too often, traders forget this. They obsess over the potential gains… when they should obsess over risk management.

After all, it only takes one bad blow to knock you out of the game.

That’s just one of the many parallels between boxing and trading.

Ever hear the saying, “It’s the punch you don’t see coming that knocks you out?” This, too, applies to trading.

Usually, the biggest threat to the market (and your account) is what you least suspect. That’s because the market has a knack for fooling the majority.

When everyone is worried about inflation, deflation (a slowing economy) is probably the bigger threat.

In other words, one of the worst things you can do as a trader is buy into popular narratives.

More often than not, the crowd is wrong.

- Maybe the biggest similarity between boxing and trading is this: “Styles make fights.”

In boxing, this means that the style of fight often dictates who comes out on top.

For example, a short boxer might have trouble with a fighter who has a reach advantage. The lankier fighter can control the distance more easily… even if he’s the inferior fighter. The style of the fight favors him.

A tactical boxer might struggle against a pressure boxer if the fight turns into a junkyard brawl.

The same principle applies to trading.

At any given time, the market can be more suitable for one style over another.

Trending markets, for example, favor swing traders. On the other hand, volatile, choppy markets are better suited to day traders.

There are also periods when certain kinds of stocks work in between.

For example, when the market is “risk on,” tech and growth stocks are usually the ones to own.

But when the market is “risk off,” like today, defensive stocks like utilities and staples are a much better bet.

- “Justin, is it time to play offense or defense?”

I’ve been getting this question a lot lately.

Sounds simple, but traders who get this right—consistently—are the ones who come out on top.

That’s why I created my PRO Meter.

This simple chart helps me determine if we’re in a strong market where we should be aggressively looking to profit… or a weak market where we should be more concerned with protecting our capital.

In other words, it helps me avoid unexpected “sucker punches.”

- Lately, the PRO Meter has been signaling caution.

It’s still too early to know if the correction we’re seeing will turn into the start of a bear market. We’ll only know that in hindsight.

But I’ve been encouraging readers in my Express Trader advisory to play defense.

In short: Now’s the time to be selective with your trades and only put money into areas of the market that are still “working”… like our latest gold trade.

If you’d like to join Express Trader and get access to my PRO Meter—and my three strongest trades at the start of every week—you can join us here.

Justin Spittler

Chief Trader, RiskHedge