Is it time to play “small ball?”

If you’ve been following the markets, you’ve probably noticed a trend.

The big boys have been doing the heavy lifting.

Mega-cap leaders like Nvidia (NVDA), Google (GOOG), and Apple (AAPL) have been on a tear lately.

In many ways, they’ve carried the market.

But I think the back half of the year could look very different.

Small- and mid-cap stocks could play catch up in a major way. They could even massively outperform the indices.

I say this because both the small- and mid-cap stock ETFs have been consolidating for months. They’re storing up energy for their next major move, which I think will be to the upside.

I say this for a simple reason: Interest rates appear to have topped.

If rates held lower, that would benefit many stocks—especially more rate-sensitive groups like small- and mid-caps.

That brings me to my new Trade of the Week: Onto Innovation (ONTO).

Onto is an $11.5 billion semiconductor equipment stock. It’s much smaller than leading semi names like Nvidia, Micron Technology (MU), or Broadcom (AVGO).

We’re putting on this trade for a few reasons.

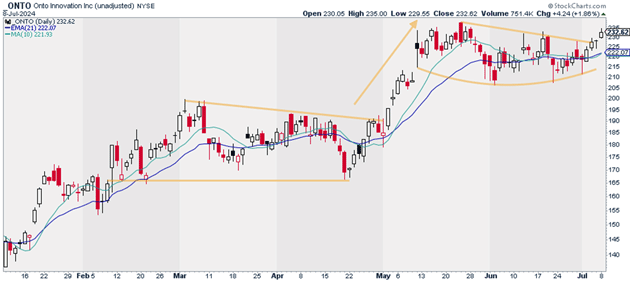

For one, ONTO isn’t just any mid-cap stock. It’s one of the strongest on the planet. It’s rallied 52% higher so far this year and 113% over the past year.

In short, it’s in a strong uptrend. And it appears to have just begun its next major leg higher. You can see what I mean below:

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

I suggest putting on a starter position in ONTO. I believe ONTO could hit $310 over the next 12 months.

Exit your position if ONTO closes below $210. That gives us a risk-reward ratio of more than 3:1 on this trade.

Action to take: Buy ONTO at current market prices.

Risk management: Exit your position if ONTO closes below $210.

Justin Spittler

Chief Trader, RiskHedge

PS: I expect to see a ton of new trade opportunities open up as market rotation continues out of mega-caps and into lesser-known names like Onto.

To stay ahead of the curve, consider joining our All-Access program. It’s a way to get everything RiskHedge publishes for the next 18 months—including my premium trading room—for a one-time flat fee… so you never miss a thing.

Go here for complete details—and a special summertime offer.