Nvidia (NVDA) is the stock of a lifetime.

It’s surged 500%+ since I recommended it to RiskHedge readers back in 2018.

And it just printed the best earnings results I’ve ever seen. I’ll tell my grandkids about how I was alive to see these numbers.

But its stock has tripled since January. And investors are asking: Is it time to take profits?

Today, I’ll tell you where I see Nvidia heading over the next six months.

- I have one word for you…

“Expectations.”

I’ve eaten in fancy, Michelin-star restaurants and walked out feeling like I got robbed.

Problem was, I expected to be blown away. And when the bar is that high, it’s hard to top it.

My wife and I have also had dinner sitting at a plastic table in someone’s back garden while their dog wandered around our feet. And the first thing I said to her when we left was, “That was incredible.”

I didn’t have high hopes going in, and I was positively surprised.

Expectations shape happiness...

They drive stock prices, too.

Back in May, artificial intelligence (AI) chip leader Nvidia jumped 25% overnight when it announced this quarter’s earnings would exceed investors’ wildest imaginations.

Expectations were dangerously high ahead of results. Surely, Nvidia couldn’t jump over such a high bar?

Think about the best earnings you’ve ever seen, then 2X it. That’s how sublime Nvidia’s numbers were.

Its sales have doubled over the past year. Huge demand for Nvidia’s AI chips from the likes of Google (GOOGL)… Microsoft (MSFT)… and Amazon (AMZN) has fueled record results.

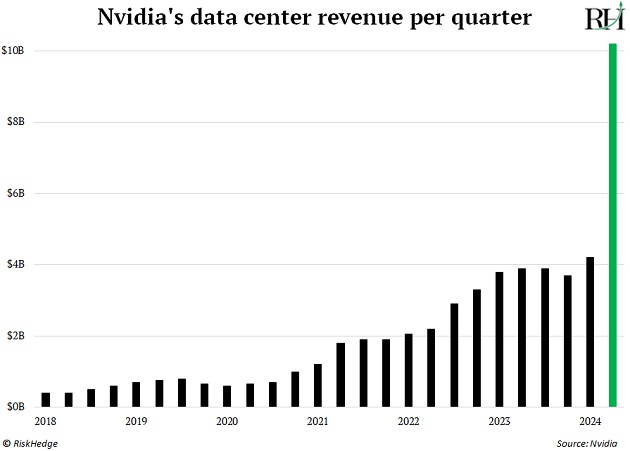

AI chip sales surged 170% year over year. This chart shows Nvidia’s INSANE growth:

- Can Nvidia keep marching higher?

Earnings were incredible, but Nvidia’s surging stock price reflects that. It’s already “priced in,” as the pros say.

Investors are wondering if it’s time to take profits while the going is good—before the inevitable crash.

Some folks are even calling Nvidia “the next Cisco.”

|

Discover Effortless Investing: Unveil a hidden gem of investment that's triumphed over the market for 50 years, ensuring serene sleep while profiting from others' fears. No expertise or hefty portfolio required. We unravel 9 essential questions for your seamless journey into the world of lucrative investing. Click here to see how you can effortlessly outshine renowned, |

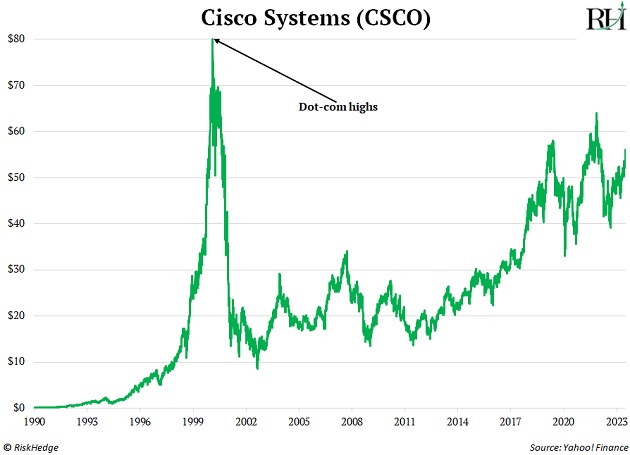

Cisco Systems (CSCO) connected the world to the internet. Its switches and routers allowed computers around the world to easily communicate with each other.

As businesses rushed to build websites in the ’90s, they tore the hinges off the door to buy Cisco’s products.

Its stock shot up 100,000% in 10 years—turning every $1,000 invested into a million dollars.

And that was the time to sell.

Cisco crashed 90% during the dot-com bust and still hasn’t eclipsed those former highs:

Despite growing revenues of 10% per year since 2000, Cisco’s valuation was so out of whack back then that it may never surpass its dot-com highs.

Nvidia rhymes with Cisco. It’s a disruptor fueling a new tech boom, handing out big gains to investors.

But our research suggests it’s nowhere near the “crash” part of its story.

It’s easy to forget Cisco handed early investors 1,000X their money before plummeting.

It paid to own Cisco in the “sweet spot”—the period in the mid ’90s when the internet was being built out and sales were soaring.

Nvidia is in the “sweet spot” today.

- The AI chip-buying frenzy has legs.

World governments… trillion-dollar tech giants… and fast-growing start-ups are all scooping up every Nvidia chip they can get their hands on.

Google, Amazon, and Microsoft have already spent tens of billions of dollars on AI chips. And they’ve told us they’re about to buy a heck of a lot more on recent earnings calls.

Inflection AI recently raised $1.3 billion. That’s a lot of dough for a start-up. Where’s all the money going? It’s paying for 22,000 Nvidia chips.

The governments of Saudi Arabia and the UAE are snatching up thousands of AI chips, too.

Every company worth talking about is experimenting with AI right now. They’re figuring out how to use this tech to boost their businesses and “one up” competitors.

The experiments have only begun. These companies will be on an AI chip-buying frenzy for at least another few quarters. And that means Nvidia’s stock can keep marching higher.

We’re in the “sweet spot.” It’s not time to sell… yet.

- Here’s my playbook for the next six months…

Nvidia expects revenues to hit $16 billion next quarter, up from $13.5 billion in Q2.

That’s impressive growth… and I still think it’s sandbagging.

After all, this is the same company that told us revenues would clock in at around $11 billion this quarter… and ended up at $13.5 billion.

Our research suggests Nvidia’s sales will touch $18 billion next quarter… sending its stock surging to new highs.

The AI chip-buying spree is only starting. It has at least another six months to run. It’s too early to sell Nvidia; the stock is headed higher.

But understand, this doesn’t mean Nvidia will go up in a straight line. You should ALWAYS expect pullbacks.

People forget just 10 months ago, Nvidia was in a 70% drawdown and trading for $115/share!

I’ve owned Nvidia since 2018 and have sat through two gut-wrenching 50%+ corrections. And yet RiskHedge members who’ve held on since I first recommended it are sitting on 500%+ gains.

If you own Nvidia already, consider buying a little more on pullbacks. If you’re a paid-up subscriber to my Disruption Investor advisory, you own Nvidia shares risk-free because we took profits on it when markets topped out in November 2021.

If you don’t own it, it’s not too late to buy… as crazy as that sounds.

Let your winners ride.

Stephen McBride

Chief Analyst, RiskHedge